If You’d Invested $1,000 in the Vanguard S&P 500 ETF (VOO) 10 Years Ago, Here’s How Much You’d Have Today

VOO Delivers Decade of Dominance—Traditional Finance Finally Gets Something Right

The Compounding Engine

That $1,000 investment didn't just sit there—it went to work. While crypto was making headlines with 100x moonshots and catastrophic collapses, VOO quietly compounded returns year after year. No flashy promises, just relentless market participation.

The Boring Brilliance

Forget timing the market or picking individual stocks. VOO's strategy remains brutally simple: own the entire S&P 500 and let American capitalism do the heavy lifting. It's the antithesis of crypto's hyper-active trading culture—and somehow it keeps winning.

The Reality Check

Sure, the returns won't impress your cousin who 'only invests in altcoins,' but they'll likely outperform 90% of professional fund managers—most of whom still charge 2% fees for the privilege of underperforming this index. The ultimate Wall Street irony: the cheapest option often delivers the best results.

Why has the S&P 500 had such a strong decade?

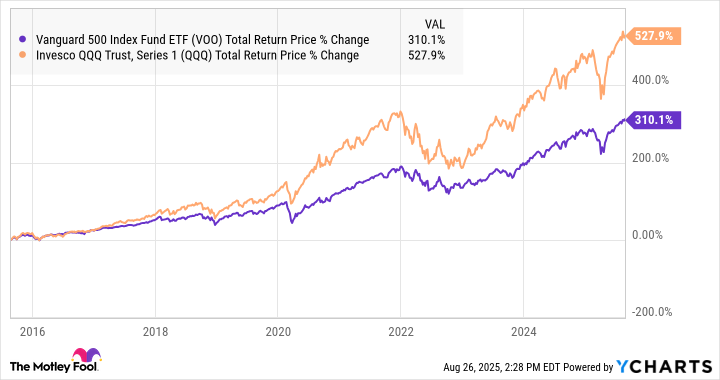

It's worth noting that a decade ago, the S&P 500 had already more than tripled from the 2009 financial crisis lows. So, adding a 310% total return on top of that is no small feat.

VOO Total Return Price data by YCharts

The short explanation is that while most sectors have performed quite well, the bulk of the stellar performance has been largely fueled by large-cap technology stocks. After all, the trillion-dollar megacap tech stock wasn't a thing back then, and now there are eight of them. To illustrate this, consider the five largest holdings of the Vanguard S&P 500 ETF and how each one has performed over the past decade:

|

Nvidia |

8.1% |

32,230% |

|

Microsoft |

7.4% |

1,270% |

|

Apple |

5.8% |

843% |

|

Amazon |

4.1% |

802% |

|

Alphabet |

3.7% |

566% |

|

S&P 500 |

100% |

310% |

Data source: yCharts, Vanguard. Percentages of assets as of 7/31/2025.

Think about this. The worst performer of the five largest megacap tech stocks in the S&P 500 outperformed the overall index by more than 250 percentage points over the past decade.

Image source: Getty Images.

Historically, the S&P 500 has delivered annualized returns in the 9% to 10% range over long periods, so it's fair to say that this has been an incredibly strong decade for S&P 500 investors. And while there's no way to predict what might happen over the next 10 years, it wouldn't be realistic to expect 15% annualized returns over the long run forever.