Can $10,000 in McDonald’s Stock Actually 5X to $50,000 by 2030?

Fast Food Fortune or Financial Fantasy?

The Golden Arches Gamble

Turning ten grand into fifty large sounds like something from a late-night infomercial—not a serious investment thesis. Yet here we are, staring down McDonald's stock ticker and wondering if those golden arches could actually gild a five-bagger by 2030.

Burger Flipping or Money Printing?

Forget the Quarter Pounders—investors are hungry for returns that outpace inflation and then some. McDonald's global footprint and relentless franchising model generate cash flow that would make most traditional finance suits blush. But quintupling your money? That requires growth assumptions even a Happy Meal couldn't contain.

The Reality Check

Sure, automation might cut labor costs and digital menus could boost margins, but turning $10,000 into $50,000 demands near-perfect execution in a world where consumers increasingly side-eye processed foods. It's the ultimate test of whether a fast-food empire can actually deliver fine-dining returns—or just another case of Wall Street's special sauce being mostly mayonnaise.

Image source: Getty Images.

Achieving fivefold growth

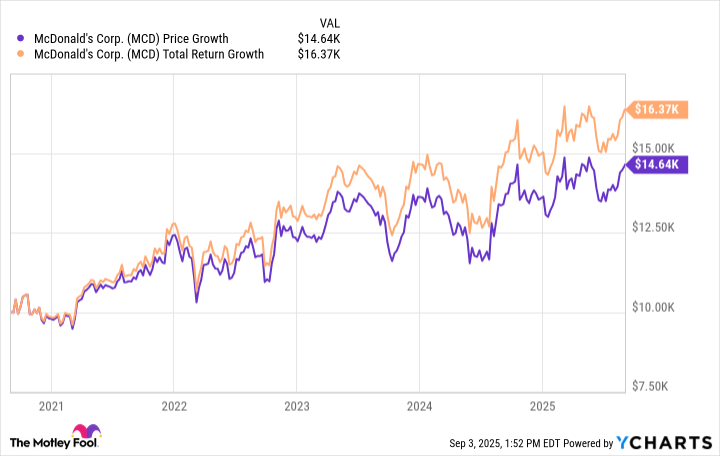

Unfortunately for McDonald's stock bulls, its recent history does not point to fivefold gains over five years. If one had invested $10,000 five years ago, that position WOULD be worth less than $14,600 today. If including dividend income, which has risen every year since 1976, that grows to less than $16,400.

MCD data by YCharts.

This is not to say McDonald's is a poor choice. Its business model revolves around 95% of its locations operating as franchises. After paying a franchising fee, franchisees must rent the properties from McDonald's and pay a royalty fee amounting to 4% or 5% of sales. Since the fixed expenses define most of this arrangement, it makes the company's business model highly recession resistant.

Nonetheless, its financial growth may not inspire fivefold gains over the next five-year period. In the first six months of 2025, revenue of $12.8 billion grew by only 1% yearly. While it kept cost and expense increases in check, the $4.1 billion in net income in the first half of the year was only a 4% yearly gain.

Moreover, its 27 P/E ratio is slightly under the(^GSPC -0.32%) average of 30. That gives its stock an average valuation, decreasing the likelihood that an expanding earnings multiple would drive it dramatically higher.

As a company, McDonald's should continue to benefit from revenue from its franchisees and rising dividends. Although that should bring positive returns to the company, its financial growth will likely not turn a $10,000 investment into $50,000 over the next five years.