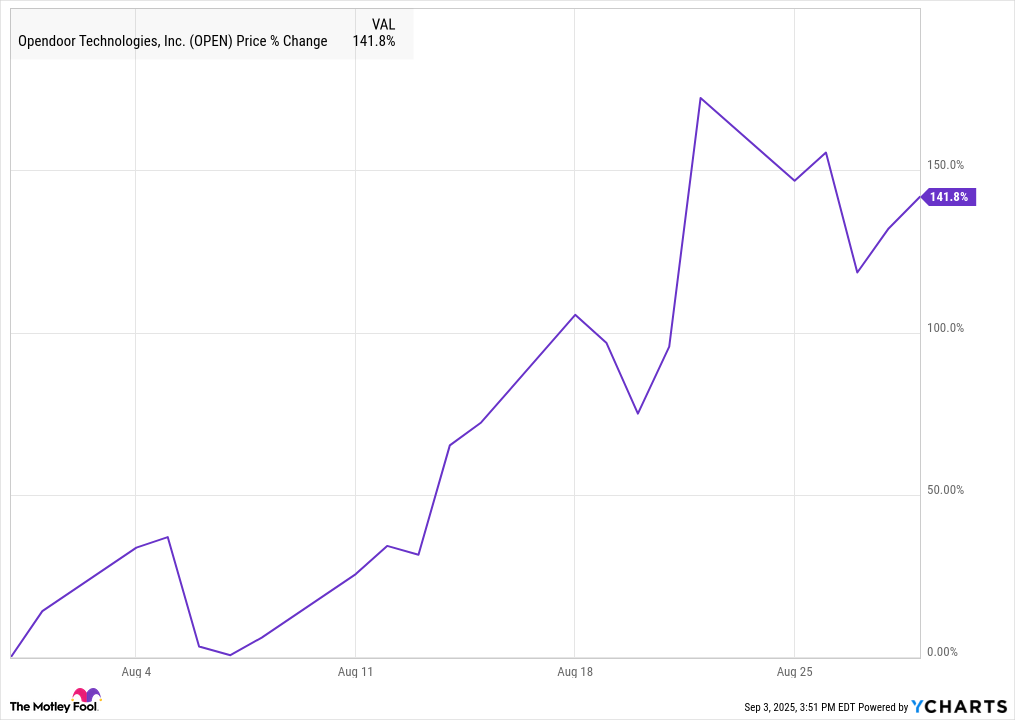

Opendoor Technologies Stock Soars 142% in August: Here’s What Fueled the Meteoric Rise

Wall Street jaws hit the floor as Opendoor Technologies defied gravity—and skeptics—with a staggering 142% monthly surge.

The iBuying Disruption Goes Into Overdrive

Traditional real estate brokers watched from the sidelines as Opendoor's tech-driven model sliced through conventional sales friction. Algorithms replaced agents, digital offers bypassed paperwork, and speed crushed traditional closing timelines.

Market Momentum Meets Macro Madness

While housing data hinted at stability, Opendoor's leap smelled more like speculative frenzy than fundamental shift—another reminder that in modern markets, narrative often trumps numbers. Still, you don't argue with a 142% move unless you're short on conviction or long on regret.

Tech transformation meets real estate revolution—and for once, the disruptors aren't just knocking on the door. They're buying it.

OPEN data by YCharts

Retail investors are still in

Toward the end of July, there were signs that the rally in the stock was fading after trading volume had soared earlier in a meme stock rally that seemed to begin with an argument on social media platforms like X and. Hedge fund manager Eric Jackson argued that the stock could be the next, since Opendoor was essentially left for dead as investors gave up on the home flipper's business model due to a weak housing market and disappointing financial results.

Opendoor stock got a second wind in August after a subpar unemployment report kicked off August, sending the stock higher on hopes that it would lead the Fed to cut interest rates. The stock then pulled back after its second-quarter earnings report showed the business is still struggling, and its guidance called for revenue to fall on a sequential basis in the third quarter. It began a new rally in the second week of the month as an inflation report added to hopes that the Fed would cut interest rates, and Wheeler announced her resignation.

Finally, Opendoor stock jumped nearly 40% on Aug. 22 after Fed Chair Jerome Powell signaled in his Jackson Hole address that it would be appropriate to cut interest rates in September. The stock pulled back over the rest of August, but jumped again to start September.

Image source: Getty Images.

Can Opendoor keep gaining?

It's been a remarkable rally for a stock that has now topped $5 a share, just two months after it was trading around $0.50 a share.

Opendoor is still a small company at a market cap of $3.8 billion, but at some point, the business will have to show real improvement. Still, for now, if interest rates do come down and the housing market starts to show signs of life, the stock is likely to MOVE higher.