Michael Burry’s Latest Bombshell Move: Does The ’Big Short’ Legend See What Wall Street Is Missing?

Michael Burry just placed another contrarian bet that's sending shockwaves through finance circles—proving once again that when the 'Big Short' legend moves, markets listen.

The Ultimate Contrarian Play

While Wall Street analysts chase quarterly earnings and whisper numbers to favored clients, Burry operates on a different frequency entirely. His latest regulatory filing reveals a position so starkly against consensus that it either screams genius or madness—and with his track record, betting against him seems far riskier.

Reading Between The Financial Lines

Burry doesn't do press tours or CNBC interviews. His moves speak through SEC filings, leaving hedge funds scrambling to reverse-engineer his thesis while retail traders FOMO into the wake. It’s almost poetic—the man who famously bet against the housing bubble now taking a stance that implies the smartest guys in the room might be wearing dunce caps again.

Why This Move Matters Now

Timing is everything, and Burry’s latest play coincides with peak market complacency—where volatility gets priced like a luxury add-on rather than a core feature of over-leveraged systems. His track record suggests he isn’t just guessing; he’s connecting dots most don’t even see.

Wall Street’s collective shrug says everything—nothing terrifies institutional analysts more than a thinker who can’t be bribed with banking fees or swayed by Bloomberg terminal headlines. Sometimes the smartest trade is recognizing that finance’s 'geniuses' are often just overpaid trend-followers.

Image source: Getty Images.

Burry's purchase of stock and call options

So, first, let's find out which stock Burry is most bullish on, according to his latest moves:(UNH 2.48%). Burry bought 20,000 shares and call options on 350,000 more -- a call option is a contract allowing you to buy an asset in the future at a preset price. It's a bet on the asset's price rising -- the idea is the preset price will be lower than the stock's actual price, allowing you to buy at a level that's below market value.

Both the shares and call options are new positions in Burry's portfolio, which also has shown a shift to general bullishness: The investor, who had bearish options betting on declines in tech stocks such asandin the first quarter, no longer held those positions in the second quarter.

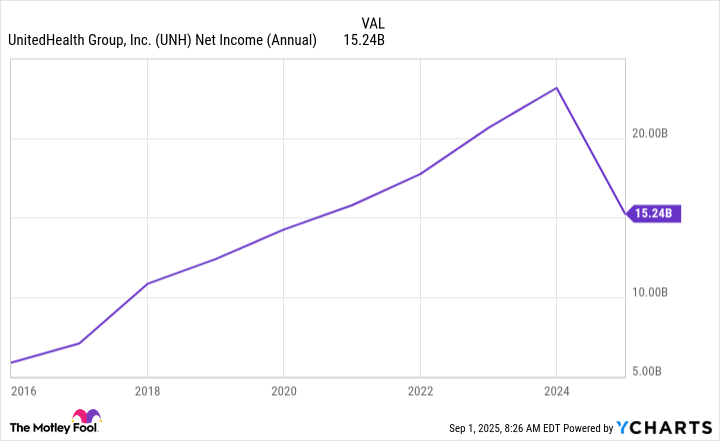

Now, let's consider the UnitedHealth bet. This company is the biggest U.S. health insurer, operating both UnitedHealthcare -- its insurance unit -- and Optum -- a unit that offers health services such as patient care, pharmacy benefits management, and more. This player clearly has a strong market position, and it's grown earnings over the years.

UNH Net Income (Annual) data by YCharts

But this year, UnitedHealth has faced serious challenges that have weighed on earnings and stock performance, from a U.S. Department of Justice probe into the company's Medicare business, to rising healthcare costs and greater-then-expected patient use of medical services. In the second quarter, UnitedHealth reported adjusted earnings per share of $4.08, missing analysts' estimates of $4.48, and the company expects pressure on earnings to continue through this year.

Why is Burry buying?

Considering all this, you may be wondering why Burry has been piling into shares of this struggling healthcare giant. Though this top investor hasn't revealed the reasons behind his moves, a look at UnitedHealth's market position and current situation offer us some clues -- and a reason why we, too, might offer this stock a second look.

As mentioned, the company is the leading U.S. health insurer, and on top of that, it also generates revenue through its Optum services business. UnitedHealth isn't likely to lose this position overnight, and it's important to note that rivals also face the reality of increasing healthcare costs and greater use of services -- so this isn't a UnitedHealth-specific problem.

At the same time, UnitedHealth is making moves to address current challenges. For example, the company is exiting plans where costs have become too difficult to manage, it's raising premiums on certain plans, and it's using artificial intelligence (AI) to drive efficiency -- in fact, AI is expected to help lower costs by $1 billion for Optum next year. In a filing this summer, UnitedHealth also said it is complying with all Justice Department requests concerning the probe.

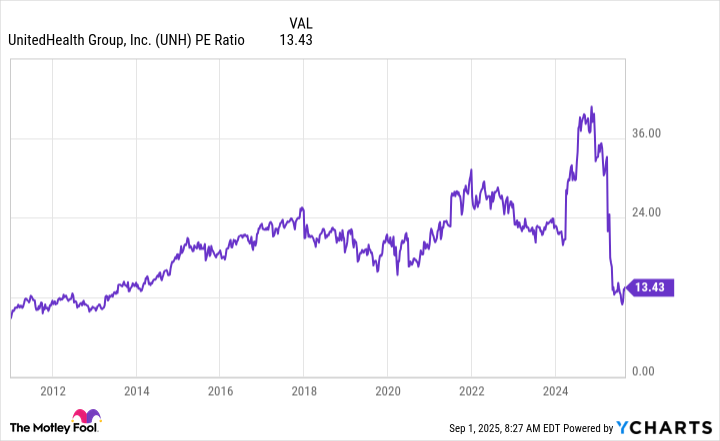

A cheap stock

Finally, today, UnitedHealth, trading at 13x trailing-12-month earnings, is NEAR its cheapest level in about a decade.

UNH PE Ratio data by YCharts

UnitedHealth's latest earnings reports may not look fantastic, but the company's leaders have identified the problems, set out concrete plans to address them, and even predict a return to earnings growth next year.

So, UnitedHealth might not have been a Wall Street favorite earlier this year, but Michael Burry is right to forget about that and focus on the future. From that perspective, UnitedHealth looks like a smart healthcare stock to buy now for a dirt cheap price and hold through the company's recovery and beyond.