Amazon vs. Alphabet: Which Tech Titan Delivers Bigger Gains in 2025?

Tech investors face a trillion-dollar dilemma—Amazon's e-commerce empire or Alphabet's search dominance? Both giants trade at valuations that make traditional finance guys sweat through their custom suits.

The Cloud War Heats Up

Amazon Web Services continues printing money while Google Cloud plays aggressive catch-up. Neither shows signs of slowing down—infrastructure demand skyrockets as AI eats the world.

Advertising Arms Race

Google's search monopoly faces Amazon's product-led ad surge. Both leverage user data like nobody's business—because your privacy is their revenue stream.

Regulatory Thunderstorms

Antitrust lawsuits loom over both—because nothing says 'free market' like government agencies deciding which monopolies get broken up.

Bottom line: Pick your poison—the everything store or the everything search. Just remember the first rule of tech investing: past performance guarantees exactly nothing.

Image source: Getty Images.

A closer look at Amazon

Amazon is perhaps best known as being the biggest e-commerce company in the world, and the second-largest retailer in the world behind. Amazon completely disrupted the retail space by creating a massive distribution network and making it possible for customers to have products both large and small delivered directly to their homes, often by the next day.

Amazon saw gross sales of $100 billion in North America with its e-commerce business in the second quarter (up 11% from last year) and earned another $36.7 billion in international sales (up 16%). Those are mammoth numbers, but at the same time, Amazon spent $127.8 billion to bring in those sales. That means the company's e-commerce division brought in only $9 billion in operating income for the quarter.

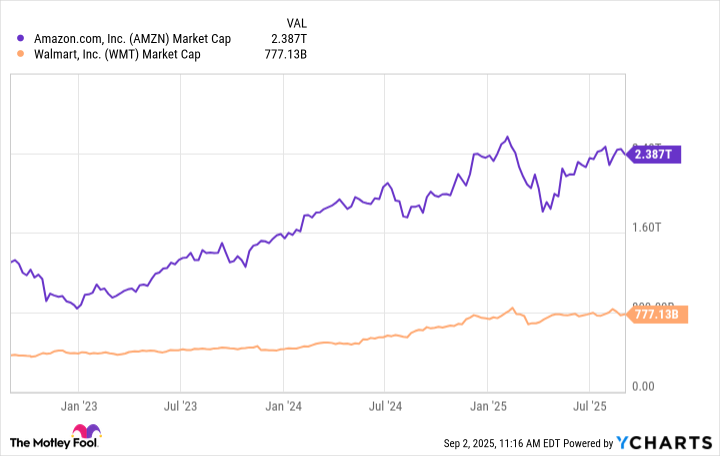

But Amazon's market capitalization isn't because people are excited about its retail business. Keep in mind that Walmart had global retail sales in 2024 of $675.5 billion, much higher than Amazon's $391.4 billion. Yet Walmart's market cap is only $773 billion while Amazon is the fifth-largest company in the world.

AMZN Market Cap data by YCharts

Investors value Amazon more because of its dominant cloud computing business. Cloud computing is becoming increasingly more important as companies lean into using artificial intelligence (AI)-capable platforms that are scalable and efficient. And Amazon is the biggest cloud computing company in the world through its Amazon Web Services (AWS) platform. Amazon had a commanding 30% of the global cloud computing business in the second quarter, toppingAzure (20%) and Google Cloud (13%), according to Synergy Research Group.

The cloud computing space is continuing to grow rapidly, reaching $99 billion in the second quarter, up 20% from a year ago. And Amazon saw $30.87 billion in revenue from AWS in the quarter, up 17.5% from the same period a year ago.

Even better is the profit margin. While Amazon made only $9 billion from its massive e-commerce sales, it brought in $10.16 billion in net profits from its comparatively smaller AWS. That's why AWS is decidedly the biggest driver for Amazon's future.

A closer look at Alphabet

While Amazon is best known for its e-commerce business, Alphabet's No. 1 business is advertising. The company's massively popular Google search engine maintains a roughly 90% global market share, despite concerns that chatbots like ChatGPT or Grok WOULD eat into Google Search.

Instead, Google's AI-powered search engine is helping to strengthen the company's moat. Alphabet says AI Overviews have more than 2 billion users every month, reaching users in 200 countries and territories. In the second quarter, Google Search revenue increased 12% from a year ago to reach $54.19 billion. Overall, Google Services revenue was $82.5 billion for the quarter, up 12% from a year ago.

Alphabet's advertising network is massive and powerful -- so much so, in fact, that the Department of Justice sued on the grounds on the grounds that Alphabet has an illegal monopoly on online search and digital advertising markets. The government proposed forcing Alphabet to divest itself of part of the company, such as its Chrome browser or Android smartphone operating system. But a federal judge rejected those options on Sept. 2, ruling instead that Alphabet must share search data with competitors. Alphabet stock jumped more than 8% the following day on the news.

Which stock is the better buy?

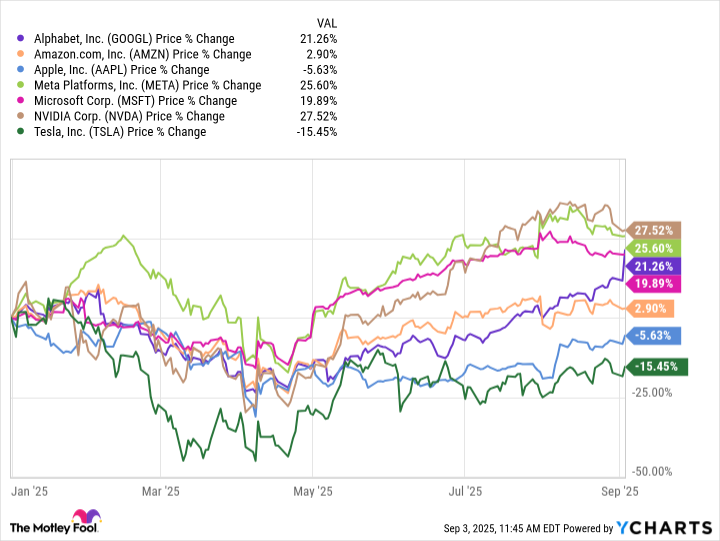

While Amazon is struggling so far this year due to tariff fears -- up less than 3% on a year-to-date baiss, Aphabet is one of the best-performing Magnificent Seven stocks. Coupled with a solid second-quarter earnings report and investor enthusiasm now that the DOJ case is over, Alphabet stock is up more than 21% in 2025.

GOOGL data by YCharts

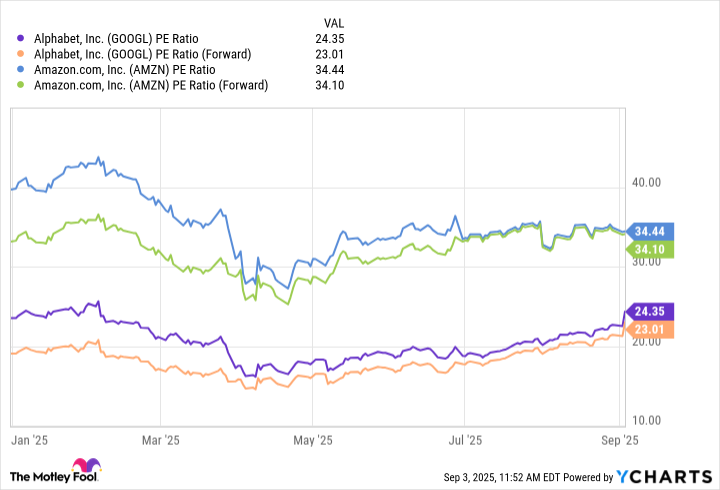

Both of these companies are excellent additions to a portfolio. But if you need to choose one over the other, the valuation is the main difference-maker. Alphabet's price-to-earnings ratio and price-to-sales ratio are both markedly better than Amazon's. Alphabet even trades at a valuation equal to the, which has a forward P/E of 23.

GOOGL PE Ratio data by YCharts

The opportunity to purchase a Magnificent Seven stock when its valued similarly to the overall index should be too good to pass up here. Alphabet is the choice.