Think Dutch Bros Stock Is Expensive? This Chart Will Blow Your Mind

Dutch Bros defies valuation gravity—again.

Pricey Perception vs. Performance Reality

That eye-watering P/E ratio masks explosive growth metrics traditional analysts keep missing. Same-store sales scream upward while expansion plans hit hyperdrive.

Caffeine-Fueled Financials

Revenue trajectories mimic their lines around 7 AM—steep and relentless. Customer loyalty programs print money faster than the Fed's digital printer. Store economics? Let's just say each location generates enough cash to buy its own Tesla fleet.

The Growth Addiction

Wall Street worries about saturation while Dutch Bros opens locations like it's solving caffeination emergencies. Their unit economics make Starbucks look like a sleepy bureaucracy—which, let's be honest, it is.

Traditional valuation models choke on this growth story. But then again, traditional finance still thinks fax machines are relevant.

Image source: Dutch Bros.

High growth, high profits for Dutch Bros

With performance as good as Dutch Bros' has been posting since it went public in 2021, it's surprising that it's taken the market this long to take notice. It reliably reports high sales growth, and profits continue to rise. In the 2025 second quarter, revenue increased 28% year over year, while net income ROSE from $22.2 million last year to $38.4 million this year.

However, there were reasons the market was concerned until recently. It didn't report its first annual profit until 2023. In addition, investors were worried about its chances when same-store sales growth was low, even in negative territory for a short time, and most of the increase was coming from price hikes.

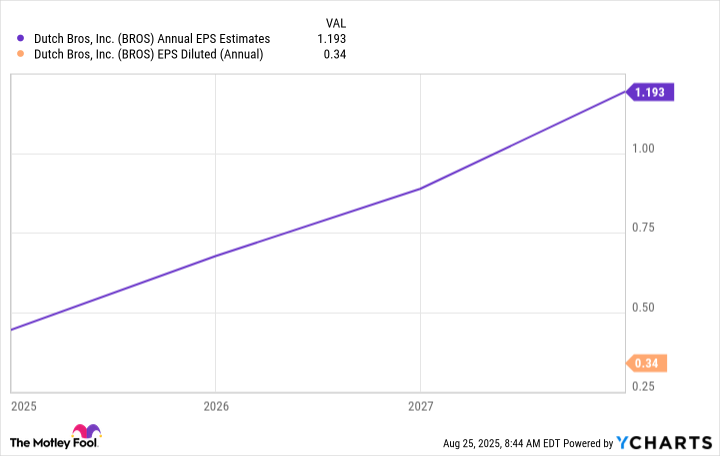

Dutch Bros has moved way past that now. Earnings per share (EPS) increased from $0.03 to $0.34 in 2024, and from $0.12 to $0.20 in the 2025 second quarter year over year. Same-store sales were up 6.1% in the quarter, with a 3.7% rise in transactions.

More importantly, analysts expect EPS to increase about 350% over the next three years.

Data by YCharts.

There's a lot of expectation here. Dutch Bros has a huge growth runway in opening new stores, and net income is following. While there's some growth built into Dutch Bros' current price, the opportunity is enormous, which is why it commands a premium valuation. As for other valuation methods, the forward one-year P/E ratio is a more reasonable 74, and the price-to-sales ratio is a very reasonable 5.