Palantir Stock: Still a Buy After Soaring 100%+ This Year?

Palantir's stock rockets past the century mark—defying gravity while defying skeptics. But can the data-mining giant keep climbing?

Momentum vs. Valuation

Up over 100% year-to-date, Palantir trades like a tech darling on steroids. Bulls see AI-driven growth; bears see bubble territory. The numbers don’t lie—but neither do balance sheets.

Institutional Adoption Accelerates

Government contracts expand. Commercial clients multiply. Yet profitability remains a tightrope walk—even for a company that literally spies for a living.

The AI Factor: Hype or Here to Stay?

Artificial intelligence fuels the frenzy. Palantir’s platforms pivot toward machine learning, enticing investors drunk on AI narratives. But tech transitions cost cash—and patience.

Risk Ahead: Volatility Meets Valuation

Sky-high P/E ratios clash with macroeconomic headwinds. One bad earnings report could trigger a sell-off faster than a leaked CIA memo.

Bottom Line: Data Doesn’t Deceive—But Markets Do

Palantir’s run reflects either visionary forecasting or classic market mania. Remember: Wall Street sells shovels during gold rushes—but also sells optimism in bulk. Tread carefully, or become another statistic in the annual report of hindsight.

Image source: Palantir.

Palantir is an incredibly strong business

Palantir is a leader in artificial intelligence (AI), and its platform ingests multiple data streams, processes them, and then provides decision-makers with the most accurate information in real time. It can also deploy AI agents through its Artificial Intelligence Platform (AIP), enabling automation. This software was originally developed for government use, but it eventually found a use case outside of its original intent. Still, even with its government business being the more mature segment, it's growing at a rapid pace alongside its commercial division.

Q2 was a masterclass for Palantir, as it delivered 47% revenue growth in the commercial sector to $451 million, and government revenue ROSE 49% to $553 million. Unlike many of its high-flying software peers, Palantir is also incredibly profitable, and converted 33% of its revenue into net income.

That's about as good a quarter as it gets for most public companies of Palantir's size. With the business obviously thriving in these market conditions, it seems like Palantir is a no-brainer buy right now. However, there is one other important consideration before investing in Palantir's stock, which quickly undermines the investment thesis.

Too much growth is priced into Palantir's stock

No matter how good an investment is, if you pay the wrong initial price for it, it can turn out to be a failure.

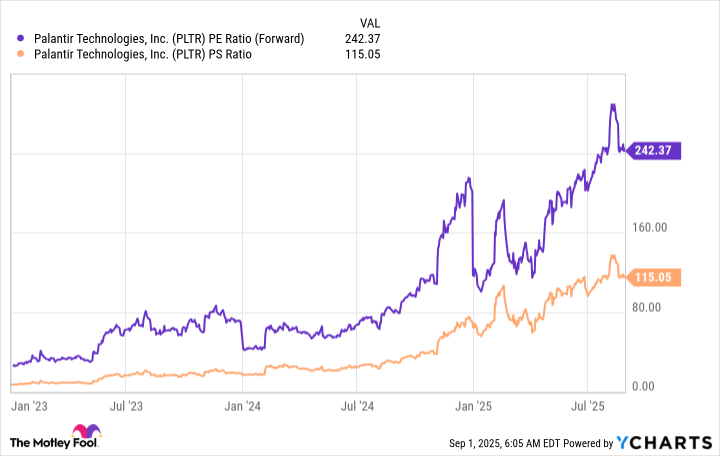

That's how I view an investment in Palantir today. The company is doing phenomenally well, but there's just too much future growth priced into the stock right now. Despite the 15% pullback, Palantir's stock still trades at 242 times forward earnings and at a price-to-sales ratio of 115.

PLTR PE Ratio (Forward) data by YCharts

These two valuation metrics make Palantir one of the most expensive stocks in the market, if not the most expensive. In Q2, Palantir grew revenue at a combined pace of 48%. That's still slower than AI king(NASDAQ: NVDA), which grew at a 56% pace. However, Nvidia trades for 39 times forward earnings.

If we set a long-term valuation target of 40 times forward earnings for Palantir's stock, it WOULD take years of growth without the stock price increasing to reach this level.

Let's make these assumptions:

- Palantir's revenue is projected to grow at a 50% compound annual growth rate (CAGR) over the next five years.

- Palantir's profit margin reaches 35%.

- Palantir's total shares outstanding amount doesn't change.

If all three of these factors come true, Palantir would generate $26 billion in revenue and $9.1 billion in profits. Five years from now, that would value Palantir's stock at 41 times forward earnings. So, approximately five years' worth of growth is baked into Palantir's stock price based on those assumptions.

The problem is that those are flawed assumptions.

Wall Street only expects Palantir's revenue to grow at a 34% pace next year. Furthermore, the larger a company gets, the harder it is to grow revenue at a rapid pace, so each successive year will make it harder to reach that elusive 50% growth rate.

If this figure is adjusted down to a more realistic 30% CAGR, it would take Palantir eight years of growth to reach a valuation of around 40 times forward earnings.

Palantir is an incredibly expensive stock that's unrealistically valued. As a result, I think investors should avoid investing in it, as it is likely to be a long-term loser due to its high starting point.