Why The Metals Company Is Exploding Right Now - And What It Means For Crypto Investors

Deep-sea mining startup The Metals Company just became Wall Street's latest obsession—and crypto traders are taking notice.

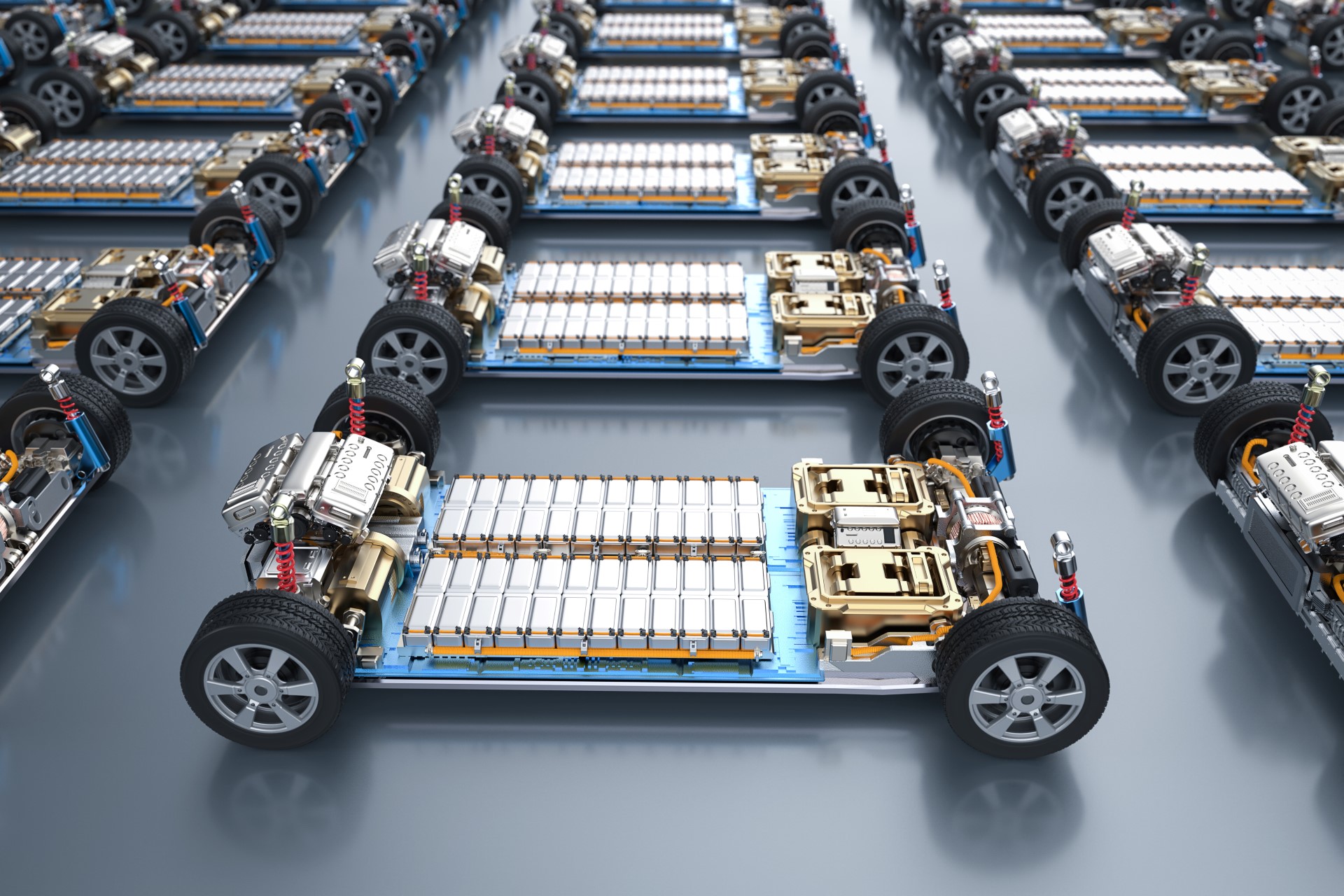

The Battery Metal Revolution

While bitcoin miners chase energy, TMC goes straight to the source: harvesting polymetallic nodules from the ocean floor. These potato-sized rocks contain nickel, cobalt, and copper—the trifecta of battery metals. No digging, no blasting, just vacuuming the seabed. It’s like finding a saturated mining pool that nobody’s tapped yet.

Green-Tech’s Dirty Secret

Electric vehicles and renewable storage depend on these metals. Traditional mining faces environmental hurdles and supply chain nightmares. TMC’s approach bypasses land-based politics and ESG headaches. They’re basically running a proof-of-work consensus for physical assets—without the carbon guilt trip.

The Crypto Connection

Speculators are piling in because battery metals are the new oil—and TMC controls potentially massive reserves. Their stock surge mirrors crypto’s appetite for disruptive tech plays. When lithium prices moon, so does investor frenzy. This isn’t just about metals; it’s about betting on the infrastructure of the digital and green transition.

Of course, Wall Street analysts—who still think Bitcoin is a passing fad—are suddenly experts in deep-sea geology. Because nothing says 'due diligence' like chasing a stock that’s up 200% on hype alone.