Netflix Stock: The Next Nvidia-Level Winner?

Streaming giant Netflix just delivered numbers that made Wall Street's algorithms blink—and not just because everyone finally finished Stranger Things.

Subscriber Growth Defies Gravity

Netflix added more users last quarter than most platforms gain in a year. Password crackdown? More like a revenue rocket. The street expected a bump—they got a tidal wave.

Content Engine on Steroids

Originals are pulling viewers harder than a cliffhanger finale. No ads? No problem. Their ad-tier now quietly prints money while legacy media still figures out what 'streaming' means.

The AI Play Nobody's Talking About

Their recommendation algorithm eats viewer data for breakfast. That's not just UX—it's a moat deeper than HBO's content budget. And it keeps getting smarter.

Cash Flow Goes Brrr

Remember when Netflix burned cash like a crypto startup? Those days are gone. Free cash flow now funds content, buybacks, and the occasional dystopian reality show.

So is it the next Nvidia? Maybe—if you think dominating attention is as valuable as dominating chips. Either way, it's making traditional media execs sweat more than a character in Squid Game. (And honestly, their stock projections have more plot twists than a Netflix thriller.)

Nvidia caught AI lightning in a bottle

First and foremost, it should be pretty obvious that Nvidia is riding a unique wave here. Artificial intelligence (AI) is all the rage, especially in the special niches of generative AI and large language models (LLMs). Nvidia's AI accelerator chips are the leading providers of number-crunching power behind these AI tools. Other tech titans just can't get enough of these processors, creating a long-lived and extremely lucrative revenue stream for Nvidia.

Game-changing opportunities like this AI boom are incredibly rare. It's simply unrealistic to assume that Netflix will hit a similar jackpot any time soon.

Netflix has a different path to greatness

I don't expect Netflix to post a 1,130% return in three years, as Nvidia has done. A more sensible target WOULD be Nvidia's multi-trillion-dollar valuation.

Extreme market values grow common over time. Apple saw the first trillion-dollar market cap in August of 2018. Apple also had the largest cap in 2015, ending the year at just $584 billion. In 2010,held the throne with a $364 billion cap. A trillion dollars sounded outlandish back then. There are now 10 of those massive market caps, or 12 if you include the dual stock classes ofand.

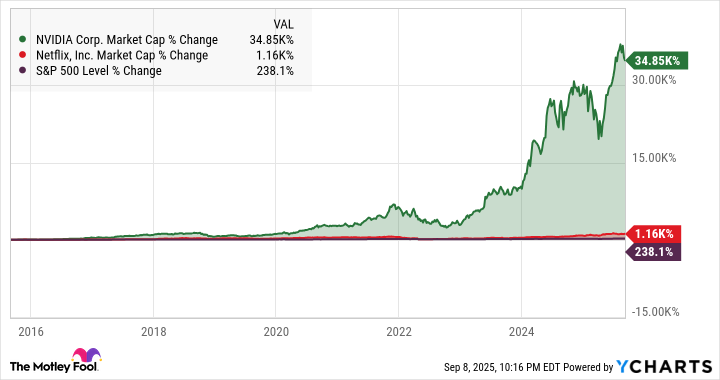

Netflix itself has indeed climbed quite high. Patient investors have pocketed a 1,160% return over the last decade, starting from a fairly modest $42.1 billion market value in September, 2015. As impressive as that gain is, Netflix still can't compare to Nvidia's dominant performance. The chip stock matched Netflix's 10-year return in just three years, you know. Comparing these stocks over the last 10 years makes Netflix look downright slow. Let's throw in the(^GSPC 0.27%) stock market index too, just to illustrate how huge Nvidia's returns have been:

NVDA Market Cap data by YCharts

Netflix has a long history of strong returns and I do expect it to join the trillion-dollar club eventually. It currently boasts the market's 19th largest capitalization, just a couple of million dollars below's $530 billion.

If Netflix delivers a compound annual growth rate (CAGR) of 15% over the next 5 years, it would end up with a $1.06 trillion market cap in the late summer of 2030. From there, a sustained 15% CAGR would pass the $4 trillion mark after another decade. These would be market-beating returns, comfortably ahead of the S&P 500's average annual return of 13% in the last decade.

Image source: Getty Images.

Will Netflix still be winning in 2040?

That brings me to the thrilling conclusion of this numerical drama. Does Netflix have what it takes to generate market-beating shareholder returns for 15 years or more?

Honestly, nobody knows. Anything could happen on this long time scale. Another pandemic could shake up the global entertainment industry again. What if China opens its massive but locked-down media market to foreign options like Netflix? Or perhaps someone else comes up with a superior media delivery platform that makes Netflix obsolete overnight. And then the zombie apocalypse starts, right? You just never know.

That being said, Netflix is on my short list of companies I expect to stay relevant forever, for all intents and purposes. Under the nimble leadership of Reed Hastings, followed by the equally capable co-CEO team of Ted Sarandos and Greg Peters, Netflix often leads the charge into uncharted waters. The Netflix of 2040 will surely look very different from the streaming media portal you see today. I mean, it was still a DVD-mailing powerhouse with a free streaming feature 15 years ago, and things will probably just change faster in the future.

Netflix won't be the next Nvidia, and that's OK

So it all depends on where you set the goalposts. Yes, Netflix should eventually outgrow Nvidia's current market value. No, it probably won't get there with a quick burst of skyrocketing returns (unless the rotting zombies give Netflix an unlimited source of fresh content, of course).

And yeah, Netflix remains one of my favorite stocks to hold with a long-term mindset in 2025. It can offer wealth-building returns in the long haul without beating Nvidia's peerless AI gains.