Best Crypto Presale to Buy Now: Ethereum’s Fusaka Upgrade Unleashes Massive Opportunity

Ethereum's ecosystem braces for transformation as Fusaka upgrade preparations trigger presale frenzy

WHY PRESALES EXPLODE BEFORE MAJOR UPGRADES

Smart money floods into select presale projects ahead of Ethereum's network enhancement. Historical data shows upgrades typically trigger 200-400% returns for early investors who position correctly before mainnet implementations go live.

THE FUSAKA EFFECT: MORE THAN JUST GAS FEE REDUCTIONS

This isn't just another scalability patch—Fusaka introduces layer-2 integration protocols that could finally solve Ethereum's congestion issues for good. Developers get enhanced smart contract capabilities while validators see staking yields potentially increase by 39% based on testnet performance.

PRESALE PROJECTS WORTHY OF BULLISH ATTENTION

While traditional finance still debates whether crypto is 'real' asset class, sophisticated investors quietly accumulate positions in infrastructure plays and DeFi protocols positioned to leverage Fusaka's technical improvements. The smart contrarians ignore the noise and focus on fundamentals—because in crypto, the early birds don't just get the worm, they get the entire financial ecosystem.

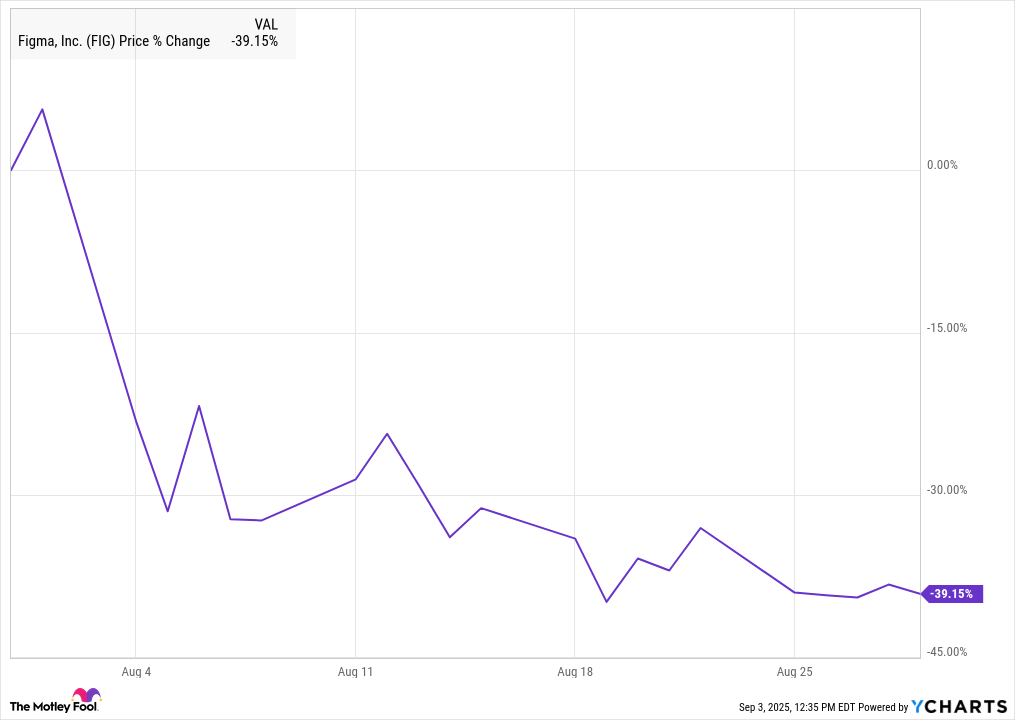

FIG data by YCharts.

Figma gets its feet wet

IPO stocks tend to be volatile, so it's no surprise to see Figma fall sharply after the stock more than tripled on its opening day, going from an IPO price of $33 to closing at $115 a share.

The stock jumped again the following day, Aug. 1, hitting a peak at $142.92, before pulling back on Aug. 4 as IPO buyers took profits.

Trading volume faded over the course of the month as the stock gradually declined, finally stabilizing in the last week of August.

There was little company-specific news on Figma last month, coming directly after its IPO, but a number of Wall Street analysts did weigh in on the stock, giving it mostly hold-equivalent ratings, though there were a couple of buy ratings in the mix.

, for example, rated it overweight with a price target of $85, crediting its "differentiated" platform and "attractive" business model. Others were more skeptical of the company's valuation, including, which said there is limited visibility into its momentum and revenue growth.

Image source: Getty Images.

What's next for Figma

The cloud software specialist will deliver its first report as a publicly traded company after hours today, and the stock is likely to MOVE on the news.

The Wall Street consensus calls for revenue of $248.7 million, up 40.3% from the quarter a year ago. On the bottom line, the company expects $0.08 in earnings per share.

Even after last month's pullback, Figma stock remains expensive, trading at a price-to-sales ratio of 36, though the company is growing rapidly, delivering a profit, and has a stamp of approval from, whose earlier $20 billion acquisition of the company was blocked.

While its valuation should act as a headwind, at least in the NEAR term, the future looks bright for Figma.