The Smartest Growth Stock to Buy With $20 Right Now

Crypto's proving Wall Street wrong again—while traditional markets wobble, digital assets keep printing opportunities. Forget overpriced blue-chips; that $20 bill in your pocket could become serious alpha if you know where to look.

Micro-Investing Revolution

Platforms now slice top crypto assets into fractions smaller than a satoshi. Your twenty bucks buys exposure to projects moving faster than hedge funds can short them. We're talking decentralized infrastructure, AI tokens, and layer-2 solutions eating traditional finance's lunch.

Compound Growth Engine

That $20 isn't just sitting there—it's working. Staking rewards, yield farming, and token appreciation compound faster than your bank's pathetic 0.01% APY. The smart money's already shifting allocations while mainstream investors still worry about inflation.

Timing The Wave

Market cycles wait for nobody. Entry points this accessible vanish when FOMO hits. Remember when Bitcoin was 'too expensive' at $10K? Today's altcoin gems are tomorrow's 'I told you so' stories—if you act before the herd arrives.

Just don't tell your financial advisor—they'd probably still recommend a mutual fund with 2% fees and dinosaur-era returns.

Image source: Getty Images.

SentinelOne is getting an AI-powered boost

SentinelOne reported a 22% year-over-year increase in its revenue in fiscal Q2 to $242 million. Even better, the company slightly raised its full-year guidance because of a favorable spending environment, citing an improvement in demand for its AI-enabled endpoint and cloud security platform Singularity.

The company now expects its fiscal 2026 revenue to increase by 22% to $1 billion. CEO Tomer Weingarten pointed out on the earnings conference call that SentinelOne is benefiting from "new customer additions, expansion with existing accounts and increased adoption of our AI and data solutions."

SentinelOne has been integrating AI tools across its cybersecurity solutions, and the good part is that its offerings are gaining traction among customers. For instance, the company's Purple AI security assistant grew at a triple-digit pace last quarter. This solution was attached to more than 30% of the product licenses sold by the company in fiscal Q2.

The strong adoption of this platform isn't surprising, as SentinelOne points out that Purple AI users are witnessing "55% faster threat remediation, 60% lower likelihood of major incidents and an impressive 338% return on investment over just 3 years." This explains why SentinelOne is looking to push the envelope in AI, and its recently announced acquisition of Prompt Security is a step in that direction.

SentinelOne is making this acquisition to further strengthen its AI-native Singularity platform. Prompt Security will help companies oversee their generative AI applications and assets in real time. As a result, it won't be surprising to see SentinelOne attracting more customers while winning a bigger share of the wallets of existing customers since it will have new solutions to cross-sell.

Investors can expect the company's growth to accelerate in the long run

It is worth noting that half of the contracts booked by SentinelOne were for its emerging products focused on AI, cloud, and data analytics. This bodes well for the company, as these niches present an addressable opportunity of close to $50 billion. Therefore, SentinelOne seems to be in a solid position to maintain healthy growth in the long run.

Additionally, new product introductions and its recently announced acquisition should also have a positive impact on its margins thanks to cross-selling opportunities. In fact, SentinelOne is already witnessing margin growth. Its non-GAAP (adjusted) net income margin tripled year over year in the previous quarter to a record 5.4%.

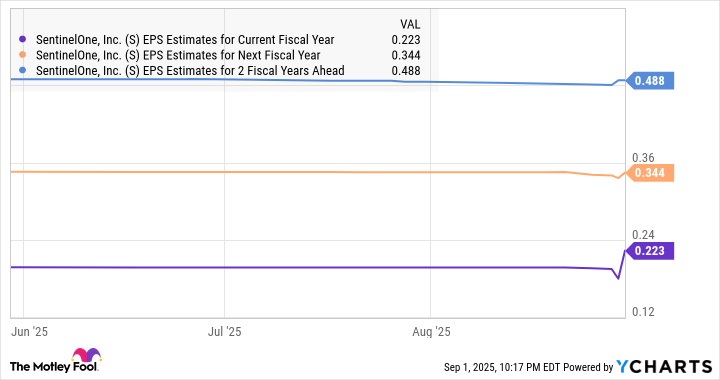

As a result, the company's adjusted earnings quadrupled to $0.04 per share. This also explains why analysts are expecting SentinelOne's earnings growth to accelerate impressively.

S EPS Estimates for Current Fiscal Year data by YCharts

So investors looking to buy a growth stock right now should consider taking a closer look at SentinelOne. Its sales are growing at an impressive pace, its margins are getting better, and it is trading at just under 7 times sales as compared to the U.S. technology sector's average price-to-sales ratio of 8.6, suggesting that investors are getting a good deal right now.