AI Unicorn Anthropic Hits Staggering $183B Valuation - Here’s Why Amazon Investors Should Care

Another day, another AI valuation that makes traditional tech stocks look like they're moving in slow motion.

Anthropic just shattered expectations with a $183 billion valuation - numbers that would make even the most bullish Amazon shareholder do a double-take.

Why This Matters for Big Tech

Amazon's deep pockets have been fueling Anthropic's rise. That strategic partnership now looks like absolute genius - or sheer luck, depending on how cynical you are about corporate foresight.

The Cloud War Just Got Hotter

While Wall Street analysts debate whether this valuation represents real innovation or just another bubble in the making, Amazon's infrastructure moat gets stronger every day Anthropic scales.

Remember when billion-dollar valuations were impressive? Now we're playing in the hundreds of billions - and Amazon investors are sitting at the right poker table. Just don't ask if anyone actually understands how the AI magic works behind the scenes.

Image source: Getty Images.

While these gains are a clear win for the venture capital firms that backed Anthropic early on, the company's trajectory carries even greater strategic weight for Amazon.

Let's explore how Amazon is integrating Anthropic into its broader artificial intelligence (AI) ecosystem -- and what this deepening alliance could mean for investors.

AWS + Anthropic: Amazon's secret weapon in the AI arms race

Beyond its e-commerce dominance, Amazon's largest business is its cloud computing arm -- Amazon Web Services (AWS).

Much like's integration of ChatGPT into its Azure platform, Amazon is positioning Anthropic's Claude as a marquee offering within AWS. Through its Bedrock service, AWS customers can access a variety of large language models (LLMs) -- with Claude being a prominent staple -- to build and deploy generative AI applications.

In effect, Anthropic acts as both a differentiator and a distribution channel for AWS -- giving enterprise customers the flexibility to test different models while keeping them within Amazon's ecosystem. This expands AWS's value proposition because it helps create stickiness in a fiercely intense cloud computing landscape.

Cutting Nvidia and AMD out of the loop

Another strategic benefit of Amazon's partnership with Anthropic is the opportunity to accelerate adoption of its custom silicon, Trainium and Inferentia. These chips were specifically engineered to reduce dependence on's GPUs and to lower the cost of both training and inferencing AI workloads.

The bet is that if Anthropic can successfully scale Claude on Trainium and Inferentia, it will serve as a proof point to the broader market that Amazon's hardware offers a viable, cost-efficient alternative to premium GPUs from Nvidia and.

By steering more AI compute toward its in-house silicon, Amazon improves its unit economics -- capturing more of the value chain and ultimately enhancing AWS's profitability over time.

From Claude to cash flow

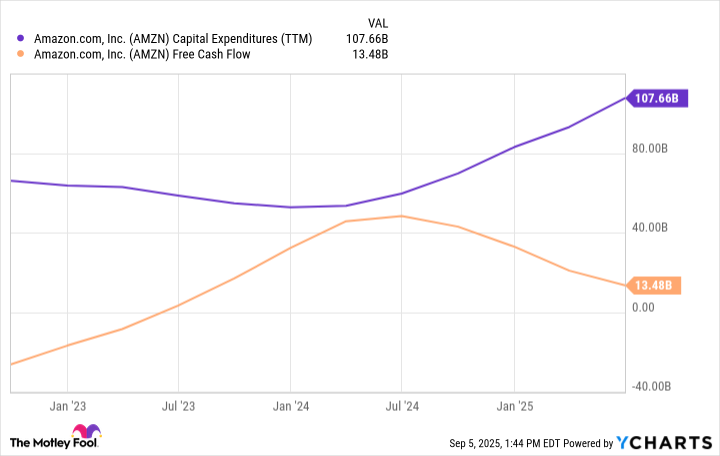

For investors, the central question is how Anthropic is translating into a tangible financial impact for Amazon. As the figures below illustrate, Amazon has not hesitated to deploy unprecedented sums into AI-related capital expenditures (capex) over the past few years. While this acceleration in spend has temporarily weighed on free cash flow, such investments are part of a deliberate long-term strategy rather than a short-term playbook.

AMZN Capital Expenditures (TTM) data by YCharts

Partnerships of this scale rarely yield immediate results. Working with Anthropic is not about incremental wins -- it's about laying the foundation for transformative outcomes.

In practice, Anthropic enhances AWS's ability to secure long-term enterprise contracts -- reinforcing Amazon's position as an indispensable backbone of AI infrastructure. Once embedded, the switching costs for customers considering alternative models or rival cloud providers like Microsoft Azure or Google Cloud Platform (GCP) become prohibitively high.

Over time, these dynamics should enable Amazon to capture a larger share of AI workloads and generate durable, high-margin recurring fees. As profitability scales alongside revenue growth, Amazon is well-positioned to experience meaningful valuation expansion relative to its peers -- making the stock a compelling opportunity to buy and hold for long-term investors right now.