Palantir Tumbles Today — Is This AI Stock a Must-Buy Opportunity Right Now?

Palantir's stock just hit a speed bump — but smart investors are circling.

What’s driving the dip?

Market jitters, profit-taking, or something deeper? This isn’t just another tech stock — it’s a pure-play AI data giant with government contracts and commercial momentum. When it stumbles, attention follows.

Why it still tempts traders:

Foundational tech. Classified deals. Real revenue. This isn’t vaporware — it’s actual artificial intelligence deployed at scale. Bulls see a long-term hold; skeptics see hype. And let’s be real — on Wall Street, sometimes a dip is just a discount in disguise.

Timing beats guessing.

If you believe in data-driven warfare, smart cities, and corporate AI — this might be your entry. Or not. After all, since when did traditional finance ever understand disruption before it went mainstream?

Image source: Getty Images.

Is Palantir stock a buy right now?

Palantir is one of the strongest overall players in the artificial intelligence (AI) software space, and it's been posting momentous sales and earnings growth. On the other hand, it's not as if the company hasn't already gotten a lot of valuation credit for its strong business growth and long-term expansion opportunities.

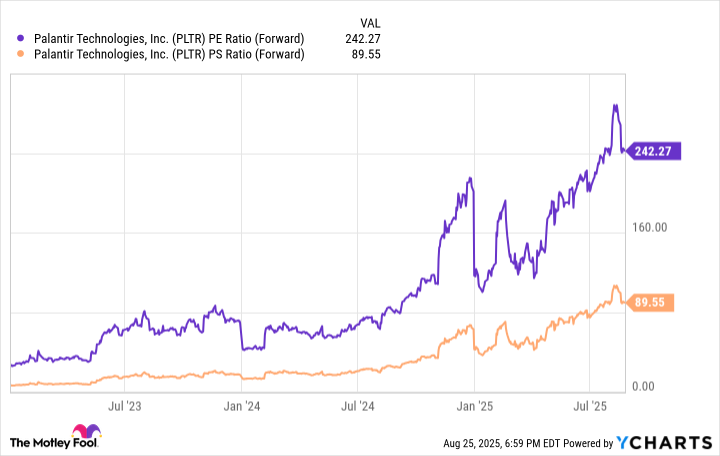

PLTR PE Ratio (Forward) data by YCharts

Trading at approximately 90 times this year's expected sales and 242 times expected non-GAAP (generally accepted accounting principles) adjusted earnings, Palantir has a valuation profile that stands out as being extraordinarily growth dependent even among the field of high-flying AI stocks. Despite the stock seeing a significant pullback from its all-time high, Palantir is still up 108% across 2025's trading and 1,840% over the last three years.

Recent sell-offs connected to macroeconomic risk factors and concerns about the current state of practical business applications for AI technologies are a reminder of the high level of risk that comes with investing in a company that already has a lot of explosive growth priced into its valuation. Along those lines, Palantir is probably still too richly valued to be a sensible investment for investors without very high levels of risk tolerance.

While I think the stock looks quite risky right now, I also think that it has a good chance of significantly outperforming the broader market over the next five years. In addition to very strong momentum with private-sector customers, Palantir's heavy exposure to the defense industry suggests that the stock comes with characteristics that help offset some of the risks associated with the biggest sources of potential geopolitical destabilization for the market.