This Artificial Intelligence (AI) Stock Could Be the Nvidia of Quantum Computing - Here’s Why It’s Dominating the Next Frontier

Quantum Leap: AI-Powered Stock Positioned to Dominate the $1 Trillion Quantum Computing Race

The Architecture of Disruption

While traditional investors chase yesterday's tech, this company built quantum-ready AI infrastructure years ahead of the curve. Its neural networks already process quantum-level calculations that leave classical computers in the dust.

Hardware That Thinks Different

Their proprietary chips don't just compute—they anticipate. Unlike legacy systems that brute-force problems, this architecture dances with quantum states, turning theoretical physics into tangible profits.

The Ecosystem Play

Every major quantum research lab now runs on their platform. From drug discovery to cryptography, their AI orchestrates quantum workflows that would make Wall Street's supercomputers blush—if those dinosaurs could even understand the math.

Financial Realities Bite

Sure, hedge funds will still pour millions into 'quantum' startups that are just repackaged cloud databases. But this stock? It's the actual engine—the only one making real revenue while others make PowerPoint presentations.

Bottom line: When quantum hits mainstream, this won't be another player. It'll be the house—and the table.

Image source: Getty Images.

(GOOGL -0.31%) (GOOG -0.35%) may be charting a similar path in quantum computing. Through a series of strategic moves in recent years, the company is laying the groundwork to become the Nvidia of quantum platforms.

Building the hardware foundation like Nvidia's GPUs

Nvidia's GPUs were the gateway for developing the CUDA framework. Alphabet's parallel effort on the hardware side centers on its tensor processing units (TPUs) and its research into superconducting quantum processors (i.e. Willow). While TPUs are not quantum devices, they highlight Google's capability to design custom silicon tailored for new, increasingly sophisticated computational needs.

The company's Sycamore processor -- which demonstrated quantum supremacy in 2019 -- provided a proof-of-concept that its approach to building quantum hardware was viable. Since then, Alphabet has poured years of investment into refining its AI and quantum Stacks -- assembling the engineering talent and technological expertise to iterate on architectures until they achieve practical utility.

Much like Nvidia's cycle of GPU innovation, Alphabet is positioning itself to develop successive generations of quantum processors that can be paired with proprietary systems and software -- creating an integrated ecosystem just as Nvidia has.

Cirq could be Alphabet's version of CUDA

Hardware alone rarely creates a durable moat. Nvidia's true competitive advantage comes from its one-two punch of GPUs and CUDA. This combination has created a powerful lock-in effect, making the switching costs to competing platforms -- even those with lower upfront investment -- extremely steep. Once developers build and optimize their models on CUDA, abandoning Nvidia's walled garden becomes almost unthinkable.

Alphabet is pursuing a similar strategy in quantum computing, though with a different design philosophy. Its analogue to CUDA is Cirq -- an open-source quantum programming framework the lets developers build and run applications across multiple backends. Unlike CUDA, Cirq does not tie developers exclusively to Google's hardware. In fact, platforms such asAzure andalready integrate with Cirq, underscoring its interoperability.

Paradoxically, this openness may strengthen Alphabet's position. By fostering a larger community of developers who become fluent in Cirq -- even outside of Google's hardware stack -- the company is ensuring that when its own quantum applications reach commercial scale, an ever-growing developer base is already aligned with its tools.

In other words, while Nvidia's moat is supported by tight integration, Alphabet is cultivating an ecosystem anchored in accessibility and collaboration -- an open framework that could become just as sticky, but drawing developers in voluntarily rather than lock-in.

DeepMind: The path to unlock valuation expansion

While CUDA has been the foundation of Nvidia's dominance, the company's success ultimately hinged on widespread external adoption and validation by developers.

Alphabet, by contrast, already controls one of the world's premier AI research labs -- DeepMind -- which gives it a built-in feedback loop to stress-test its quantum algorithms, refine Cirq, and push next-generation processors like Willow forward more quickly.

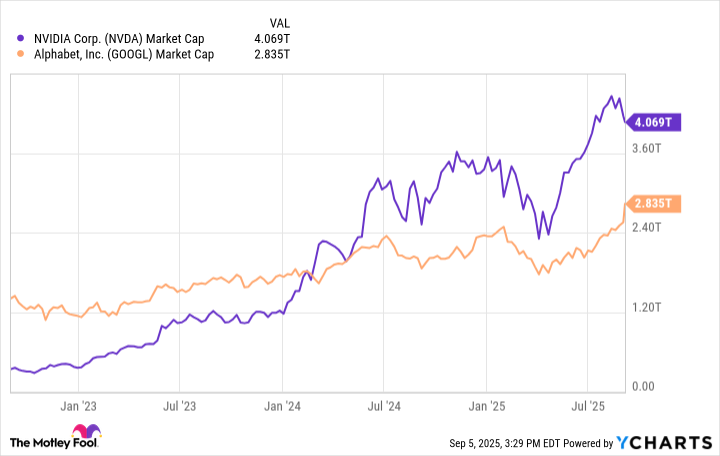

This vertical integration across research, hardware, and software mirrors the Nvidia GPU-CUDA dynamic that made it indispensable to AI development. Nvidia's ecosystem has translated into years of explosive revenue growth, expanding profit margins, and record valuation expansion.

NVDA Market Cap data by YCharts

Alphabet appears to be deploying a similar playbook -- but adapted for the quantum era. Instead of a closed system, Alphabet is building an open, yet sticky, ecosystem designed to attract developers by choice and create a powerful gravitational pull around its platform.

For investors, the takeaway is clear. As AI workloads grow more complex and quantum computing inches closer to real-world utility, Alphabet is positioned to drive and monetize this shift at scale.

Long-term investors should view Alphabet not just as a leader of today's technology landscape, but one that is at the forefront of the next frontier of AI. I think that buying and holding Alphabet stock offers exposure to a potential Nvidia-like return over the next several years.