Schwab U.S. Dividend Equity ETF: Growth Investor’s Dream or Value Hunter’s Goldmine?

Dividend ETFs face off: Growth versus value strategies collide in Schwab's flagship fund

The Yield Chase

Schwab's dividend ETF delivers steady income streams while maintaining exposure to blue-chip American corporations. It targets established companies with proven track records of shareholder returns—not exactly the flashy tech startups growth investors adore.

Value Investor's Playground

This fund leans heavily toward traditional value sectors: financials, healthcare, and consumer staples dominate the portfolio. These aren't moonshot companies—they're cash-generating machines that actually turn profits instead of promising them someday.

Growth Limitations Exposed

Missing: the high-flying tech stocks that drive aggressive growth portfolios. Schwab's dividend approach prioritizes stability over explosive gains—a conservative strategy that might leave growth investors checking their portfolios less often, but also less excitedly.

The Verdict

Value investors get exactly what they pay for: reliable income, lower volatility, and the comfort of investing in companies that actually make money. Growth seekers might want to look elsewhere—unless they enjoy watching paint dry while their friends gamble on unprofitable tech startups.

Because nothing says financial excitement like preferring dividends over dreams of lambos.

What does the Schwab U.S. Dividend Equity ETF do?

As an index-tracking ETF, the Schwab U.S. Dividend Equity ETF does whatever the index it tracks does. This is an important fact because it means that the real story here is the index, not the ETF. The index in this case is the Dow Jones Dividend 100.

Image source: Getty Images.

The Dow Jones Dividend 100 index starts out by only looking at companies that have increased their dividends for 10 years or more (excluding real estate investment trusts). That is a mixture of a quality and a growth screen. A company can't increase dividends every year if it isn't growing. And it WOULD also have a hard time if the company were on weak financial footing.

By comparison, one of its competitor funds -- the-- tracks the S&P U.S. Dividend Growers Index. But the only other thing done with the Vanguard ETF is to lop off the highest yielding 25% of the qualifying stocks, which biases the fund toward growth.

However, the Dow Jones Dividend 100 index doesn't stop with a single screen. Its next step is to create a composite score for all of the stocks that pass the first screen. The composite score includes the metrics cash FLOW to total debt, return on equity, dividend yield, and a company's five-year dividend growth. There's a lot going on here.

Cash Flow to total debt looks at financial strength, which is a value issue. Return on equity is a company quality issue, which is more growth leaning. Dividend yield is about the income that's created, so it's neutral in the growth-versus-value conversation, though higher yields will generally be seen as more toward the value side. A company's five-year dividend growth rate will lean toward growth, since it requires more growth to increase dividends at a higher rate.

In other words, both growth and value are being considered throughout the selection process that creates the portfolio of the Schwab U.S. Dividend Equity ETF. The 100 companies with the highest composite scores get into the index and the ETF with a market-cap weighting. All of that work is being done for a very tiny expense ratio of 0.06%.

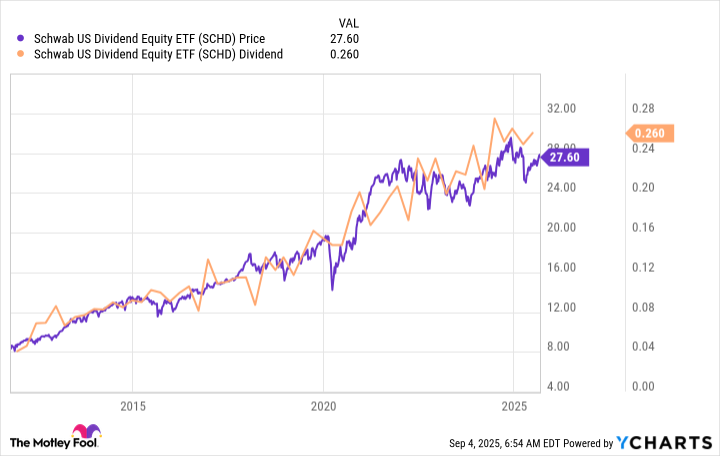

SCHD data by YCharts.

Is this a growth or a value ETF?

What actually comes out of the mix here is hard to put into a single box. The goal is really to find good companies that have attractive and growing dividends. That's basically what most dividend investors are trying to achieve. So, the big story is that dividend lovers will probably appreciate this Schwab ETF.

On the growth-versus-value front, however, the ETF isn't really picking sides. It is trying for the middle, which means that either value or growth investors could comfortably buy the ETF and claim it offers them the investment bias they prefer.

Or, conversely, value and growth investors might also decide that by not picking sides, the Schwab U.S. Dividend Equity ETF isn't pure enough for them. In the end, it will depend on your perception and willingness to accept an approach that goes for the middle.

The one thing that remains certain is that the Schwab U.S. Dividend Equity ETF is meant for dividend lovers. But even here, there's a compromise. The dividend yield is around 3.8% today. That's well above the market's yield, but you can easily find ETFs with higher yields. So this is another compromise that has to be made if you are trying to maximize the income your portfolio generates.

The Schwab U.S. Dividend Equity ETF is a good middle ground

No investment is perfect, so you will always have to make compromises. In this case, the compromises are all reasonable and lead to an attractive outcome. The Schwab U.S. Dividend Equity ETF has, over time, provided a generally rising share price and a generally rising dividend.

Given the attractive yield and the fairly complicated screening process, growth, value, and income investors could all comfortably add this high-yield ETF to their portfolios without feeling like they have compromised too much.