Meet the Skyrocketing Artificial Intelligence (AI) Stock That’s Leaving Nvidia in the Dust

Wall Street's newest obsession isn't just beating the competition—it's vaporizing it.

While Nvidia struggles to maintain its AI crown, this under-the-radar player is posting growth numbers that make traditional tech giants look like they're moving in slow motion.

The AI Revolution's Dark Horse

Forget what you know about semiconductor dominance. This company bypassed the hardware arms race entirely, cutting directly to the most profitable segment of the AI value chain. Their proprietary algorithms process data 40% more efficiently than industry standards—and they're not sharing how.

Institutional money pours in as retail investors scramble to understand what they're missing. Sound familiar? It should—it's the same pattern we saw with crypto, just with better suits and worse coffee.

Market analysts can't upgrade fast enough. Price targets get shattered before the ink dries on the reports. Short sellers? Obliterated. The only thing rising faster than the stock price is the blood pressure of fund managers who missed the entry.

One hedge fund manager actually described it as 'watching someone else win the lottery with your numbers'—which, coming from finance, counts as emotional vulnerability.

So while Nvidia's still counting chips, this company's counting billions. The future arrived—and it brought its own spreadsheet.

Image source: Getty Images.

AI has supercharged Ambarella's growth

Ambarella designs computer vision processors that are deployed in drones, vehicles, security cameras, and other devices. Its chips are gaining terrific traction in edge devices that are intended to handle AI processes locally.

This helps explain why Ambarella's revenue jumped 50% year over year to $95.5 million in its fiscal 2026 second quarter, which ended on July 31. What's more, the company posted a non-GAAP profit of $0.15 per share as compared to a loss of $0.13 per share in the prior-year period. Management pointed out on the earnings conference call that its edge AI revenues have now set fresh records for five consecutive quarters.

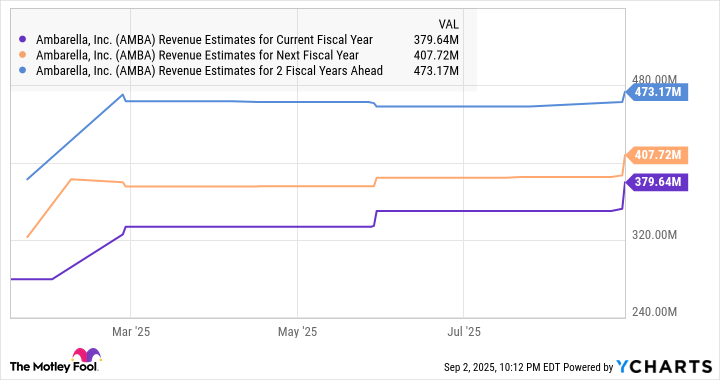

The company expects edge AI processors to account for 80% of its overall revenue this year. Importantly, the rising demand for its chips for various uses in drones, video cameras, and vehicles has encouraged management to increase its full-year guidance. It now forecasts that its revenue will rise by 33% in fiscal 2026 to $379 million, up from an earlier forecast of 22% growth.

This improved outlook is backed by the new customer wins Ambarella scored last quarter across various markets, as well as a production ramp-up of chips that are destined to go into robotic drones and edge AI devices. Another thing worth noting is that Ambarella's edge AI processors are driving an improvement in its average selling price, which explains how the company reported a major improvement in its bottom line.

Even better, Ambarella is confident that it will be able to sustain its AI-fueled growth over the long run. The company projects that its serviceable addressable market in edge AI chips could increase at an annual rate of 18% over the next five years to $12.9 billion. The company also believes that it is in a position to grow at a faster pace than its addressable market does and thus win a larger market share.

However, don't be surprised to see Ambarella sustaining its terrific growth levels for a much longer period. According to an estimate from market research from Market.US, the edge AI processor market's revenue could jump by 20 times over the next decade. That growth will be driven by the faster processing that edge AI processors are capable of, which is the reason why their adoption in autonomous vehicles and industrial applications is set to rise.

An attractive valuation and the improving growth potential make it a buy right now

Ambarella stock popped by nearly 17% after the company released its latest quarterly results on Aug. 28. Yet even after that gain, the stock trades at just under 10 times sales, which isn't very expensive when compared to the U.S. technology sector's average price-to-sales ratio of 8.5. The company has demonstrated that it is capable of clocking stronger top-line growth, and analysts have upgraded their expectations on that score as well.

AMBA Revenue Estimates for Current Fiscal Year data by YCharts.

However, the sizable opportunity in the edge AI market and Ambarella's ability to grab a bigger slice of this pie could help it exceed Wall Street's expectations again. As such, this little-known AI stock looks worth buying, as its impressive growth is likely to be rewarded with a higher share price.