Warren Buffett’s $344 Billion Warning Echoes Through Wall Street - Should You Buy or Avoid Stocks During the Market’s Historically Worst Month?

Warren Buffett's seismic $344 billion warning just shook Wall Street to its core. As September unfolds—the market's notorious worst-performing month—investors face a critical crossroads.

The Oracle's Ominous Signal

Buffett's massive cash position screams caution while traditional markets wobble. His Berkshire Hathaway sits on a mountain of dry powder waiting for real opportunities—not overpriced equities.

September's Historical Bloodbath

Statistical ghosts haunt this month. Historical data shows consistent underperformance—a pattern savvy investors know all too well. Meanwhile, digital assets continue disrupting traditional finance's outdated models.

The Crypto Alternative

While old-school investors panic about seasonal trends, decentralized networks operate 24/7/365. No historical month patterns—just continuous global market participation. Traditional finance's calendar-based anxiety seems almost quaint now.

Smart Money's Real Move

Buffett might avoid tech, but his cash hoard reveals more than his words ever could. Meanwhile, blockchain infrastructure grows exponentially while Wall Street debates which month to be scared of. The real warning? Traditional markets might be the riskiest bet of all.

Image source: The Motley Fool.

Stocks in September

So, first, let's talk about the month of September. It's been the worst for investors over time, and this trend is confirmed if we look at recent data. Over the past five years, the S&P 500 only advanced once in September -- by 2% last year. The other Septembers resulted in losses of about 3% to 9%. If history is correct, we may be heading for another tough month that could lower the value of your portfolio, at least temporarily.

Now, let's MOVE on to Buffett's warning. The billionaire never joins in big market movements. For example, if everyone is buying artificial intelligence (AI) stocks, Buffett won't be part of this crowd. He doesn't do this just to be contrary. Instead, Buffett prefers focusing on value stocks -- quality companies that may be overlooked by the general market today but have what it takes to deliver growth over the long run.

So, in recent quarters, as investors flocked to technology and growth stocks and the S&P 500 soared, Buffett bought selectively and grew his pile of cash, readying himself for future investment opportunities. Buffett's warning is essentially this: Stocks have become expensive, and as a result, the market could pull back at any moment.

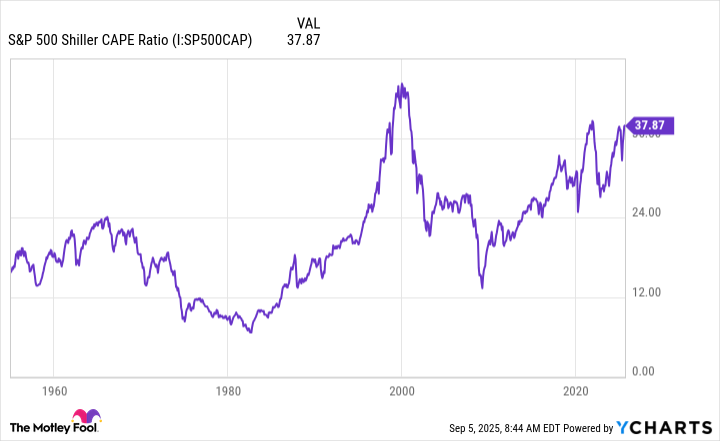

We can see this through the S&P 500 Shiller CAPE ratio, today at levels it's only reached twice before since the S&P 500 launched as a 500-company index.

S&P 500 Shiller CAPE Ratio data by YCharts

What Buffett does in this investing environment

The Shiller CAPE ratio is a particularly sound metric because it measures a company's earnings per share, adjusted for inflation, over a 10-year period. And the current level shows that stocks, overall, are expensive, making this the sort of environment that Buffett approaches with caution.

Considering all of this, should you buy or avoid stocks during what generally is the worst month for the stock market? Like Buffett, we all should pay close attention to valuation and avoid buying stocks that look overvalued -- but this is an important rule to invest by at any time, whether the overall market is rising or falling. (Of course, there may be some exceptions. Aggressive investors might, for example, consider shares of a high-growth tech company that's trading for a steep valuation if the full long-term picture looks bright.)

Opportunities on the horizon?

Still, this doesn't mean we should avoid stocks altogether, and Buffett isn't telling us to stop investing either. Instead, his huge cash pile implies opportunities may be limited at the moment, in many cases due to high valuations. But here's the good news. If stocks actually follow the historical trend and decline in September, this may create opportunities -- so September may be a fantastic time for the bargain-hunting long-term investor to go shopping for stocks.

Buffett backs up this idea as we can see in a comment he once made: "The best chance to deploy capital is when things are going down."

After all, the overall market and quality stocks have shown over time that they don't remain in the doldrums forever. So, when you buy at a low point and hold on for a period of years, you could set yourself up for a big win.

All of this means that, yes, you should consider buying stocks during the worst month of the year -- as long as, like Buffett, you make sure the price is right.