Vanguard 500 Index Fund ETF: Crypto Investor’s Gateway to Traditional Market Alpha?

While Bitcoin smashes ATH after ATH, smart money diversifies into proven performers. The Vanguard 500 ETF isn't just another trad-fi relic—it's a liquidity anchor in volatile markets.

Massive institutional adoption mirrors crypto's infrastructure growth. BlackRock, Fidelity, and Vanguard dominate flows just like Binance and Coinbase command crypto volumes.

Zero crypto volatility with exposure to tech giants driving blockchain innovation. Apple, Microsoft, and Google pour billions into Web3—your ETF stake backs the very companies building crypto's future infrastructure.

Lower fees than most crypto ETFs—Vanguard charges just 0.03% while crypto funds skim 1-2% off your stack. Traditional finance finally undercuts crypto on costs—now there's a plot twist.

Perfect hedge when crypto corrections hit. When BTC dips 20%, your S&P 500 exposure keeps the portfolio bleeding minimal. Diversification isn't betrayal—it's strategic positioning.

Remember: the S&P 500 returned 10% annually for decades while crypto projects promised moonshots and delivered rug pulls. Sometimes boring wins.

Image source: Getty Images.

What does Vanguard 500 Index ETF do and how well does it do it?

From a big-picture perspective, Vanguard 500 Index ETF's only goal is to track the performance of the S&P 500 index. The S&P 500 is a portfolio of roughly 500 stocks selected by a committee to be representative of the broader U.S. economy. The stocks in the index are market-cap weighted, so the largest businesses have the biggest impact on performance. That's logical and is basically how the economy works.

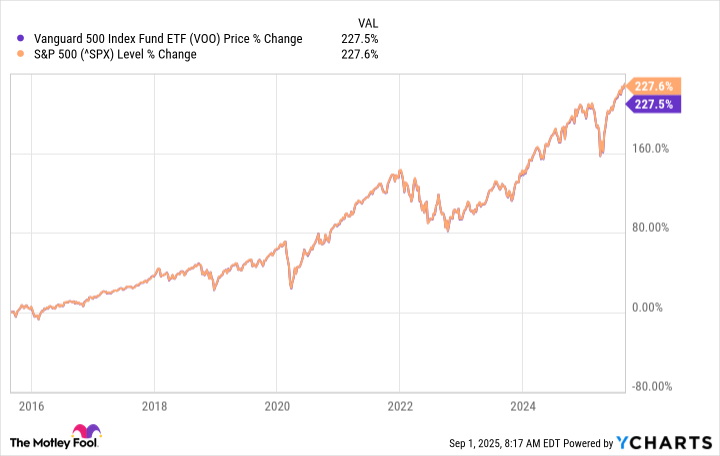

VOO data by YCharts

Vanguard 500 Index ETF's value on the last trading day of August was $593.08 per share. The price that the exchange-traded fund (ETF) traded for among investors was $592.70 per share. It is basically tracking along with the value of its portfolio, which is the value of index. Performance-wise, the S&P 500 index is up 227.6% over the past decade while Vanguard S&P 500 Index ETF is up 227.5%, which is virtually identical.

So, Vanguard S&P 500 index ETF does what it sets out to do. But it also does it for a very attractive cost -- a 0.03% expense ratio. That's as close to free on Wall Street as you can probably get and lower than some of the other S&P 500 index alternatives. So if you want to track the S&P 500 index, then Vanguard S&P 500 index ETF could be a good buy for you right now.

Do you want to track the S&P 500 index?

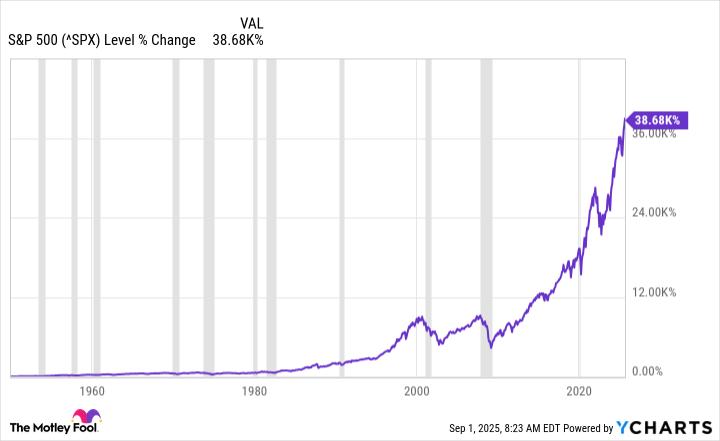

From a long-term perspective, the S&P 500 index has been a wonderful investment choice. A look at the long-term performance graph below shows that the trend is up and to the right. Even some of the worst recessions and bear markets are mere blips along the way higher at this point. If you are looking for an easy investment that doesn't require a lot of thought, Vanguard S&P 500 Index ETF could be a great choice for you.

^SPX data by YCharts

The problem is that the S&P 500 index swings between bull and bear markets. To put that another way, stocks move higher in a jagged pattern. That's an issue right now because the S&P 500 index is currently trading NEAR all-time highs. It could easily keep moving higher, but if you care at all about valuation, you'll likely be worried that the next big move could be lower.

To put some numbers on that, Vanguard S&P 500 Index ETF has an average price-to-earnings ratio of 27.6x. Its average price-to-book value ratio is 5x. Both of those figures are high from a historical standpoint. While there's no way to know where the S&P 500 index goes from here, the clear evidence is that the index is likely closer to a top than it is to a bottom.

Thus, if the question is whether it is worth buying the S&P 500 index right now, you have to think about your Vanguard S&P 500 index ETF decision a little differently. History suggests you will be fine even if you buy today, assuming you hold for a very long time. But you may have to go through a material drawdown in the near term, given the lofty valuation of the index that this ETF tracks.

Is the Vanguard 500 Index Fund ETF a buy now?

The answer to the big question here is, unfortunately, it depends. If you are an active investor who likes to trade a lot, you will probably be better off with something other than Vanguard S&P 500 Index ETF. When, not if, there's another bear market, you could be tempted to sell an investment that really needs to be bought and held for decades. However, if your plan is to buy this ETF and just keep adding to it through thick and thin, then even today, when the S&P 500 index looks expensive, could still be a good time to buy.