Alphabet’s Meta Partnership Ignites Rally: Is GOOGL Stock Primed for Another Breakout?

Alphabet just landed a game-changing deal with Meta—and Wall Street's taking notice.

The tech giant's stock surged on the news, sparking renewed bullish momentum across big tech.

Why This Deal Matters

This isn't just another partnership. It's a strategic power move that positions Alphabet at the center of the next wave of digital infrastructure—AI, cloud, and advanced data analytics. Meta doesn’t partner lightly, and this collaboration signals deep confidence in Alphabet’s tech stack.

Market Impact

Traders are piling in, betting this is more than a short-term pop. Institutional flows have turned positive, and options activity suggests bigger moves ahead. If you’ve been waiting for a catalyst to drive GOOGL beyond recent resistance—this might be it.

But let’s be real—Wall Street’s excitement lasts exactly until the next earnings miss. For now, though, momentum is building, and this deal could be the fuel that sends the stock toward new highs.

Image source: Getty Images.

Terms of the partnership

Under the terms of the deal, Meta will pay Google $10 billion over six years. In exchange, it will receive access to Google Cloud's storage, server, and networking services, along with other products.

Meta has previously relied on's Amazon Web Services (AWS) and's Azure for such services. The deal does not necessarily mean it will deal less with these companies. More likely, it speaks to Meta's insatiable demand for cloud infrastructure as it seeks to become a major player in the AI space.

Additionally, Meta and Alphabet are each other's largest competitors in the digital advertising market. And in the first half of 2025, 98% of Meta's revenue came from digital ads. Hence, in a sense, it is remarkable that these two WOULD become partners in a different business.

How it helps Alphabet

However, in another sense, this is a huge step forward for Alphabet's future. In the first half of this year, Alphabet earned 74% of its revenue from the digital ad market, down from 76% in the same period in 2024. This is also by design, as Alphabet has purchased dozens of businesses unrelated to the digital ad market in its efforts to transition into a more diversified technology enterprise.

So far, Google Cloud is the only one of these enterprises to appear in Alphabet's financials. It accounted for 14% of Alphabet's revenue in the first two quarters of 2025, up from 12% in the same year-ago period.

Additionally, Google Cloud generated over $49 billion in revenue over the trailing 12 months, implying the $10 billion from Meta over six years will make up a relatively small portion of Google Cloud's business.

Nonetheless, the deal serves as a vote of confidence for Alphabet's cloud business, one that continues to lag AWS and Azure in terms of market share.

Image source: Statista. Y-o-y = year over year.

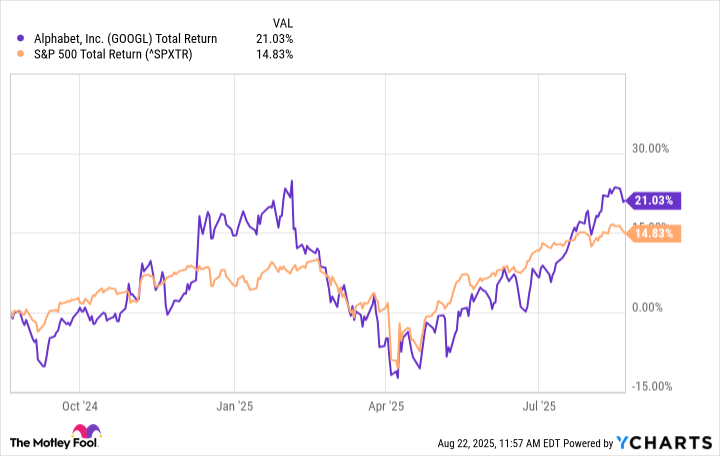

The investor perspective is also crucial. Over the last year, Alphabet stock has outpaced the total returns of theby a significant but not eye-popping margin. However, it may help that Alphabet's price-to-earnings (P/E) ratio of 22 is the lowest among "Magnificent Seven" stocks. Hence, the Meta deal could prompt investors to look more favorably upon that earnings multiple.

GOOGL Total Return Level data by YCharts.

Furthermore, if the Meta deal prompts other companies to do more business with Google Cloud, it could provide a boost to its market share and, by extension, Alphabet stock.

The Meta deal and Alphabet stock

Ultimately, Meta's deal with Google Cloud will more than likely take Alphabet stock a leg higher, but investors should expect the effects to be more indirect. Indeed, the deal is remarkable in that it serves as a boost for third-place Google Cloud and is notable since the two companies are direct competitors in each other's largest enterprises.

Although $10 billion in added business over six years is substantial, Google Cloud generated $49 billion over the last 12 months. Thus, it is a significant but not game-changing boost to the enterprise.

However, the deal may make Google Cloud more attractive to prospective customers, and the low P/E ratio could attract more investors to Alphabet. In the end, those could become the more significant benefits of the deal.