Think It’s Too Late to Buy Nike? Here’s Why There’s Still Massive Upside Potential

Nike Just Hit Its Stride—And Wall Street's Still Sleeping

The Swoosh isn't just surviving; it's dominating. While traditional retail collapses, Nike's digital transformation slashes overhead and bypasses middlemen entirely.

Digital Revenue Skyrockets

Direct-to-consumer sales crush expectations—again. The app-driven model generates margins that make legacy retailers weep into their spreadsheets.

Global Supply Chain Reset

Inventory management now runs on AI-powered logistics. Real-time demand forecasting eliminates deadstock and maximizes hot product runs.

Cultural Cachet = Pricing Power

Limited drops and athlete partnerships create scarcity economics in plain sight. Consumers pay premium prices for status—basic human psychology beats fundamental analysis every time.

Innovation Pipeline Overflowing

From sustainable materials to biometric wearables, R&D spends actually yield commercial results. Unlike some tech companies burning cash on metaverse fantasies.

Bottom Line: Nike operates like a tech company with physical products—and still trades at a discount to SaaS peers. Maybe because finance bros understand algorithms better than air cushioning.

Image source: Getty Images.

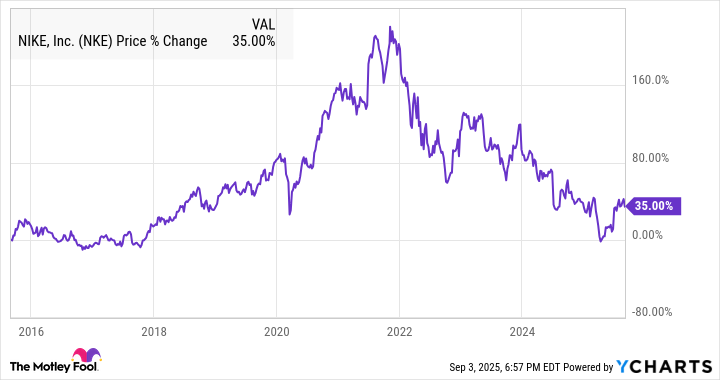

That led to Donahoe's departure a year ago as Nike brought back veteran executive Elliott Hill to run the company. Hill has been hard at work repairing relationships and bringing innovation back to the product line, but the stock is still a long way off its former peak, as the chart below shows.

NKE data by YCharts

Though the stock rebounded following a June earnings report that showed that the worst could be behind the company, it's still trading down more than 50% from its peak in 2021, and is roughly flat over the last seven years, trading around where it was 2018 while thehas more than doubled since then.

While current stock purchasers will have missed the rebound following the June report, it's still not too late to buy the stock.

Let's take a look at a few reasons why.

The numbers are still ugly

Nike is only at the beginning stages of its recovery, and a successful turnaround is far from a foregone conclusion at this point.

Even as the stock surged following its fiscal fourth-quarter earnings report in June, the results were dismal. For the full year, revenue was down 10% to $46.3 billion, and net income dropped 44% to $3.2 billion. In the fourth quarter, the collapse was even clearer as revenue declined 12% to $11.1 billion, and gross margin tumbled 440 basis points to 40.3% due to markdowns. As a result, net income was down 86% to $211 million.

However, Nike investors were willing to overlook that as management said that its growth WOULD improve from here. For the first quarter, it expects revenue to decline mid-single digits, though it expects pressure on the bottom line, including from tariffs, which it said would add about $1 billion in costs before mitigation efforts.

Nike's core advantages remain

While Nike made plenty of unforced errors in the last few years, the Core assets of the business remain and continue to give it a competitive advantage.

Nike has an unmatched roster of sponsors, including Michael Jordan, LeBron James, Cristiano Ronaldo, Caitlin Clark, and Serena Williams, and it continues to bring on top prospects.

It's also the most valuable brand in sportswear, with a logo that's recognized around the world and a franchise of classic sneakers like the Air Force 1 and Air Jordan that remain popular to this day.

Management understands that Nike needs to recapture its reputation for product innovation and inspiring ad campaigns, but it's not starting from scratch. While Nike might face upstart competition like Hoka and On, it still has plenty of goodwill among global consumers that it can tap into, so turning the brand around shouldn't be as hard as it looks.

There's plenty of upside potential

There's no guarantee that Nike stock will get back to its previous peak, but if the company can reach its previous profit levels, it should be able to get there. That should be easier now as the footwear and apparel market has only grown since 2021.

On a fiscal-year basis, Nike's net income peaked at $6 billion in fiscal 2022, which ended May 31, 2022. That's well ahead of the $3.2 billion it reported in fiscal 2025. Still, as the brand returns to health, Nike could get back to making $6 billion in annual profit. If it can accomplish that, doubling to get back to its previous peak seems reasonable.