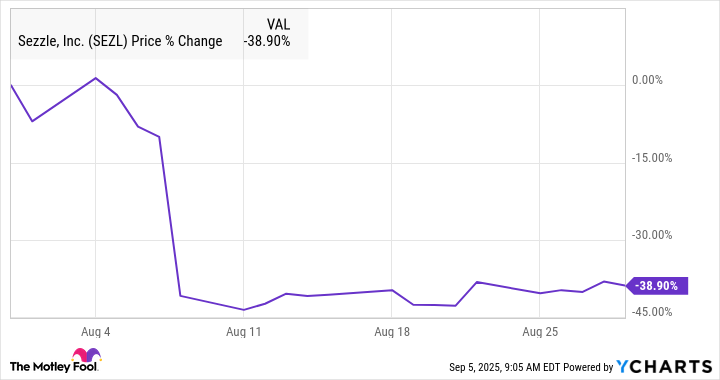

Sezzle Stock Plunges 39% in August: What Sparked the Selloff?

Another fintech darling gets brutalized by market realities.

The Numbers Don't Lie

Sezzle's 39% nosedive in August wasn't just a correction—it was a full-scale investor exodus. The buy-now-pay-later sector faced mounting pressure from rising interest rates and regulatory scrutiny, crushing valuations across the board.

Market Forces Exposed

Traditional lenders finally woke up and started competing with aggressive financing options. Meanwhile, consumers began prioritizing essentials over discretionary spending—bad news for installment payment platforms banking on endless growth.

Wall Street's Short Memory

Remember when every fintech IPO was hailed as the next revolution? Now they're just another lesson in how quickly momentum reverses when fundamentals actually matter. Sometimes the market's efficiency looks suspiciously like institutional amnesia.

SEZL data by YCharts

Is the Sezzle breakout over?

Sezzle continued to deliver blistering growth in the second quarter with revenue up 76.4% to $98.7 million, which topped estimates at $94.9 million. That was driven by strong on-demand growth, meaning consumers who use the BNPL product without a subscription, as well as its partnership with WebBank, which agreed to be its exclusive banking partner last year.

User growth was strong as well with monthly on-demand and subscribers (MODS) reaching 748,000, up from 658,000 in the first quarter, and it delivered impressive margin expansion as operating income jumped 116.1% to $36.1 million, and adjusted earnings per share was up 97% to $0.69, which beat the consensus at $0.58.

Sezzle's growth seems to be driven by a combination of new products, its focus on subscribers, and broader adoption of BNPL, which has seen strong growth as consumer confidence has fallen over fears around tariffs and now a weakening job market.

Image source: Getty Images.

What's next for Sezzle

Sezzle sees strong growth for the full year, but it may have been below investor expectations given the strong Q2 results. It also did not update its guidance from the first quarter, which was likely a disappointment to investors.

For the full year, the company sees revenue growth of 60% to 65%, though that implies a sharp slowdown after revenue essentially doubled in the first half of the year. It also called for adjusted earnings per share of $3.25, which is slightly below the consensus at $3.27.

Sezzle has delivered a remarkable performance over the past couple of years. The stock was trading at under $2 a share (split-adjusted) at the end of 2023.

While the company's differentiated model has helped it build momentum, it's understandable for the stock to cool off in response to slowing growth. Still, the valuation looks attractive now at a forward P/E under 30.