Amazon’s Golden Goose: From Cash Cow to Red Flag?

Amazon's profit engine sputters as regulatory clouds gather.

The e-commerce giant faces mounting pressure on multiple fronts—antitrust scrutiny, labor disputes, and supply chain chaos. Once-unstoppable revenue growth shows cracks while operating costs skyrocket.

Wall Street's darling now trades at valuations that make crypto bulls blush—and that's saying something.

Amazon Web Services, long the profit center, faces brutal competition from Microsoft Azure and Google Cloud. Retail margins get squeezed by rising fulfillment costs and wage inflation.

The company's famous 'flywheel' shows signs of friction. Prime membership growth slows as subscription fatigue sets in. Advertising revenue—the new golden child—faces privacy headwinds and platform saturation.

Meanwhile, regulators circle like vultures. The FTC probes competitive practices while European commissions levy billion-dollar fines. Labor organizers gain traction in warehouses nationwide.

Does Bezos' creation need reinvention? The market punishes perfection—and Amazon's no longer perfect. Maybe they should've bought Bitcoin instead of chasing rockets.

One thing's clear: the days of easy growth are over. Now comes the hard part—actually earning those multiples.

Image source: Getty Images.

Microsoft and Google are racing ahead in the cloud

In the second quarter, AWS posted revenue growth of 17% year over year. This is notably slower than its rivals. Microsoft Azure posted accelerating growth over the first quarter, with Azure revenue increasing by 39% over the year-ago quarter. Google Cloud's market share ranks third in the cloud market, and it grew 32% year over year last quarter.

While Amazon experienced capacity constraints that is contributing to slower cloud growth, it's worth noting that Microsoft Azure and Google Cloud are experiencing the same headwind but still growing much faster than AWS.

So why are businesses choosing Microsoft and Google over AWS? There could be many reasons, but from a high-level perspective, Microsoft has been the trusted software provider for individuals and businesses for many years, and it can leverage this expertise to grow its cloud business. Microsoft is able to integrate its productivity software like Office with Azure services, which could be a key selling point for businesses.

For Google, it has one of the most capable AI models in 2025 with Gemini. Gemini powers the AI features in its consumer apps like Gmail and Search, in addition to enterprise AI services in Google Cloud. Google just scored a $10 billion multi-year deal with, which chose Google Cloud over AWS.

Amazon's greatest advantage

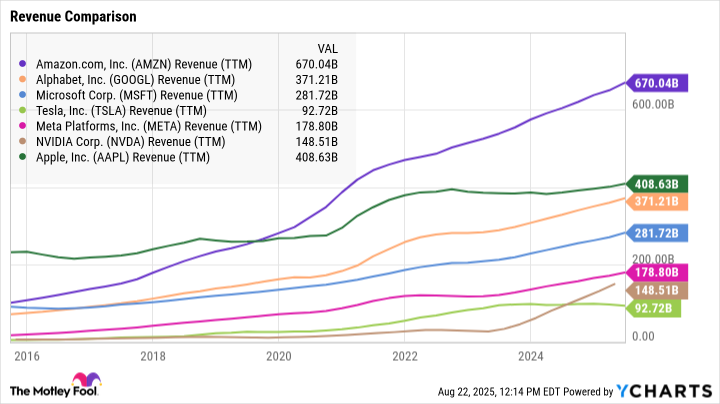

One advantage for Amazon is that it generates far more revenue than any other "Magnificent Seven" company, including Microsoft and Google. Amazon generated $670 billion in trailing-12-month revenue, compared to $281 billion for Microsoft and $371 billion for Alphabet.

Revenue (TTM) data by YCharts

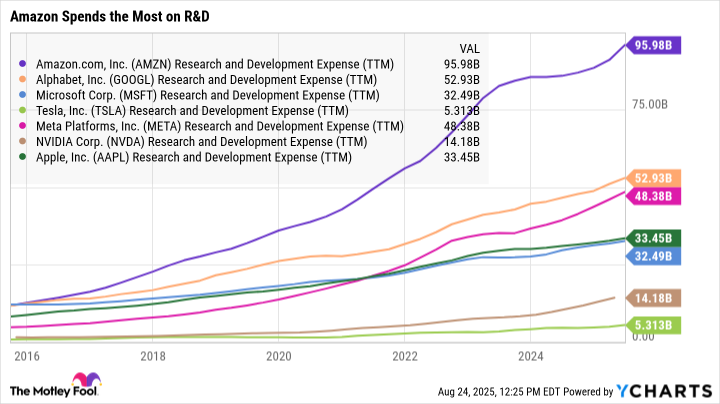

The advantage of generating so much revenue can be seen in Amazon's annual spending on research and development (R&D). Amazon has one of the largest spending budgets of any business in the world. This is important because compensation for tech engineers that work on AI is included in R&D expense. In the race among big tech to land top talent and invest in AI initiatives, Amazon is able to outspend everyone else.

Research and Development Expense (TTM) data by YCharts

While Microsoft may overtake Amazon in the cloud market considering its faster rate of growth, this doesn't make Amazon a bad investment.

How AWS is unlocking value for Amazon investors

The massive amount of revenue Amazon generates across e-commerce, cloud, advertising, subscriptions, and third-party fulfillment fees are funding investments in opportunities that make the stock worth owning for the long term.

Amazon's Project Kuiper is a great example of how the company leverages capabilities from AWS to benefit its entire business. Kuiper is a satellite broadband internet service that Amazon has been investing in. It will tap into a large market of at least 400 million households worldwide that lack access to broadband internet.

But the ability for satellite broadband to provide service to remote areas will also be valuable for enterprises and governments. These organizations need to be able to take data from space and immediately put it in the cloud for data analytics and AI. The integration of Kuiper with AWS will give Amazon a major advantage in this market.

The synergy between Project Kuiper and AWS is why investors shouldn't judge Amazon by its cloud performance alone but consider how all the parts of the business fit together.

Growth in Amazon's non-retail businesses, which generate high margins, have contributed to strong profit growth for several years. Its total operating profit grew 31% year over year in Q2. It's worth noting that Amazon stock has outperformed Microsoft and Google since 2022, and Wall Street analysts expect Amazon's profits to continue growing at double-digit rates in the coming years, as the company increasingly leans on AI technology (thanks to AWS) to lower costs in the e-commerce business.

Given the nearly $100 billion it is spending on R&D every year, Amazon is more than likely going to surprise to the upside over the long term as it invests in opportunities. Notable billionaires like Bill Ackman have been buying the stock this year, indicating attractive return prospects. It's for these reasons Amazon remains a top growth stock worth holding.