3 Reasons to Buy Target Stock Like There’s No Tomorrow

Retail giant Target surges as traditional investors scramble for defensive plays—meanwhile, crypto continues eating Wall Street's lunch.

Resilient Consumer Base Defies Economic Headwinds

Three distinct catalysts drive Target's momentum while legacy finance clings to brick-and-mortar nostalgia.

Omnichannel Strategy Outperforms Pure E-Commerce

Physical locations serve as distribution hubs—cutting last-mile costs and bypassing digital-only limitations.

Private Label Brands Boost Margin Expansion

Exclusive product lines deliver higher profitability than third-party offerings—because apparently selling other people's stuff isn't actually a business model.

Balance Sheet Strength Enables Aggressive Buybacks

Strong cash flow funds shareholder returns while crypto protocols automate yield without boardroom approvals.

Target represents everything right with traditional retail—and everything wrong with traditional finance's innovation pace.

1. Target looks cheap and has an attractive yield

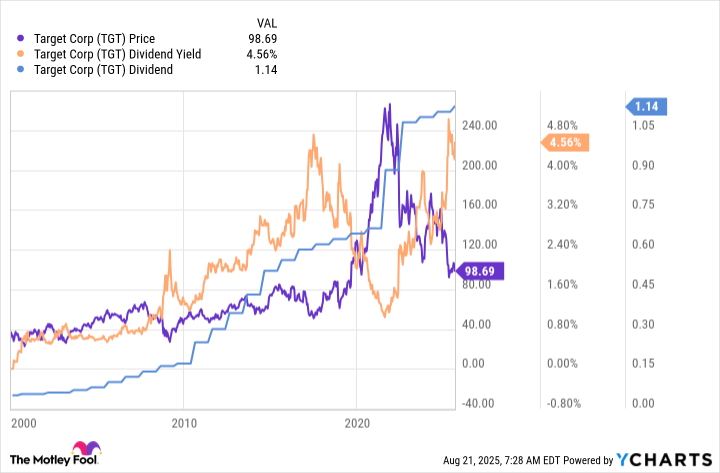

One of the biggest reasons to buy Target right now is its dividend yield, which sits at around 4.2%. That is far above the 1.2% of theindex and is actually NEAR the highest levels in Target's history. Using dividend yield as a rough gauge of valuation, Target looks like it has been put on the sale rack.

Image source: Getty Images.

Looking at some more traditional valuation metrics supports that view. The company's price-to-sales ratio, price-to-earnings ratio, and price-to-book-value ratio are all below their five-year averages. To be fair, there's a reason why Wall Street is so downbeat on Target's stock. Sales and earnings both fell year over year in the second quarter of 2025, continuing a trend of performance weakness. That's a very real concern, but there's a caveat here to consider.

2. Target is a Dividend King

Target's dividend has been increased every year for 58 consecutive years. That makes it a Dividend King, which is a highly elite group of companies. You can't build a record like that by accident, it requires a strong business model that gets executed well in both good times and bad times. In fact, Target's dividend streak is longer than Walmart's, which is 52 years long.

If history is any guide, Target deserves the benefit of the doubt as it deals with its current headwinds. Over the past 58 years there have been many hard times to muddle through, and Target has succeeded each time. That includes the Great Recession between 2007 and 2009 and the coronavirus pandemic in 2020, which was also accompanied by a brief recession.

It is easy to justify cutting and running from a troubled business. But investors who think outside the box, so-called contrarian investors, might actually find Target's stock decline, attractive valuation, and business history a perfect combination for justifying a bullish view. But there's one missing piece.

3. The board and management is making tough calls

An attractive price and a strong business history are nice, but the real question today is what is Target doing to get back on track. And the answer is that management and the board of directors are shaking things up in a very big way. To put it simply, the company is changing up its leadership team in an effort to bring in new voices.

This effort has included eliminating the chief strategy officer role and replacing it with a team of experienced insiders. The new group, to be known as the enterprise acceleration office, was just step one, however. The board also moved to promote a Target veteran to the role of CEO.

TGT data by YCharts

Changes like this are hard, and it can take time for them to bring about the desired improvement. But they are the types of choices that well-run companies make when they need to. And, right now, Target needs change. That said, the second-quarter earnings results weren't all bad. In fact, store traffic and sales trends improved from the first quarter. That's not to suggest that Target's turnaround is complete, but that there are some signs of light at the end of the tunnel.

Worth the risk for more aggressive investors

There is no question that Target has its work cut out for it. But given the attractive valuation, long history of success as a business, and the moves the company is making to adjust today, it is probably worth a DEEP dive for contrarian investors. The turnaround story won't play out in a quarter or two, so you'll need to be willing to hold for the long term. But if history is any guide, Target could be an attractive buy today.

It is worth noting that, despite the company's challenges, the board hiked the dividend by 1.8% in June, a clear sign that the board believes the current troubles are temporary.