Coupang Stock Below $30: A Can’t-Miss Opportunity or Value Trap?

South Korea's e-commerce giant trades at bargain levels—but is the market missing something?

Price Plunge Creates Opening

Coupang's stock dipped below $30 this week, putting one of Asia's fastest-growing e-commerce plays squarely in value territory. The company's relentless logistics network—famously delivering orders within hours across South Korea—continues gaining market share while traditional retailers scramble to keep pace.

Numbers Don't Lie—But Analysts Do

Revenue growth remains robust despite macroeconomic headwinds, with expanding margins in core operations. The company's push into fintech and streaming services creates additional monetization avenues—though Wall Street remains skeptical about profitability timelines (surprise, surprise).

Regulatory Winds Shifting

Recent regulatory clarity from Korean authorities provides tailwinds for established players. While crypto bros chase the next memecoin, Coupang builds actual infrastructure that moves real goods to real people—imagine that.

Bottom Line: Either the market's overlooking a structural winner, or this is another 'story stock' destined to disappoint. At under $30, the risk-reward looks compelling—unless you'd rather trust some finance guru's technical analysis lines.

Image source: Getty Images.

Building a best-in-class fulfillment model

The key engine that has enabled Coupang to win in South Korea -- its $30 billion in trailing revenue as clear evidence -- is a vertically integrated delivery infrastructure similar to Amazon's in the United States. Coupang has its own advanced fulfillment centers and delivery trucks that help it get packages to customers in the same day, including fresh groceries in as little as a few hours. If a customer orders by midnight, they will receive the order by 7 a.m. the next day. In most cases, it is even faster than Amazon's delivery network.

Like Amazon, Coupang has a subscription for free shipping it calls Rocket Wow. Outside of free shipping, Rocket Wow members get access to video streaming content like live sports, discounts on Coupang Eats food delivery, and other targeted discounts. The value of Rocket Wow is evident in the customer reaction to a recent 58% price hike on monthly subscriptions. Well, there wasn't any dip in Coupang's active customer growth, which was up 10% year over year to 23.9 million.

Not all of these shoppers are Rocket Wow members, but it is estimated that at least 10 million or more people in South Korea pay for the subscription service. This stream of recurring revenue for Coupang can be highly lucrative. At current exchange rates, the Rocket Wow membership costs $5.70 a month. If there are 10 million paying subscribers, that is $684 million in high-margin and growing subscription revenue.

International expansion opportunity

One knock on Coupang has been the limited size of the South Korean market. It is a wealthy country but only has a population of 52 million that is not growing. This could prevent Coupang from growing its e-commerce business to the size of Amazon.

In order to expand its addressable market, Coupang has entered Taiwan and begun to replicate its integrated e-commerce model. So far, the Rocket Wow business is growing like a weed. Revenue in Taiwan was up 54% quarter over quarter and has been accelerating in 2025. On an annual basis, Taiwan revenue is growing at more than 100%. It is at a small base today, but this shows that Coupang's business model may not be limited to just the South Korean market and has the potential to expand into other nations in Asia.

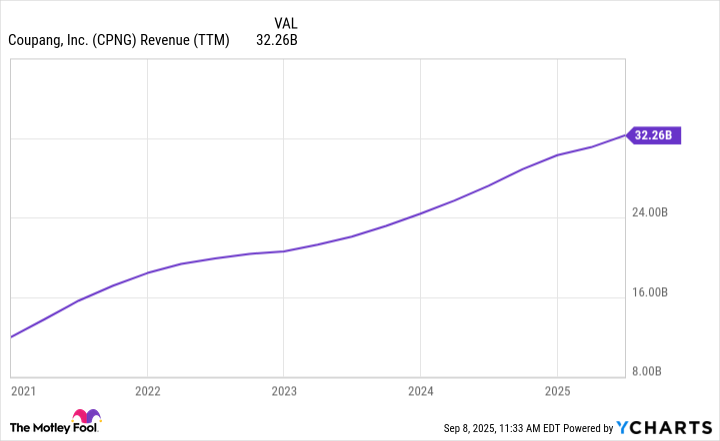

CPNG Revenue (TTM) data by YCharts

Is Coupang stock a buy below $30?

As of this writing, Coupang's stock has a market cap of $52 billion. Of course, this is much smaller than Amazon, but investors do not need Coupang to become as large as the American e-commerce giant in order for the stock to perform well.

Coupang's annual revenue is now $32.3 billion and grew 19% year over year on a foreign-currency-neutral basis last quarter. Within the next 12 months, the company should be closing in on $40 billion in revenue with plenty of room to keep growing for the rest of the decade, especially when Taiwan is factored in.

Even though it generates a sparse consolidated profit right now, Coupang's Core commerce offering in South Korea has a 9% profit margin as of last quarter, which shows the underlying profit potential of the business.

Over the long term, investors can expect the company's profit margin to expand to 10% or even higher when adding on advertising revenue and growing subscription revenue from Rocket Wow memberships. On $40 billion in revenue, that is $4 billion in potential earnings power, which WOULD be a price-to-earnings ratio (P/E) of just 13 based on today's market capitalization. This is a cheap earnings ratio for a business with a strong history of revenue growth and plenty of potential to keep growing over the next five years.

These factors make Coupang stock a buy below or even above $30 for investors with their gaze on the all-important long term.