The 1 Undeniable Reason Walmart Stock Is a Warren Buffett-Worthy Investment in 2025

Walmart's 2025 Play: Why This Retail Titan Just Became Buffett's Perfect Bet

Forget flashy tech stocks—Walmart's executing the kind of boring brilliance that makes Berkshire Hathaway drool. While crypto bros chase the next meme coin, this retail behemoth is quietly building an empire that would make the Oracle of Omaha himself nod in approval.

The Digital Transformation Moats

Walmart isn't just stacking shelves anymore. Their e-commerce infrastructure now handles supply chain logistics with military precision—cutting costs, bypassing traditional retail bottlenecks, and delivering profits that would make even the most cynical hedge fund manager crack a smile.

Financial Fortress Fundamentals

Strong cash flow generation? Check. Defensive positioning during economic uncertainty? Double-check. Walmart's playing 4D chess while other retailers struggle with checkers. Their financials read like a textbook case of sustainable growth—the kind that keeps Buffett up at night (in a good way).

The 2025 Outlook: Steady Wins the Race

No rocket emojis needed here. Walmart's strategy focuses on gradual, measurable expansion rather than hype-driven speculation. Because sometimes the smartest investment is the one that doesn't require explaining to your accountant through three panic attacks.

In a world chasing the next shiny object, Walmart remains the anti-meme stock—profitable, predictable, and perfectly positioned for 2025's economic landscape. Almost makes you wonder why we ever doubted plain old fundamentals.

Not Walmart's first rodeo

Buffett actually did own Walmart for stock for about 13 years, from 2005 through 2018. It was one of's largest holdings at first, but he began selling it off in 2015, and he exited the position in 2018.

Image source: Walmart.

At the time, he praised Walmart, calling it "a fabulous company," but he seemed to be worried about retail in light of Amazon's success with e-commerce. In fact, Berkshire Hathaway boughtstock right after that, in 2019.

He wasn't wrong. Walmart was late to the e-commerce party, and it took time for the retail giant to really get into it. However, it's getting stronger and stronger, and e-commerce sales growth accelerated to 25% year over year in the 2025 fiscal second quarter (ended Aug. 1).

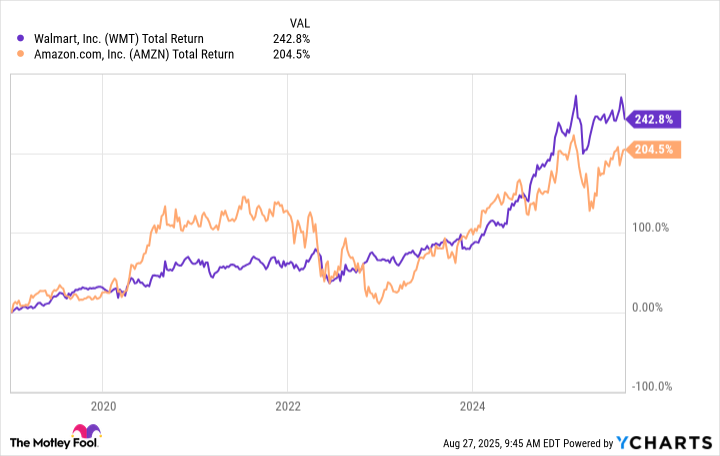

However, since January 2019, somewhere in the middle of the Walmart stock sale and Amazon stock purchase, Walmart has outperformed Amazon.

WMT Total Return Level data by YCharts

Cutting the flowers

Did Buffett make a mistake? He noted several years ago, "Just as Walmart was once totally underestimated by the seers of its time, the idea some guy in Bentonville, Arkansas, would take them to the cleaners, that was the situation at first with traditional retailers, and Amazon. You want to be underestimated at first."

It seems like Buffett underestimated Walmart himself when he sold out of it. He has made the mistake that many investors say is their biggest: selling winners too soon. When he made his famous quote about his favorite holding time being "forever," he referenced Peter Lynch as likening "such behavior" to holding on to losers in the hopes of a turnaround while selling winners "to cutting the flowers and watering the weeds."

But there's a way back.

Fitting the Buffett model

There are specific criteria Buffett always talks about in a great stock: excellent management, an important role in the economy, commitment to shareholder value, and not needing to spend a lot of money to make a lot of money.

Investors often think of him as a value investor, but his focus is more on the underlying business than getting a bargain. He says he looks for "a sensible price tag."

These days, there are some themes in the companies his team is choosing to invest in. One obvious feature is that they are predominantly, or even entirely, leaders in their fields. Consider,, and. These are literally the largest companies in their respective industries.

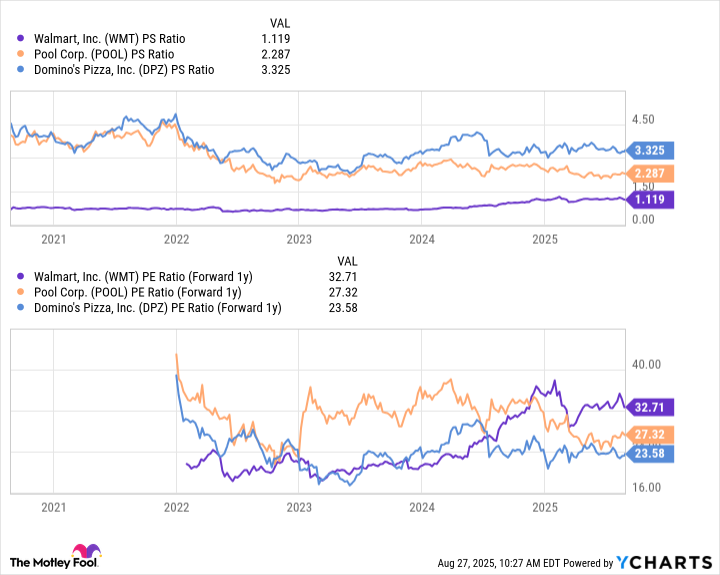

And while UnitedHealth looks like the kind of rare bargain opportunity Buffett pounces on, the others weren't necessarily so cheap when Buffett bought them. Consider their forward, one-year P/E ratios and price-to-sales ratios.

WMT PS Ratio data by YCharts

Why Walmart today?

Here's how Walmart fits in today. It's the largest retailer in the world, and despite slowing growth and the threat of Amazon, it has retained its status. Not only that, but it has the advantage of 4,600 domestic stores to use as distribution hubs, something Amazon can't match. Store deliveries increased 50% over last year in the second quarter, and they were fast -- a third were delivered in under three hours.

Walmart is flexing its retail muscle, and it's absorbing some of the impact of tariffs so that it can still offer great value to its customers. Smaller outfits can't do that, at least to the extent Walmart can. Walmart is also a Dividend King, and it has raised its dividend for the past 52 years. That's commitment to creating shareholder value.

Finally, if Buffett is beefing up positions in industry leaders while saving money for opportunities at a later point, it seems like he expects these stalwarts to manage through the dips and corrections that make those opportunities possible, anchoring the portfolio and minimizing potential losses.

With its essential products and discount prices, Walmart can gain market share in challenging times, and it shouldn't be underestimated again.