Warren Buffett’s Bold Bet: Buying This Industry Giant While Two-Thirds of Analysts Say ’Don’t Touch It’

Oracle of Omaha defies Wall Street consensus with contrarian move that's shaking analyst confidence.

The Contrarian Playbook

Warren Buffett's Berkshire Hathaway just placed a massive bet against analyst recommendations—acquiring substantial shares in a sector giant that two-thirds of Wall Street's finest are actively telling clients to avoid. The move screams classic Buffett: buying when there's blood in the water and consensus says run.

Wall Street's Herd Mentality Exposed

While analysts chase momentum plays and quarterly guidance, Buffett's looking five years ahead. His track record of spotting value where others see risk has built one of history's greatest fortunes. This latest move suggests he sees something the spreadsheet jockeys missed—probably actual long-term value instead of next quarter's earnings beat.

The Ultimate Test of Conviction

When the Street says sell and Buffett buys, someone's about to look very foolish. Given his history, it's probably not the guy in Omaha. Sometimes the best investment insight comes from ignoring the experts who think diversification means owning more than one stock bubble.

Image source: The Motley Fool.

Buffett's building a position in this builder

Berkshire Hathaway requested confidentiality on several positions it established in the first quarter, exempting them from disclosure on its quarterly 13F filing with the SEC. But last month's filings revealed all the new stocks Buffett and his team have been buying. Among them is homebuilder(LEN 3.07%) (LEN.B).

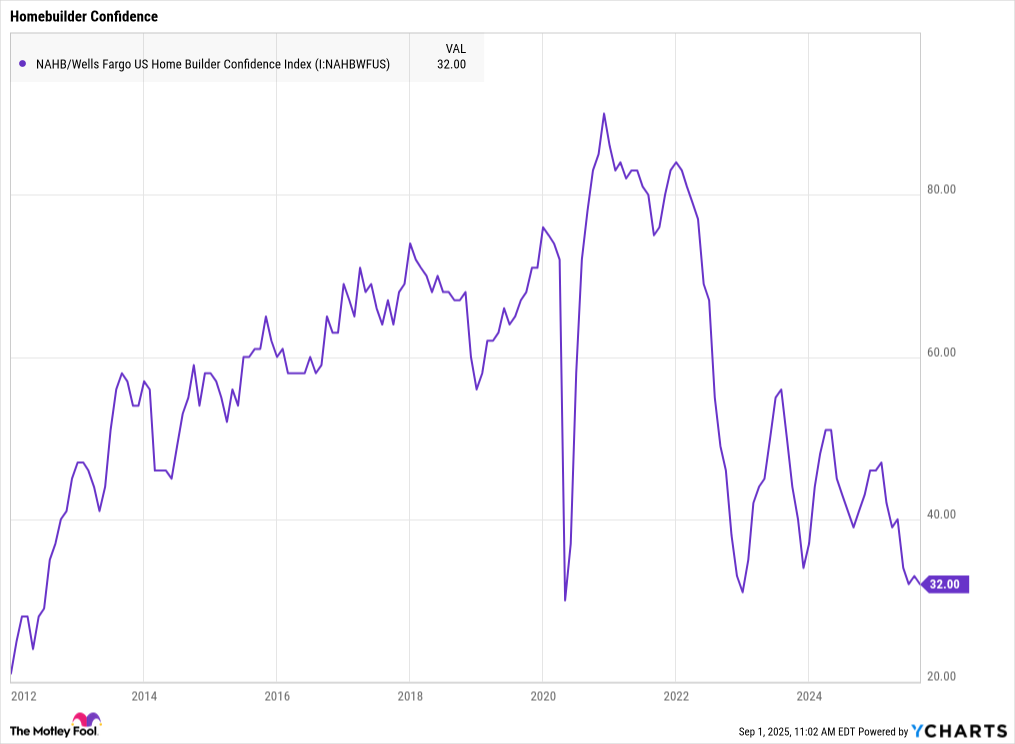

Lennar is the second-largest homebuilder in the United States, trailing only(DHI 2.72%), another homebuilder Buffett bought in the first quarter. The homebuilder industry has faced significant headwinds, as housing affordability has led to a dearth of buyers. Homebuilder confidence sat at 32 in August, its third-lowest reading since 2012 and its 16th consecutive month in negative territory.

NAHB/Wells Fargo US Home Builder Confidence Index data by YCharts

Several factors are making business difficult for Lennar and D.R. Horton. Average rates for a 30-year conventional mortgage have hovered between 6.5% and 7% throughout the year. At the same time, home prices remain elevated, making it one of the least affordable housing markets in history.

On top of that, growing economic uncertainty has led many Americans to remain more financially conservative and avoid big purchases like a home. As a result, the number of U.S. homebuyers fell to its lowest in over 12 years (save the start of the COVID-19 pandemic), according to data from the Multiple Listing Service and Redfin.

That means there's only one way for homebuilder to keep selling new homes: reduce their profits. Indeed, Lennar and D.R. Horton have seen their gross margins shrink 460 basis points and 260 basis points, respectively over the past year. On top of that, both saw revenue slide around 7% last quarter.

With weakening financial results in an industry that's rarely offered a worse outlook for itself, it's no wonder Wall Street has soured on the stocks. Lennar's stock price is down 28% from its all-time high in late 2024, and that's after a recovery in price and a bump from Berkshire's disclosure that it added the stock to its portfolio. D.R. Horton is doing slightly better, but it's still down 14% from its high-water mark.

What might Buffett see that Wall Street doesn't?

Lennar has been building homes since 1954, and this certainly isn't the first slowdown in the market it's seen. In the past, Lennar took more actions to protect its profit margins at the expense of sales volume. While that enabled it to produce strong profits in difficult markets, it might not have been its best strategy for the long run.

Executive chairman and co-CEO Stuart Miller explained during Lennar's most recent earnings call, "We learned through those times that once we step backwards and lose momentum, it becomes increasingly more difficult to restart and recapture volumes."

That's important because the United States still faces a severe housing shortage, and the deficit is growing.estimates there were 4.7 million more American families that need homes versus what was available on the market in 2023. The means there's ample opportunity for Lennar to keep building and meeting the buyers where they are. It's recently focused more on entry-level homes and offers incentives like rate buy-downs to improve their affordability.

But maintaining its volume puts it in a position to expand its margins to even higher levels over the long run as it improves operations at scale. Management thinks its profit margins haven't hit bottom yet, but it's close.

As interest rates come back down and the macroeconomic outlook becomes clearer, more buyers should enter the market, and Lennar won't have to offer such big incentives for purchases. Margins and sales will improve, but that will take years.

Most analysts don't look too far beyond the next 12 months. Price targets are based on near-term expectations. It's true that Lennar is in a tough spot, and it doesn't expect things to get any better for the next few quarters.

But Buffett has always used a much longer time horizon for his investment decisions. And Lennar is in a great position to support the inevitable demand for housing over the long run, as the housing shortage still remains an issue for the country.

With that in mind, Buffett took the opportunity to buy up shares of the stock at a bargain price. Investors can still get a good deal on shares of Lennar. The stock currently trades for just 1.8 times tangible book value. That's slightly above its historical average, but Lennar has made moves to reduce land assets on its balance sheet, using options contracts to control land with more financial flexibility. As a result, it deserves a premium to its historic valuation.