Meet the Magnificent ’Ten Titans’ Growth Stock With a 7.5% Weighting in the S&P 500 That Could Single-Handedly Move the Stock Market on Aug. 28

One stock holds enough market power to shift the entire S&P 500 with its 7.5% weighting—and it's poised to make waves tomorrow.

The Heavyweight's Move

This titan's sheer size gives it unprecedented influence over market indices. When it moves, the entire market feels the ripple effect—because index funds blindly follow whatever this behemoth does. Nothing says 'efficient markets' like one stock moving the entire benchmark.

August 28th Showdown

Mark your calendars for what could be the most consequential trading day of the month. This single equity's performance doesn't just matter—it dictates the direction of billions in passive investments. Because why bother with fundamental analysis when you can just ride one company's coattails?

Tomorrow's market doesn't need catalysts—it needs this one stock to sneeze so the whole market can catch a cold.

Image source: Getty Images.

Nvidia's profound impact on the S&P 500

The Ten Titans are the largest growth stocks by market cap -- making up a staggering 38% of the S&P 500.

Nvidia is the largest -- with a 7.5% weighting in the index.

The other Titans are,,,,,,,, and.

Aside from its value, Nvidia is also a major contributor to S&P 500 earnings growth.

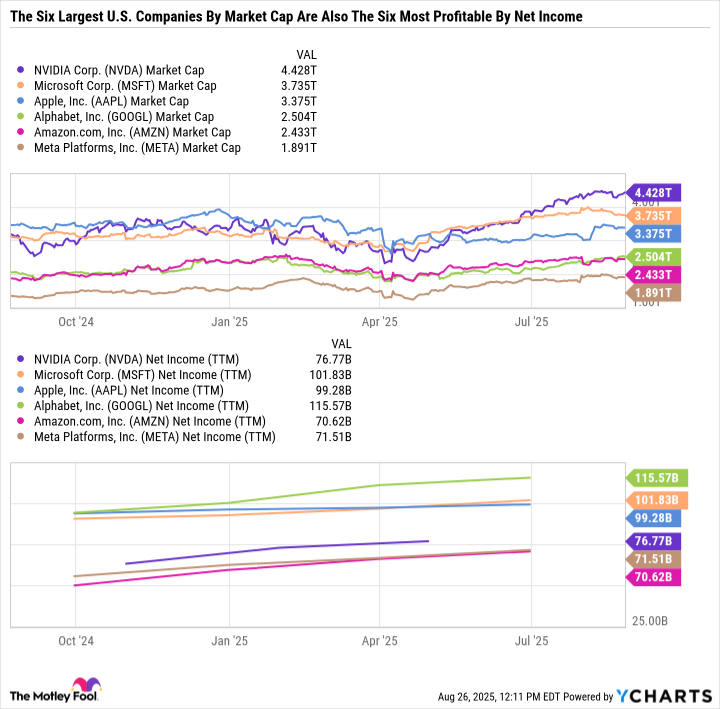

NVDA Market Cap data by YCharts

Megacap tech companies influence the value of the S&P 500 and its earnings. And since many of the top earners are growing quickly, the market arguably deserves to have a premium valuation.

Since the start of 2023, Nvidia added roughly $4 trillion in market cap to the S&P 500. But it also added over $70 billion in net income -- as its trailing-12-month earnings went from just $5.96 billion at the end of 2022 to $76.8 billion today. That's like creating the combined earnings contribution of,,, andin the span of less than three years.

Nvidia's value creation for its shareholders, and the scale of just how big the business is from an earnings standpoint, is unlike anything the market has ever seen. But investors care more about where a company is going than where it has been.

Nvidia's unprecedented profit growth

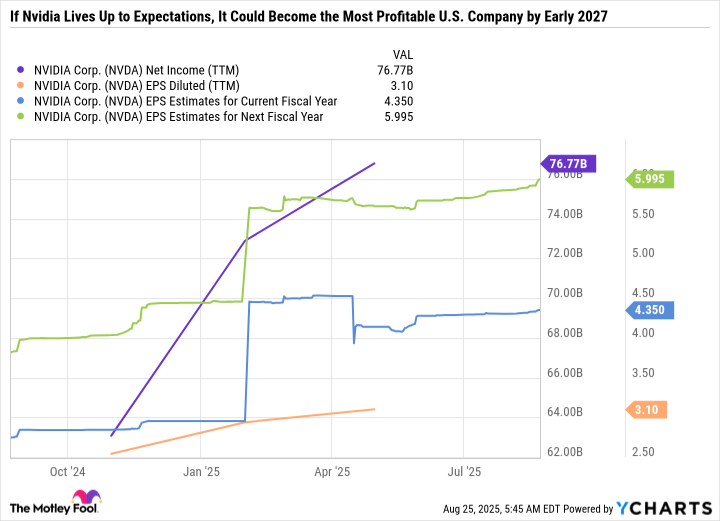

Expectations are high for Nvidia to continue blowing expectations out of the water. Over the last three years, Nvidia's stock price ROSE after its quarterly earnings report 75% of the time. Analysts have spent the last few years flat-footed and scrambling to raise their price targets as Nvidia keeps raising the bar. It looks like they aren't making that mistake any longer -- as near-term forecasts are incredibly ambitious.

As mentioned, Nvidia's trailing-12-month net income is $76.8 billion, which translates to $3.10 in diluted earnings per share (EPS). Consensus analyst estimates have Nvidia bringing in $1 per share in earnings for the quarter it reports on Wednesday and $4.35 for fiscal 2026. Going out further, analyst consensus estimates call for 37.8% in earnings growth in fiscal 2027, which WOULD bring Nvidia's diluted EPS to $6 per share.

NVDA Net Income (TTM) data by YCharts

Based on Nvidia's current outstanding share count, that would translate to net income of $107.7 billion in fiscal 2026 and $148.5 billion in fiscal 2027. Unless other leaders like Alphabet, Microsoft, or Apple accelerate their earnings growth rates, Nvidia could become the most profitable U.S. company by the time it closes out fiscal 2027 in January of calendar year 2027. These projections strike at the core of why some investors are willing to pay so much for shares in the business today.

The key to Nvidia's lasting success

Nvidia can single-handedly move the stock market due to its high weighting in the S&P 500. However, its influence goes beyond its own stock, as strong earnings from Nvidia could also be a boon for other semiconductor stocks, like Broadcom. But the Ripple effect is even more impactful.

In Nvidia's first quarter of fiscal 2026, four customers made up 54% of total revenue. Although not directly named by Nvidia, those four customers are almost certainly Amazon, Microsoft, Alphabet, and Meta Platforms. So strong earnings from Nvidia would basically mean that these hyperscalers continue to spend big on AI -- a positive sign for the overall AI investment thesis.

However, Nvidia's long-term growth and the stickiness of its earnings ultimately depend on its customers translating AI capital expenditures (capex) into earnings -- which hasn't really happened yet.

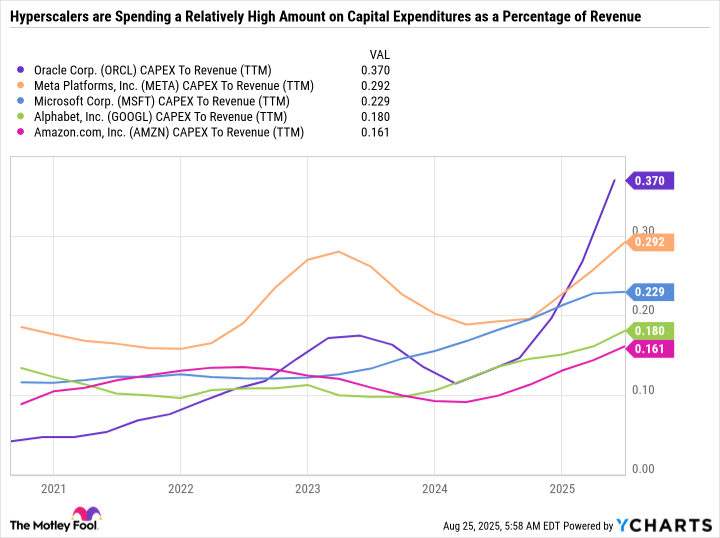

ORCL CAPEX To Revenue (TTM) data by YCharts

Cloud computing hyperscalers are spending a lot on capital expenditures (capex) as a percentage of revenue -- showcasing accelerated investment in AI. But eventually, the ratio should decrease if investments translate to higher revenue.

Investors may want to keep an eye on the capex-to-revenue metric because it provides a reading on where we are in the AI spending cycle. Today, it's all about expansion. But soon, the page will turn, and investors will pressure companies to prove that the outsize spending was worth it.

The right way to approach Nvidia

Almost all of Nvidia's revenue comes from selling graphics processing units, software, and associated infrastructure to data centers. And most of that revenue comes from just a handful of customers. It doesn't take a lot to connect the dots and figure out just how dependent Nvidia is on sustained AI investment.

If the investments pay off, the Ten Titans could continue making up a larger share of the S&P 500, both in terms of market cap and earnings. But if there's a cooldown in spending, a downturn in the business cycle, or increased competition, Nvidia could also sell off considerably. So it's best only to approach Nvidia with a long-term investment time horizon, so you aren't banking on everything going right over the next year and a half.

All told, investors should be aware of potentially market-moving events but not overhaul their portfolio or make emotional decisions based on quarterly earnings.