If You’d Dropped $10K on Shopify Stock a Decade Ago, Here’s What You’d Be Sitting On Today

Tech investors who backed Shopify early are laughing all the way to the bank—while traditional finance skeptics missed the rocket.

From Obscure Startup to E-Commerce Juggernaut

Shopify didn’t just ride the e-commerce wave—it built the damn surfboard. While legacy retailers clung to brick-and-mortar dreams, Shopify armed entrepreneurs with digital storefronts, payment gateways, and logistics tools. No MBA required—just grit and an internet connection.

The Numbers Don’t Lie (But Your Financial Advisor Might)

That hypothetical $10,000 investment? It ballooned into a life-changing sum—enough to make Wall Street’s favorite blue-chips blush. Forget ‘diversification’ dogma—sometimes going all-in on a visionary tech play crushes the spreadsheets.

Crypto Parallel: Decentralization’s Silent Partner

While crypto grabbed headlines, Shopify quietly powered the actual economy—processing billions for merchants who’d rather accept crypto than beg banks for approval. Talk about a backdoor revolution.

Lesson: Bet on platforms that empower people, not pedigrees. And maybe question that mutual fund manager still charging 2% for sub-inflation returns.

Image source: Getty Images.

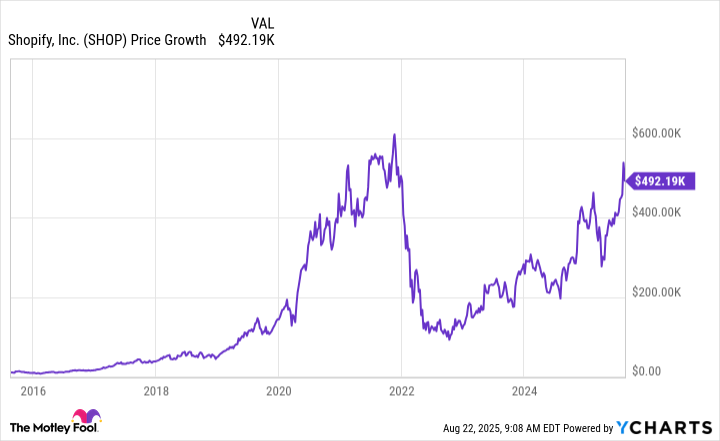

Shopify over the last 10 years

Over the last 10 years, a $10,000 investment became worth just over $492,000.

SHOP data by YCharts

This is noteworthy since Shopify has a relatively narrow competitive moat, at least at first glance. When choosing e-commerce platforms, merchants have numerous choices and can also turn to(NASDAQ: AMZN) if they don't desire the independence from large sellers that Shopify offers.

However, Shopify offers a no-code platform that doesn't require merchants to hire IT staff to build a sales site, and the speed of its platform makes it less likely for merchants to lose sales due to slow speeds. An ecosystem with numerous ancillary services and an increasingly AI-driven focus have also bolstered Shopify's competitive advantage.

Admittedly, the growth did not come without challenges. Investors sold off the stock in the 2022 bear market after the pandemic-driven increase in online shopping ran its course. Moreover, a misstep into the fulfillment business temporarily turned Shopify back to net losses.

Nonetheless, Shopify has become the most popular e-commerce platform in the U.S. and one of the leading e-commerce ecosystems globally. Additionally, Grand View Research projects a compound annual growth rate (CAGR) of 19% through 2030. That will bring the e-commerce market size to an estimated $83 trillion by 2030.

In comparison, Shopify reported a gross merchandise volume of $327 billion over the last 12 months compared to $259 billion over the previous 12-month period, a 26% increase. With Shopify claiming only a tiny percentage of this fast-growing market, investors should not expect the long-term gains to stop anytime soon.