2 Monster Cryptocurrencies to Hold for the Next 5 Years

CRYPTO'S NEXT WAVE: TWO DIGITAL ASSETS POISED TO DOMINATE THROUGH 2030

Forget traditional stocks—the real monster gains are brewing in the crypto space

BNB: THE ECOSYSTEM POWERHOUSE

Binance Coin continues defying expectations, quietly building the most comprehensive crypto infrastructure platform on the planet. Its utility spans trading fees, transaction processing, and ecosystem participation—creating relentless demand that outpaces even the most optimistic traditional finance projections.

ETHEREUM: THE DEFI BACKBONE

While Wall Street debates ETF approvals, Ethereum's network effect grows exponentially. Smart contract dominance, institutional adoption, and layer-2 scaling solutions position it as the undisputed foundation of decentralized finance—because sometimes the obvious choice remains the smartest one.

Five-year horizons separate speculators from investors. These two assets represent infrastructure bets on crypto's inevitable march toward mainstream finance—whether traditional institutions are ready or not.

Image source: Getty Images.

1. Eli Lilly

(LLY 0.47%) has climbed more than 130% over the past three years as customers have flocked to its weight loss drugs. The company commercializes tirzepatide under the name Mounjaro for type 2 diabetes and Zepbound for weight loss -- but doctors have prescribed either for the weight loss indication. Demand has been high, even surpassing supply at times and temporarily landing tirzepatide on the U.S. Food and Drug Administration's drug shortage list.

Tirzepatide is off the shortage list now, but demand remains high and has translated into enormous growth for Lilly. Mounjaro and Zepbound both have become blockbusters, and in the recent quarter, they helped the pharma giant report a 38% increase in revenue to more than $15 billion.

Lilly isn't only a weight loss drug company, of course, and offers a broad portfolio of drugs across therapeutic areas. But the weight loss portfolio could be the driving force behind revenue growth and stock performance in the coming years. And what could offer a new boost is the potential approval of a weight loss drug in pill FORM (today's drugs are injectables). Lilly recently completed successful clinical trials of oral candidate orforglipron and now is preparing to file for regulatory review.

Lilly's leadership in the weight loss drug market has transformed this pharma company into a monster stock, and both market growth and Lilly's innovation should help it keep up this momentum over the coming years.

2. Taiwan Semiconductor Manufacturing

When you think about AI giants, the first name that may come to mind is AI chip leader,. But Nvidia wouldn't be where it is today without another player, a company that makes Nvidia's designs a reality. I'm talking about(TSM 3.77%), the manufacturer of Nvidia's chips as well as chips from other market giants such asand.

As a result, TSMC benefits not only from the success of the market leader but also from the successes of many other players. This makes the company a great bet on the high-growth area of AI, especially today as companies increase spending on AI infrastructure --andmade such announcements in their recent earnings calls. TSMC will benefit because those players will rush to Nvidia and other chip designers, and those designers need TSMC to produce their chips.

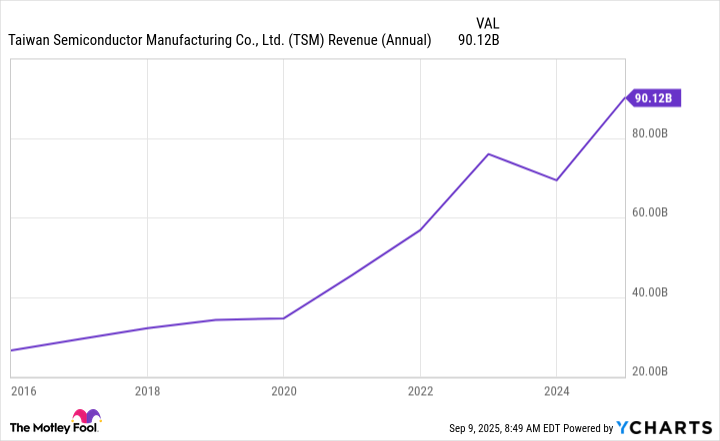

TSMC has seen revenue advance over time, but it truly took off as the AI boom gathered momentum.

TSM Revenue (Annual) data by YCharts

The chipmaker recently expressed Optimism about what's to come, saying demand from companies as well as from countries should continue at a high level. It's also important to keep in mind that Nvidia has pledged to update its chips on an annual basis, this implies more growth ahead for TSMC, the manufacturer of those chips.

Another plus is TSMC is investing $165 billion in U.S. manufacturing, a MOVE that may shield it from the impact of import tariffs and make it easier to work with its U.S. chip customers.

All of this means that investors are likely to benefit if they hold this monster stock -- one that's gained 200% in three years -- as this new phase of AI growth takes off.