Why Lululemon’s High-Stakes Battle With Costco Could Make or Break Its Stock in 2025

Lululemon takes on retail giant Costco in a legal showdown that could reshape its market valuation.

Premium vs. Bulk: The Brand Equity War

Lululemon's lawsuit alleges trademark infringement against Costco's dupes—claiming the discount retailer's products dilute their premium athleticwear positioning. The outcome hinges on whether courts believe luxury branding can survive wholesale competition.

Financial analysts watch margins tighten as legal fees mount. One Wall Street skeptic quipped: 'Nothing says growth like spending millions to stop people from buying $25 leggings.'

The verdict could trigger either a brand value surge or a catastrophic devaluation—no middle ground for investors betting on premium retail survival.

Image source: Getty Images.

Why the Costco lawsuit could be critical for Lululemon

Lululemon is alleging that Costco has been selling "dupes" of its products and that they are confusing its customers. The suit claims that Costco has infringed on Lululemon's intellectual property due to how similar the items are, and that they go beyond just selling similar types of clothing. It says that Costco is also using the same color names, such as "Tidewater Teal," which Lululemon says, "is an important component" of its business.

If Costco is able to fend off the lawsuit and continue selling the products, it could pose a serious threat to Lululemon's growth at a time when it's already struggling to grow sales at a high rate. Consumers have been cutting back on discretionary expenditures and if Lululemon has to also compete against Costco and its low prices, that could exacerbate its current woes.

Many Lululemon pants frequently retail at more than $100, and if consumers can buy similar products at their local Costco, that could hurt the company's pricing power, possibly forcing it to reduce prices, which WOULD hurt its gross margins and impact its overall level of profitability.

Lululemon's growth rate has been falling sharply in recent years

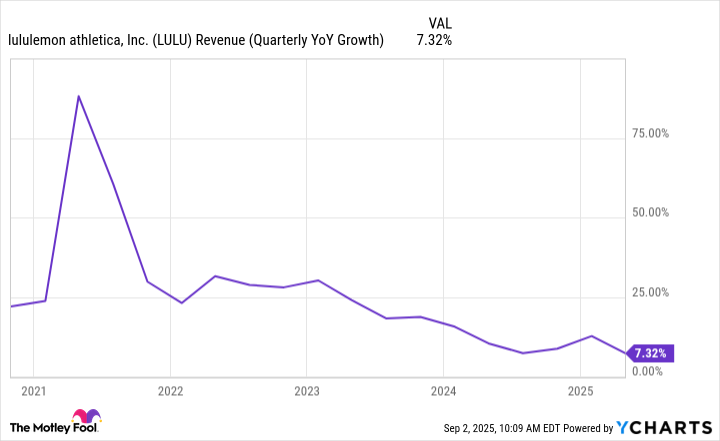

In recent quarters, Lululemon has been growing its sales by just single digits, which is down significantly from how well the business did in previous years -- when it wasn't uncommon for its growth rate to be in excess of 20%.

LULU Revenue (Quarterly YoY Growth) data by YCharts

If you factor in the potential for Costco to provide customers with similar-looking products, that could further erode its growth rate in the future. And with tariff uncertainty still looming with respect to China, a key market for Lululemon and where it also imports many of its products from, there are multiple headwinds for investors to consider before buying the retail stock.

Why I'd avoid Lululemon stock right now

Lululemon's intellectual property and overall competitive advantage faces a big test with its suit against Costco right now. If consumers can buy similar-looking clothing at just a fraction of the price, it could lead to even worse growth prospects for the company in future quarters. And with macroeconomic conditions not looking all that great, consumers may still be tempted to look for lower-priced alternatives. The declining growth rate does seem to suggest that demand may be constrained right now.

Although Lululemon stock may look cheap, trading at a price-to-earnings multiple of around 14, given the uncertainty the business faces in both the short and long term, this is not a company I'd invest in today. It all hinges on how much value consumers place on the brand and the willingness to pay significantly more for Lululemon products. Right now, things aren't looking too good, and unless Lululemon's growth prospects drastically improve or it wins its suit against Costco, I'd avoid the stock.