Billionaire David Tepper’s Genius Nvidia Stock Move: Here’s Why It’s Pure Alpha

David Tepper just placed a massive bet on Nvidia—and Wall Street's scrambling to decode the playbook.

Why Nvidia's AI Dominance Can't Be Ignored

Tepper's Appaloosa Management loaded up on shares as the chipmaker continues crushing earnings. The move signals confidence in Nvidia's stranglehold on AI infrastructure—data centers can't get enough of their GPUs, and competitors are years behind.

Timing the Market vs. Time in the Market

While retail traders chase memecoins, Tepper's buying the picks and shovels of the AI gold rush. Nvidia's tech powers everything from autonomous vehicles to large language models—this isn't speculation, it's infrastructure.

The Cynical Take: Wall Street's Still Playing Catch-Up

Hedge funds love to talk about 'disruption' while investing in legacy tech. Tepper's actually backing the company building the future—meanwhile, traditional finance is still trying to figure out cloud computing.

Final thought: When a billionaire known for market-crushing returns makes a move this bold, it's worth asking what he sees that others don't.

Image source: Getty Images.

The demand for AI computing capacity is rapidly expanding

Nvidia makes graphics processing units (GPUs), which are the computing muscle behind many of the AI models utilized today. Nvidia has a dominant market share in this field, with some estimates pegging Nvidia's market share at 90% or greater. It's rare to see a company hold such a dominant market position in a growing field, but that's what makes Nvidia's stock special.

While there have been significant capital expenditures on AI data centers, this number is expected to rise further. Many of the AI hyperscalers expect record-setting capital expenditure figures for 2025, but are already warning investors that expenditures in 2026 will be even greater. This aligns with Nvidia's projections, as they believe that AI hyperscalers will spend approximately $600 billion on data center capital expenditures in 2025. However, this figure is expected to rise to between $3 trillion and $4 trillion by 2030, when accounting for all clients. That's massive market expansion, and if that projection pans out, it makes Nvidia a no-brainer buy today.

Paying attention to what billionaires are doing with Nvidia stock is a wise idea, as these investors often have strong connections within the industry that most individual investors lack. So, if you see billionaire hedge fund managers maintain or add to their Nvidia positions, it's a bullish sign overall.

But what kind of performance can investors expect moving forward?

Nvidia is still a market-beating stock with a conservative estimate

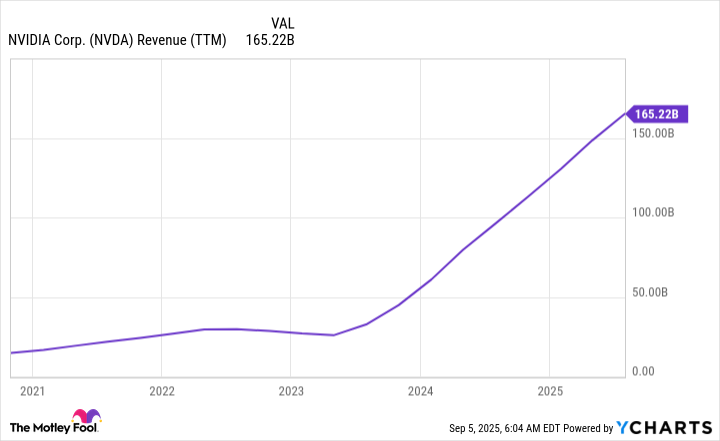

Nvidia generally captures around 35% of data center spending when all costs are accounted for. So, if it can maintain its market share and capture the projected $3 trillion to $4 trillion market opportunity by 2030, it could translate into $1 trillion to $1.4 trillion in revenue. Considering that Nvidia's trailing-12-month revenue total is $165 billion, that represents a substantial amount of growth.

NVDA Revenue (TTM) data by YCharts

If that panned out, Nvidia WOULD have the potential to dwarf nearly every company on the stock market. However, I think it's far wiser to cut that projected market opportunity in half; that way, if I'm wrong, it's likely because I undershot the market opportunity.

Should data center capital expenditures reach $1.5 trillion (half of the low point of the projection) and Nvidia maintain its 35% market share, that would translate into $525 billion in revenue. At Nvidia's 50% profit margin, that would equate to $263 billion in profits.

If we bake some additional conservatism into the projection and assume that Nvidia would trade at 30 times trailing earnings, that indicates Nvidia would have a market capitalization of $7.9 trillion. That would be a compound annual growth rate (CAGR) of 12% between now and the end of 2030.

But that is only considering data center sales; Nvidia has other divisions, like its industrial segment, which could see a huge boost from self-driving cars and gaming.

The reality is that Nvidia still has market-beating potential even if the primary market it's pursuing turns out to be half the size it projects. That's a significant amount of conservatism factored into the projection, and it still outperforms the market. This makes Nvidia a solid buy, and I think investors would be wise to follow Tepper's lead and purchase Nvidia shares now.