Could Opendoor Technologies Be Your Millionaire-Maker Stock in 2025?

Disrupting real estate—one algorithm at a time.

Opendoor's tech-driven approach cuts out traditional brokers, bypasses months of showings, and turns property sales into near-instant transactions. The platform uses machine learning to make competitive offers within hours—not weeks.

But can it really mint millionaires?

Market volatility remains a real threat. Housing cycles swing. Interest rates bite. And let's be real—if getting rich were as easy as buying proptech stocks, every finance bro would already be retired in Bali.

High risk, high potential reward. Just like crypto—but with actual houses.

New CEO and retail activists

In July, professional investor Eric Jackson began buying Opendoor stock and claiming it had 100x potential from its then price of below $1.00 a share. With a large following and the spreading of the idea around social media forums, the once penny stock went on an absolute tear and now trades at close to $5, likely with a few short squeezes on the way.

Jackson and other Opendoor investors believe the company is undervalued because of the lack of competition left in the iBuying market. iBuying was a popular new real estate business model where platforms WOULD buy homes directly from people and flip them at a higher price. This ran into a wall when home price appreciation stagnated in 2022, causing Opendoor to lose a ton of money. Now, with the housing market normalizing and Opendoor adding new features to its platform (more on that below), the company may be on the road to recovery.

What's more, CEO Carrie Wheeler resigned from her post, with Shrisha Radhakrishna -- current Chief Technology Officer -- taking over as interim leader of the business. The company and its legion of retail activists are likely looking for a permanent replacement to run the business.

Image source: Getty Images.

Enhancing features to drive growth

In order to drive demand growth for its iBuying marketplace, Opendoor is expanding the features for both buyers, sellers, and real estate agents using its services. One new feature is called Cash Plus, where Opendoor gives sellers cash advances on their homes, fixes them up, and then sells them on the open market. If Opendoor is able to sell the home at a premium, then it will share a bonus with whoever sold it to the company. This can reduce Opendoor's inventory depreciation risk while also creating more flexibility for shoppers.

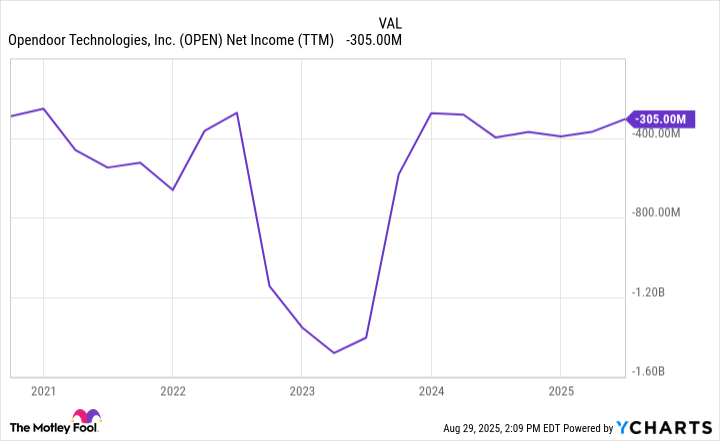

Opendoor will need to keep innovating with its product suite, because its financials look rather weak today. Last quarter, revenue grew 4% year over year. However, gross margin compressed down to a measly 8.2%, leading to another net loss for the period. Next quarter, it is projecting another net loss. The company has posted a $300 million net loss over the last 12 months and has never generated a profit, even during the 2020-2021 housing boom in the United States. This should make investors question the company's business model.

OPEN Net Income (TTM) data by YCharts.

Is Opendoor a millionaire-maker?

At today's stock price, Opendoor has a market cap of $3 billion. This is still small compared to the overall housing market, which does trillions of dollars in volume annually. If Opendoor can gain market share with these new innovations, perhaps it can start doing a lot more in revenue and begin to turn a profit.

Right now, its profit levels don't match up with this valuation figure. Opendoor's gross profit over the last 12 months was $417 million. Assuming it has the potential to wring out some efficiencies with overhead and marketing costs, maybe the company could turn this $417 million in gross profit into $100 million in net income. That would be a price-to-earnings ratio (P/E) of 30 based on the current share price. Again, the company has never turned a profit.

What's more likely is the necessity to gain more scale in real estate transactions to cover its fixed overhead costs. So far, the company has not shown the ability to do this in an efficient manner because of all the inventory it needs to take onto its balance sheet, financed by debt. Last quarter, 33% of Opendoor's gross profit went to interest expense on debt, and that is with inventory levels depleting.

Overall, this is a bad business model. The stock might be soaring today, but Opendoor stock is likely not a millionaire-maker for the type of investor who buys and holds for the long term.