Why This Dividend ETF is Perfectly Balanced for Yield and Growth

Dividend ETFs finally get it right—this fund nails the growth-yield sweet spot without the usual Wall Street baggage.

The Balanced Approach

Forget choosing between income and appreciation. This ETF structures its holdings to capture dividend cash flow while maintaining exposure to companies with serious upside potential. It's not rocket science—just smart diversification that most active managers somehow keep missing.

Yield Without the Drag

Too many dividend funds sacrifice growth for those juicy payouts. This one screens for companies that actually reinvest intelligently while sharing profits. No dinosaurs here—just firms that understand capital allocation better than your average hedge fund manager.

The Growth Engine

By weighting toward sectors with both strong cash generation and innovation pipelines, the ETF avoids becoming a passive income relic. It actually positions for the future rather than just mining the past—unlike some fund managers who still think fax machines are relevant.

Perfectly timed for investors tired of choosing between income and growth—and even more tired of paying fat fees for underwhelming performance.

Image source: Getty Images.

What is the iShares Core High Dividend ETF?

The HDV ETF is a passively managed fund operated by iShares, a subsidiary of. The fund tracks 75 U.S.-based stocks in the Morningstar Dividend Yield Focus Index, with the goal of balancing yield, performance, and low costs. As fund managers rebalance the ETF quarterly, they look specifically for stocks that have sustainable dividends and strong balance sheets.

To that end, they do well. The iShares Core High Dividend ETF has a low expense ratio of only 0.08%, or $8 annually per $10,000 invested. Its dividend yield of 3.3% is comfortably higher than the 1.2% yield of the S&P 500. And its year-to-date gain of 9.1% is on par with the overall market -- and better than you'll see in several other dividend ETFs.

What stocks do you buy with the HDV ETF?

Buying shares of the iShares CORE High Dividend ETF gets you a who's who of blue-chip dividend stocks. Nearly 20% of the fund is in financial services stocks, but you also have a healthy representation of tech stocks (16%), healthcare (12.4%), and communications (11.3%). The fund's top holdings include,,,, and.

| ExxonMobil | 8.7% | 3.5% |

| Johnson & Johnson | 6.7% | 2.9% |

| AbbVie | 6% | 3.1% |

| Chevron | 5.9% | 4.3% |

| Home Depot | 4.7% | 2.2% |

Sources: Morningstar, Yahoo! Finance. https://www.morningstar.com/etfs/arcx/hdv/portfolio

For me, the diversification and blue-chip names are a major selling point when I'm looking for dividend ETFs. You can find some with a bigger payout ratio, such as the, which tracks master limited partnerships and offers an 8% yield. But the downside is that you are heavily dependent on energy stocks, and I'm never a fan of being overly exposed to any one sector. It should also be noted that the Alerian MLP ETF is trailing the market so far this year despite that oversized yield.

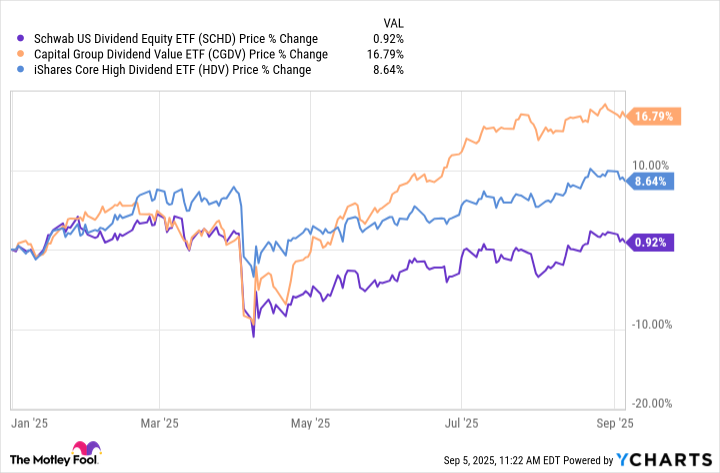

Stacking the iShares Core High Dividend ETF against the competition

Let's look at the HDV ETF in a head-to-head comparison with two other popular dividend ETFS -- theand the.

SCHD data by YCharts

Here you have three distinct flavors of funds. The Capital Group Dividend Value ETF is by far having the best year if you look strictly at the returns, but that's because it's overloaded with technology stocks that pay a low dividend. Top holdings include Microsoft, which yields 0.6%, and Nvidia, which yields a paltry 0.2%.

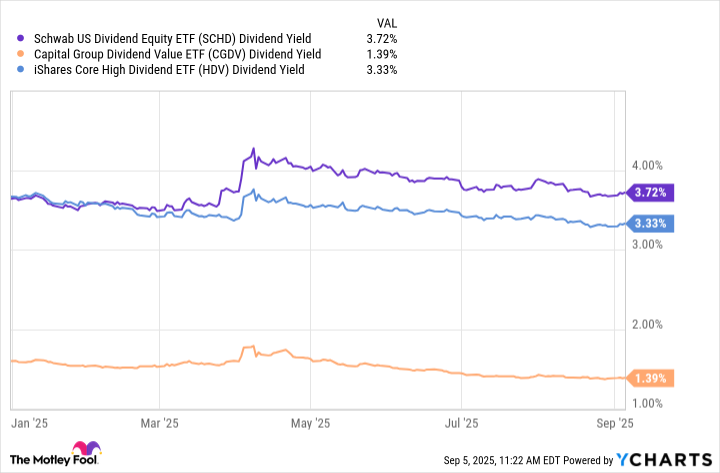

On the other hand, there's the Schwab US Dividend Equity ETF, which has a slightly superior yield to the iShares Core High Dividend ETF, but its year-to-date performance is subpar.

SCHD Dividend Yield data by YCharts

That's why I'm partial to the iShares offering here. I appreciate the blue-chip names and the balance of performance to yield. ETFs such as this are an outstanding way to diversify a portfolio, and it's even better if you can find one that actually pays you back to hold it.

If you take a position in this or any other dividend ETF, an excellent idea is to make sure you reinvest your quarterly dividend payout back into the fund to allow your earnings to compound over time. By keeping a diversified, well-rounded portfolio of dividend stocks, you'll be well on your way to meeting your retirement goals.