This AI Upstart Already Soared 300%—And It’s Just Getting Started

Forget incremental gains—this artificial intelligence disruptor just posted triple-digit returns while legacy tech plays catch-up.

Riding the AI Wave

While traditional finance still debates AI's real-world value, this platform quietly integrated machine learning into its core architecture—and the market responded with a 300% surge. No theory, no hype—just code that delivers.

The Cynical Take

Meanwhile, hedge funds are still overpaying for 'AI-washed' startups that repackage basic algorithms as revolutionary tech. Some things never change.

Bottom line: When a real AI asset moves, it doesn't ask for permission—it just rewrites the rules.

Why is Aehr critical to AI?

Here is the 30,000-foot view. When companies, notably hyperscalers, build massive data centers full of tens of millions, and sometimes hundreds of millions, of semiconductors (chips), they must ensure that they are reliable. High failure rates are extremely costly in terms of remediation, labor, downtime, and replacements. If the company selling the chips has a high failure rate, its competitors can gain traction. Aehr Test Systems provides the necessary reliability testing systems.

Their importance cannot be understated. The latest chips are stackable (multiple layers of chips forming one unit), which allows for exponentially more processing power. However, there is a catch. Many times, they are a "single point of failure." In other words, if one chip in the stack fails, the entire stack fails. The importance of reliability testing has increased by an order of magnitude as a result. And now Aehr is the hot name that could become a stock market darling again.

Image source: Getty Images.

Is Aehr stock a buy now?

You have probably heard about the massive data centers that the "hyperscalers," companies like,, Elon Musk's xAI, and other tech giants, are building across the country and the world. In fact, trying to keep up with all of the announcements of new projects WOULD make your head spin. In many cases, the data center campus spans more than a square mile and contains hundreds of thousands of chips. Elon Musk's xAI project, dubbed "Colossus," is said to require over a million GPUs in the end.

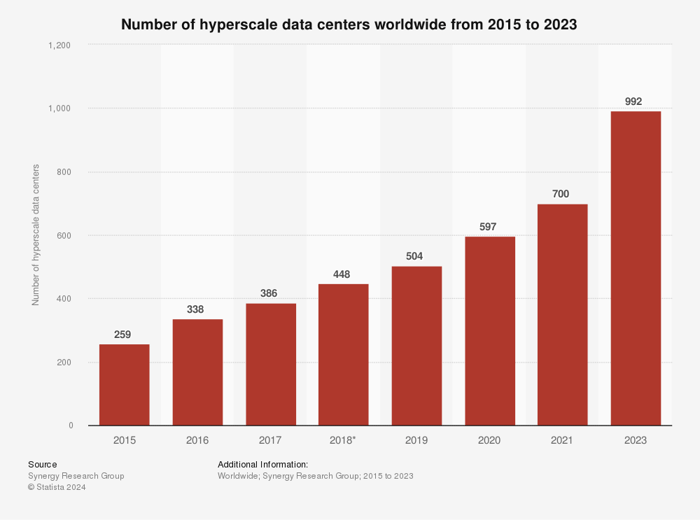

As shown below, the number of hyperscale data centers is soaring with no end in sight.

Source: Statista.

This number increased to more than 1,100 at the end of 2024, nearly doubling over the past five years. The demand is primarily driven by artificial intelligence, which is why Aehr is now an "AI stock" -- and the reason its share price took off and could continue higher over the long term.

Aehr still faces serious challenges. Its revenue fell from $66 million in fiscal 2024 to $59 million in fiscal 2025. It slipped from an operating profit of $10 million to a loss of $6 million over that period as the company undertook the challenging task of refocusing its business. However, investors who dig deeper see a very encouraging sign. The company's backlog (orders that have been placed, but not yet fulfilled) jumped to $15 million from $7 million. Aehr also announced several orders received from major hyperscalers over the last couple of months.

It's challenging to value Aehr stock at this time. The company is in a transition period, and while the AI market looks hugely promising, it is still a work in progress. In its heyday, the stock's valuation peaked at 31 times sales, and as recently as August 2023 it traded for 24 times sales compared to 12 times sales today. The AI market could be a Gold mine for Aehr, and Aehr stock looks like a terrific buy for investors.