Billionaire Stanley Druckenmiller Just Supercharged Duquesne’s Position in This Monster AI Semiconductor Stock (Hint: Still Not Nvidia)

Wall Street legend makes bold bet on AI's next frontier player

The Druckenmiller Blueprint

Stanley Druckenmiller's Duquesne Family Office just significantly increased its stake in an artificial intelligence semiconductor powerhouse—and no, it's not the obvious choice everyone's chasing. The billionaire investor, known for his prescient macroeconomic calls, is positioning for what comes after the initial AI infrastructure boom.

Following the Smart Money

When a investor with Druckenmiller's track record makes moves, the Street pays attention. His latest positioning suggests confidence in semiconductor companies that provide critical components beyond just processing power—think specialized chips for edge computing, neural networks, or quantum integration. Because sometimes the real money isn't in the gold rush, but selling the picks and shovels to the overhyped miners.

The AI Semiconductor Landscape Shifts

This move signals potential rotation within the AI sector as early leaders become crowded trades. Druckenmiller's play likely targets companies with proprietary technology, scalability advantages, or exposure to emerging AI applications beyond current market darlings. Because nothing says 'contrarian' like betting on the second-most exciting chipmaker in a room full of NVIDIA fanboys.

Image source: Getty Images.

Since then, Druckenmiller has reentered the chip landscape -- this time plowing into a key beneficiary of the artificial intelligence (AI) infrastructure boom beyond the usual suspects like Nvidia,, or.

Over the past year, Duquesne has built a solid position in foundry specialist(TSM 1.09%). During Q2, Druckenmiller increased his firm's stake in Taiwan Semi by 28% -- bringing its total exposure to roughly 765,000 shares.

Let's unpack what makes TSMC such a compelling AI chip stock, and assess if now is a good opportunity for you to follow Druckenmiller's lead.

Taiwan Semi is rolling on all cylinders, and...

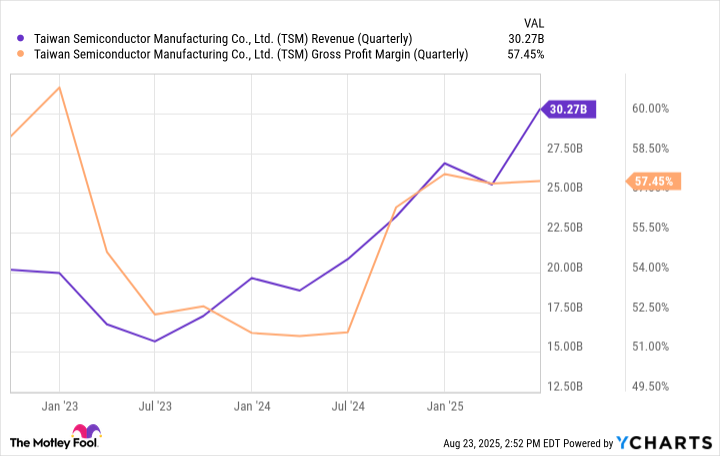

The chart below highlights revenue and gross profit margin trends throughout the AI revolution for TSMC. With an estimated 68% share of the global foundry market, Taiwan Semi is operating on a level far above rivals likeor-- giving the company the ability to exercise substantial pricing power for its services.

TSM Revenue (Quarterly) data by YCharts

...its momentum isn't slowing down

At first glance, investors might worry that TSMC's steep revenue growth and expanding profit margins are nearing a peak. But the data suggests otherwise.

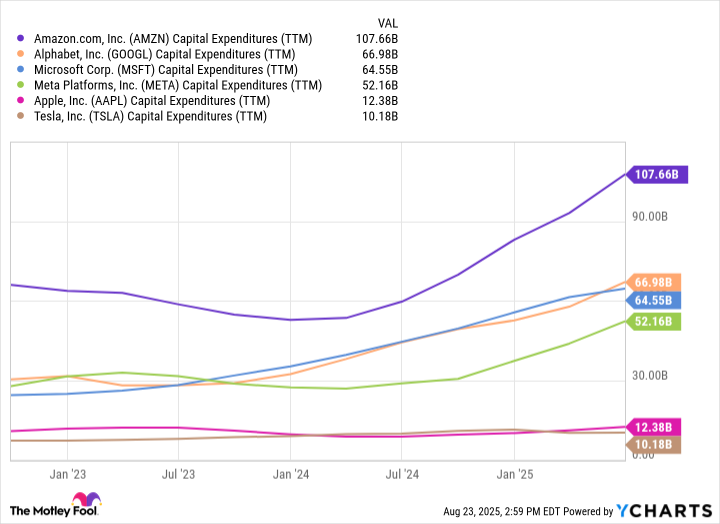

Enterprise spending on AI infrastructure is accelerating, led by cloud hyperscalers,, and, which are in the midst of a historic capital expenditure (capex) spree to acquire GPUs and networking equipment for next-generation data centers. And it's not just the cloud giants.,, andare also investing heavily to advance ambitions in robotics, autonomous driving, and consumer electronics.

AMZN Capital Expenditures (TTM) data by YCharts

Collectively, this spending acts as a proxy for GPU demand. Behind the scenes, this is an enormous tailwind for Taiwan Semi -- the foundry responsible for manufacturing these advanced chipsets for Nvidia, AMD, and many others.

While Nvidia and AMD capture most of the headline news, TSMC may actually offer the most durable growth prospects in the chip realm. In many ways, the company represents a long-term call option for the global buildout of AI infrastructure.

Is TSMC stock a buy?

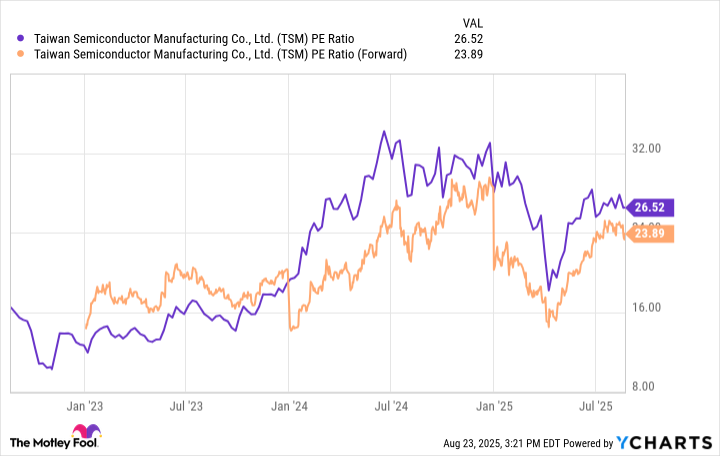

Valuing TSMC stock is a bit tricky. Like many of peers in the semiconductor landscape, the company has witnessed considerable valuation expansion in recent years. On a simple price-to-earnings (P/E) or forward P/E basis, the stock certainly doesn't look like a bargain.

TSM PE Ratio data by YCharts

But dig deeper, and a different story emerges. Taiwan Semiconductor trades at a PEG ratio well-below 1 -- suggesting the company may actually be undervalued relative to its future growth potential. That's the kind of setup investors like Druckenmiller might be trying to capitalize on -- a rare opportunity at the intersection of growth and value.

For long-term investors, I see TSMC as a no-brainer chip stock to buy and hold over the next several years. It may not command the spotlight, but it's playing a supporting role in the infrastructure revolution that underpins the AI chip era.