Think Nvidia Stock Is Too Expensive? Here Are 60 Billion Reasons to Change Your Mind

Nvidia just shattered expectations—again.

The $60 billion question isn't whether you can afford the stock—it's whether you can afford to miss it.

AI demand isn't slowing down—it's accelerating. Data centers can't get enough of those GPUs. Gaming? Still printing. Autonomous vehicles? Just getting started.

Wall Street analysts keep chasing the stock price upward—classic case of 'sell-side FOMO.' Meanwhile, the company keeps executing while traditional value investors scratch their heads.

That premium valuation? It's not a bug—it's a feature. You're paying for dominance in the most transformative tech shift since the internet.

Still think it's expensive? Your portfolio might disagree later.

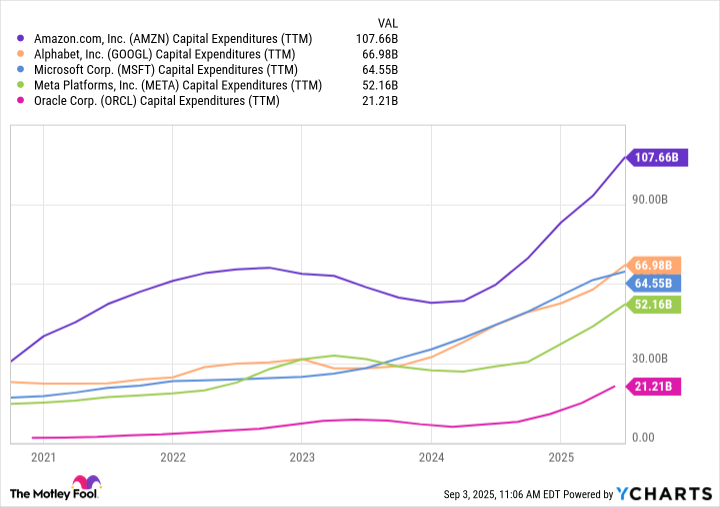

AMZN Capital Expenditures (TTM) data by YCharts.

This unprecedented demand has propelled Nvidia's market value from about $345 billion at the dawn of the AI revolution to more than $4 trillion today.

After gains of this magnitude, it's natural to wonder if the best days for Nvidia stock are already in the rear-view mirror. After all, how could a stock that has skyrocketed to such a height keep climbing?

Yet just as skeptics are beginning to call a top, Nvidia's management has moved to support the stock's trajectory with a $60 billion commitment.

To me, the question isn't whether Nvidia has peaked, but whether the world's most valuable company is just getting started.

Is Nvidia stock overvalued?

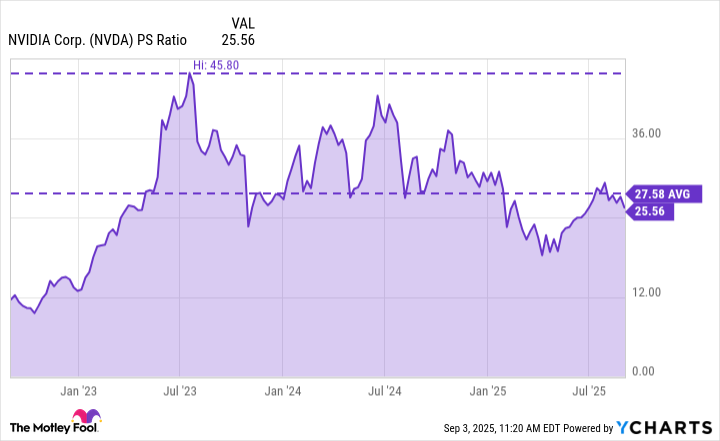

Nvidia is trading in line with its three-year average price-to-sales (P/S) ratio and significantly below the peak it hit during the early days of the AI boom.

NVDA PS Ratio data by YCharts.

So Nvidia stock may appear "cheap" compared to where it stood during prior periods of AI euphoria. That said, the so-called discount is relative. During the dot-com bubble of the late 1990s, many high-flying stocks peaked at P/S multiples in the 30 to 40 range.

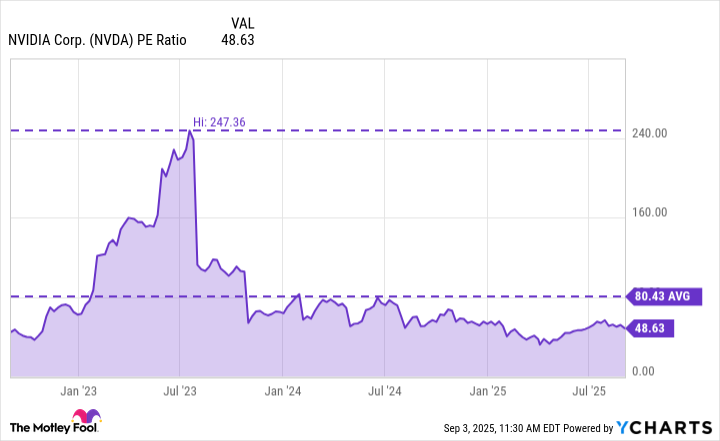

NVDA PE Ratio data by YCharts.

At first glance, Nvidia's price-to-earnings (P/E) multiple looks deeply discounted to both its historical average and its peak levels over the last few years. The nuance to point out here is that the AI trend has led to explosive growth in Nvidia's profitability. This means that the denominator in its P/E ratio (earnings) has expanded dramatically. In other words, Nvidia's current P/E of 49 reflects normalized profitability rather than investors suddenly valuing the company at a less aggressive growth multiple.

On an absolute basis, Nvidia's valuation is demanding. But for investors who are trying to determine whether the shares are truly overvalued, management's latest announcement may offer some insight.

60 billion (more) reasons to pay attention to Nvidia

During the first half of the year, Nvidia repurchased 193 million shares of its common stock for $24.2 billion. Moreover, on its second-quarter earnings call in late August, management unveiled an even more striking move: The board of directors approved an additional $60 billion stock buyback program.

Such buybacks are often interpreted as a vote of confidence. They typically signal that management believes that a company's cash flows are sustainable and that repurchasing its own stock is one of the best uses of capital. But in Nvidia's case, there may be a more strategic LAYER at play here.

For much of the last few years, Nvidia's growth narrative has been anchored on its chips being used for the training of large language models (LLMs) and other generative AI tools. Looking ahead, however, the real upside will stem from their use in more advanced applications, such as robotics, quantum computing, and autonomous systems -- each of which represents a potential trillion-dollar market. These use cases will require more computing power, which will likely mean next-generation chip architectures from Nvidia.

While the company's successor to Blackwell, dubbed Rubin, is expected to ship next year, the catch with Nvidia's next massive rally will come down to timing.

It could be five to 10 years before these new, sophisticated use cases are driving enough sales to materially transform Nvidia's profitability profile. In the interim, the company's growth will likely continue -- albeit at a slower pace.

This is why the new stock buyback program looks particularly savvy. By aggressively reducing its outstanding share count over the next few years, Nvidia can bolster its earnings per share (EPS) growth during this transitional phase of the AI narrative. In effect, the new buyback program acts as a bridge -- keeping EPS momentum robust in the NEAR term while the infrastructure wave of the AI era scales up in the background.

Image source: Getty Images.

Is Nvidia stock a buy?

All told, Nvidia is positioned to benefit handsomely from the secular tailwinds of AI infrastructure spending by hyperscalers. At the same time, the company's ability to return capital through stock buybacks highlights the strength of its cash generation, management's commitment to rewarding shareholders, and the company's view that its stock remains appropriately priced.

Taken together, these dynamics underscore why I see Nvidia as a compelling opportunity to buy and hold. With structural growth drivers and shareholder-friendly capital allocation at the forefront of its strategic roadmap, the stock remains a no-brainer opportunity in the AI realm.