Apple CEO Tim Cook Just Dropped Bombshell News for Broadcom Investors

Tim Cook just handed Broadcom shareholders the kind of validation that usually requires three earnings calls and a minor miracle.

The Supply Chain Gambit Pays Off

Apple's deepening partnership with Broadcom isn't just another supplier handshake—it's a strategic lock-in that screams reliability. When the world's most valuable company publicly reinforces its hardware dependencies, Wall Street listens.

Chips With Everything

Broadcom's components are now so baked into Apple's ecosystem that disentangling would require a surgical team and a decade. That's the kind of vendor leverage that makes accountants weep with joy and competitors grind their teeth.

The Institutional Stamp

Cook's endorsement essentially gift-wraps Broadcom's revenue projections for the next fiscal year. Because nothing comforts institutional investors like a trillion-dollar company anchoring your order book—even if it means living at the whim of Cupertino's design whims.

Another day, another tech giant making suppliers rich while pretending it's about innovation rather than just locking in margins. How delightfully predictable.

Broadcom has deep inroads with hyperscalers

While Apple may be one of Broadcom's most visible partners, the company has also been quietly building DEEP ties with AI hyperscalers --being a notable one.

Broadcom's portfolio spans custom silicon, networking switches, and optical interconnects -- the foundational layers that power modern data centers. These may not be headline-grabbing products, but they serve as the invisible scaffolding that enables AI models to train at scale and keeps data workloads flowing smoothly -- avoiding costly compute and connectivity bottlenecks.

What makes Apple's reliance on Broadcom so compelling is how it bridges two high-growth landscapes: consumer electronics (i.e., semiconductor components for the iPhone) and enterprise-grade AI infrastructure. Broadcom's established relationships with hyperscalers validate its role as a provider of specialized, mission-critical technologies. Meanwhile, Apple's endorsement amplifies that credibility -- signaling to the broader AI ecosystem that Broadcom is a trusted partner.

In essence, Broadcom is solidifying its influence across the entire technology stack -- from chips inside of consumer devices to the infrastructure driving next-generation AI applications inside hyperscale data centers.

Image source: Getty Images.

Broadcom is a quiet beneficiary of rising AI infrastructure investment

The explosion of AI workloads has only heightened the need for networking gear and the specialized chips that enable big tech to operate at scale. While Broadcom dominates many of these use cases, it rarely commands the same spotlight as,, and.

The reason is straightforward: Broadcom isn't building GPUs that capture headlines. Rather, the company designs the connective tissue that allows GPUs, CPUs, and memory chips to communicate efficiently. Without Broadcom's technologies, generative AI advancements WOULD remain throttled by data transfer limits and networking bottlenecks.

Is Broadcom stock a buy right now?

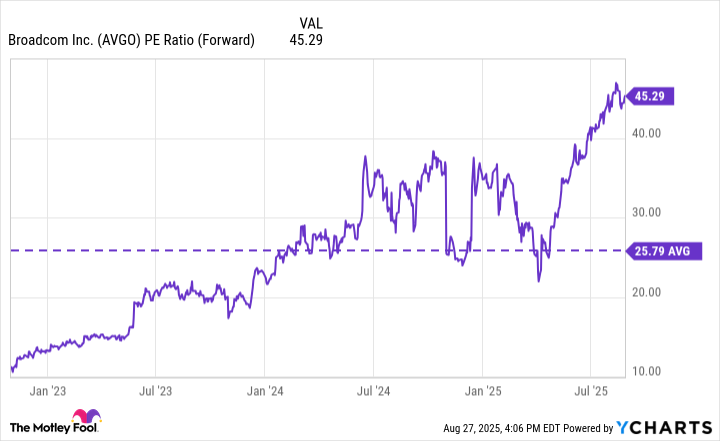

While Broadcom lacks the same levels of excitement that have crowned peers like Nvidia as an "AI darling," this hasn't translated into a bargain stock price. On the contrary, Broadcom now trades at a forward price-to-earnings (P/E) multiple of 45 -- well above its three-year average and essentially at the highest point of the current AI cycle.

AVGO PE Ratio (Forward) data by YCharts

Broadcom's premium valuation tells a clear story: The market increasingly views the company as a structural beneficiary of ongoing AI buildouts. Although expectations remain high, Broadcom's relationships with hyperscalers, as well as its alliance with communications leaders such as Apple help diversify the company's ecosystem and drive home its broad depth across various applications and use cases.

Unlike Nvidia or AMD, Broadcom does not need to rely on generational product cycles to capture the attention of investors. Instead, the company's appeal lies in its subtle, less-visible services that keep the digital economy humming along.

This quiet, indispensable nature makes Broadcom less vulnerable to hype-driven volatility while still offering meaningful upside given its exposure to myriad secular trends reshaping the technology landscape.

While the stock isn't cheap, Broadcom represents a durable infrastructure play as the AI narrative continues to unfold. To me, Broadcom is a compelling opportunity to buy and hold over the long term.