Forget the Lottery - Amazon’s Your Real Ticket to Wealth in 2025

Lottery dreams crash against brutal math while Amazon's ecosystem prints real fortunes.

WINNING ODDS VS. WINNING STRATEGY

Scratch-off tickets deliver hope in colorful packaging - and statistically guaranteed disappointment. Meanwhile, Amazon's infrastructure empire quietly minted more millionaires last year than all state lotteries combined.

THE COMPOUNDING MACHINE

Third-party sellers cleared $50 billion through Amazon's marketplace last quarter alone. That's not luck - that's leverage. The platform's logistics network bypasses traditional retail bottlenecks, slashing time-to-market from months to minutes.

DIGITAL REAL ESTATE PAYS DIVIDENDS

Prime members don't just buy products - they buy ecosystems. AWS infrastructure supports entire financial networks while Alexa devices become household command centers. This isn't commerce - it's digital territory acquisition.

Traditional finance still thinks in quarterly reports while tech builds generational wealth engines. Maybe Wall Street should try selling something besides advice.

Image source: Getty Images.

An e-commerce leader

Most of us know Amazon well for its e-commerce business. The company is a leader there, offering us everything from essentials to mass merchandise at low prices -- and Amazon has kept shoppers loyal through its Prime subscription program. Through Prime, customers get fast and free delivery, access to books and movies, and even prescription drug services.

Amazon holds "Prime Day" events annually, and they not only boost revenue -- the latest brought in record sales -- but they also attract more shoppers to join the Prime program.

But Amazon isn't just an e-commerce player, and in fact, the company's biggest profit driver is its cloud computing unit, Amazon Web Services. AWS is the world's leading cloud provider, offering everything from data storage to a wide range of AI products and services. The company serves every budget within the AI space as it gives customers access to the latest Nvidia chips, or for the budget-conscious customer, provides the Trainium chip -- designed by Amazon. Amazon also offers a fully managed service, Amazon Bedrock, that allows customers to tailor a variety of large language models to their needs.

All of this has helped AWS to reach a $123 billion annual revenue run rate in the recent quarter, with revenue surging more than 17% during the period.

A positive move for earnings growth

Amazon also is applying its investment in AI to the e-commerce business, with robotics and other tools that are helping it gain in efficiency across its fulfillment and delivery network. When Amazon does this, it decreases its cost to serve, and that's positive for earnings growth over time.

Speaking of earnings, Amazon has delivered a long track record of gains in the past years -- with the only interruption being a couple of years ago as it struggled with higher inflation. But Amazon used that time to improve its cost structure, and this effort has been paying off.

After that one annual loss in 2022, Amazon returned to profit a year later. And today, in the recent quarter, both revenue and net income climbed in the double digits to more than $167 billion and $18 billion, respectively.

Making wise investments

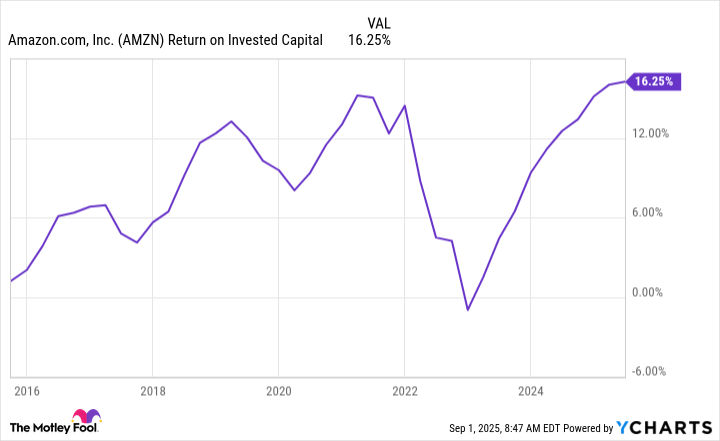

Another point I like is Amazon has a good track record of growing its return on invested capital, meaning the company has invested wisely over time.

AMZN Return on Invested Capital data by YCharts

All of this has worked out well for investors, with Amazon stock climbing 80% over the past three years. And the great news is even after that performance, Amazon shares still have plenty of room to run, considering they trade for 34 times forward earnings estimates -- a reasonable level for a growth stock -- and the fact that we're still in the early days of the AI boom. Analysts expect the AI market to reach beyond $2 trillion in a few years, and Amazon is well positioned to benefit.

This means that today, if you're looking to build wealth, you should consider fleeing the lottery and instead placing your bets on Amazon.