Why Savvy Investors Can’t Afford to Ignore the Dan Ives ETF in 2025

Wall Street's tech oracle just dropped his biggest play yet—and the smart money's already circling.

THE IVES EFFECT

Love him or hate him, Dan Ives moves markets. When Wedbush's star analyst talks tech, institutions listen. Now he's packaging his decades of sector expertise into a single ticker—and throwing traditional stock-picking out the window.

BEYOND THE BUZZ

This isn't another thematic ETF chasing yesterday's trends. The fund targets Ives' highest-conviction picks: AI infrastructure, cloud security, and quantum computing plays most retail investors haven't even heard of yet. It's early-stage exposure without the startup risk.

2025'S PERFECT STORM?

With regulatory clarity finally hitting crypto and AI driving unprecedented tech valuations, timing might be everything. The ETF launches as semiconductor shortages ease and enterprise software demand hits record levels—just as Ives predicted eighteen months ago.

THE FINE PRINT

Of course, it wouldn't be finance without a catch. That 0.75% expense ratio stings worse than a margin call, and backtested returns always look genius until real trading begins. But for investors tired of paying hedge fund fees for index fund performance? This might be the rebellion they've been waiting for.

Image source: Getty Images.

The advantages of an ETF

So, first, a bit more about ETFs. These funds include stocks across their particular theme, so that when you buy a share or more of the ETF, you gain exposure to those stocks. ETFs offer you a couple of advantages as an investor -- you don't have to hand select stocks as the ETF does this for you, and the investment in many players reduces risk (if one stock plummets, others in the ETF may compensate). Of course, on the downside, if one particular stock in the ETF explodes higher, you will benefit -- but not as much as if you owned that stock directly.

Still, considering the pros and cons, ETFs make a great addition to any investor's portfolio -- ETF investing and stock picking are complementary.

Now let's take a look at the Ives fund, one that offers you immediate exposure to a wide variety of current and potential AI winners. The fund includes 30 holdings, companies spanning areas from AI infrastructure to the application of AI to real world problems. These players also cover the range of the AI spending cycle, offering investors the ability to potentially gain throughout this AI boom.

As of today, the most heavily weighted stocks in the fund are,, and, players that you may know well -- but the fund also includes names you might not be as familiar with such as data engineering companyand nuclear tech company.

The fund grew to $100 million in assets under management after its first five days of trading back in June, and now it's reached more than $500 million.

What should investors do?

So, now, let's consider our question: Should savvy investors watch -- and possibly get in on -- this ETF in 2025? It's important to note that ETFs involve fees, expressed as expense ratios, and you should stick with ones that have an expense ratio of less than 1% to maximize your gains. The Ives fund meets our criteria, with an expense ratio of 0.75%.

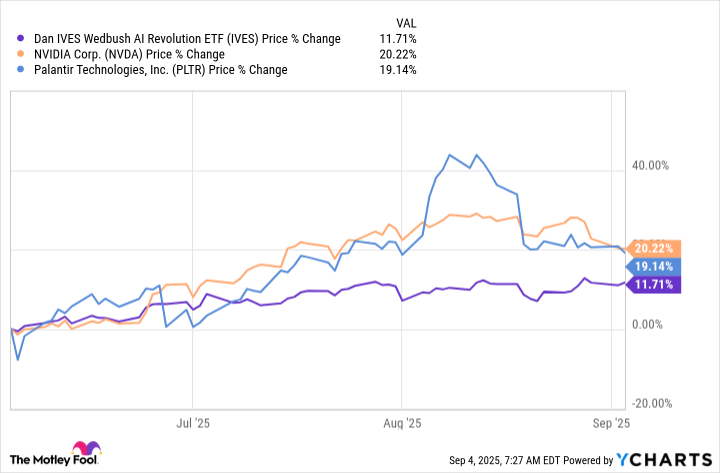

As for performance, the ETF has advanced in the double digits, as mentioned earlier, and if AI companies continue to deliver positive news and talk about strong spending in the infrastructure buildout phase, this momentum could continue. At the same time, certain individual AI stocks, such as Nvidia and, might have offered you better returns in recent times -- that's the power of stock picking.

IVES data by YCharts

All of this means that, ideally, you might invest in a couple of AI players that you strongly believe in based on your research and at the same time add shares of the Ives ETF to your portfolio. If you're more of a cautious investor, though, and aren't too comfortable selecting AI stocks, the better option may be buying shares of the Ives ETF and picking stocks in other industries that you know well.

In any case, savvy investors should keep an eye on the Ives ETF in 2025 as this AI revolution continues -- the gains may just be getting started.