Archer Aviation Stock Below $10: Your Ticket to Massive Gains?

Flying car stocks are heating up—and Archer Aviation's sub-$10 price tag has investors buzzing about explosive upside potential.

Why This Sector's Primed for Takeoff

Urban air mobility isn't science fiction anymore. Major cities are preparing infrastructure for electric vertical takeoff aircraft, and Archer's positioned at the forefront. Their Midnight aircraft promises to revolutionize urban transport with 100-mile range capabilities.

The Crypto Connection You're Missing

While traditional investors analyze P/E ratios, crypto natives understand disruptive technology adoption curves. Archer represents physical blockchain energy—actual decentralization of transportation networks. This isn't just stock speculation; it's betting on infrastructure paradigm shifts.

Risk Assessment: Volatility Ahead

Pre-revenue companies always carry higher risk profiles. Regulatory hurdles remain, and certification timelines could stretch. But remember—every major crypto winner looked risky before becoming obvious.

Positioning for the Moonshot

Dollar-cost averaging below $10 could prove brilliant if Archer executes. Their partnership with Stellantis provides manufacturing credibility, while United Airlines' conditional purchase agreement shows real demand.

Just don't mortgage your bitcoin stack to buy it.

How electric air taxis work

Unlike a helicopter with one large (and noisy) rotor, Archer's eVTOL, called the Midnight, has many small rotors that are powered by an electric drivetrain, similar to an electric car. Using battery power and smaller rotors enables the Midnight to be nimbler and quieter than a helicopter, which theoretically should allow the air taxis to operate in busier urban areas and residential neighborhoods.

The company plans to build point-to-point taxi networks with its partners such as. From a launchpad in downtown Manhattan, United plans to use the Midnight aircraft to trim an hour-long drive to the airport into a 10-minute flying taxi ride. Bundling this with its airline tickets could be of great value to wealthier passengers at first, allowing United to charge a pretty penny for each air taxi ride.

Archer is rumored to be selling each Midnight aircraft for $5 million and has orders numbering in the hundreds already. Today, the vehicle is going through certification with the FAA, which is taking a long time because of the novel nature of electric air taxis. Once approved, the company will ramp up manufacturing and start developing air taxi networks in cities including Los Angeles; New York; and Abu Dhabi, in the United Arab Emirates.

Image source: Getty Images.

Archer Aviation's ambitious plans

Today, the company is generating zero revenue. Later this year, it plans to sell its first commercial air taxi to the United Arab Emirates, while it hopes to get FAA approval shortly to start selling in the United States. Once approved, it is ready to ramp up production to 50 aircraft a year in the NEAR term.

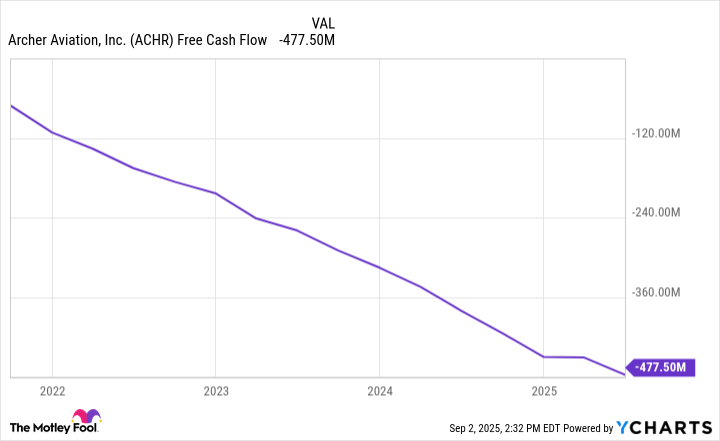

In the long run, it will likely need to start producing hundreds of Midnight eVTOLs a year to make a profit. Fifty aircraft a year at a $5 million average selling price equals $250 million in revenue; today, Archer is burning close to $450 million in free cash FLOW just from start-up costs.

Some of these expenses will go away once FAA approval occurs, but regardless, Archer Aviation is going to need a lot of scale with air taxis in order to flip to positive free cash flow. This is possible as long as the technology is viable. With hundreds of cities with traffic around the world that could use air taxi networks, the company has a huge opportunity if full FAA approval is granted.

ACHR Free Cash Flow data by YCharts.

Can the stock make investors rich?

The problem with hyped-up pre-revenue stocks is that they generally trade way ahead of the underlying progress of the business. Archer Aviation is no different. With a market capitalization of $5.6 billion -- along with a lot of shareholder dilution coming from capital raises -- it is one of the most highly valued pre-revenue businesses in the world.

Even if the company starts selling hundreds of aircraft a year and generates an estimated $2 billion in revenue 10 years in the future, this will likely be a low-margin business. A 10% profit margin would turn $2 billion in revenue into $200 million in net income, or a forward price-to-earnings ratio (P/E) of 28. That is not including any shareholder dilution within the next 10 years. Again, this could be what the company is generating in earnings 10 years from now, and would only equate to a premium earnings ratio based on today's market cap.

Electric air taxis are an exciting technology. I would love to ride in one. But that doesn't automatically mean the stock will make investors rich. Archer Aviation's valuation is getting ahead of itself, and the company will likely disappoint shareholders who buy today and hold for the next 10 years.