This Dividend Champion Stock Is Crushing the Market in 2025

While crypto markets swing wildly, one old-school dividend stock quietly outperforms everything.

Steady Cash Flow Beats Speculative Hype

This isn't about moonshots or meme rallies—it's about cold, hard cash delivered quarterly. While traders chase the next shitcoin pump, this company keeps cutting checks.

The Boring Winner You Overlooked

No flashy blockchain promises, just relentless execution in a sector everyone ignores. Their dividend track record puts crypto staking yields to shame—actual sustainable returns, not algorithmic magic tricks.

Market-Beating Performance Without the Drama

While crypto bros refresh price charts every 30 seconds, this stock delivers alpha through the most revolutionary concept in finance: making real money instead of printing fake internet points.

Sometimes the best innovation is not innovating at all—just doing what works while the 'disruptors' rediscover why financial regulations existed in the first place.

Image source: Getty Images.

Oversold and undervalued

Realty Income is a real estate dividend trust (REIT), a classification of stocks that own and lease properties and pay out 90% of their earnings as dividends. Realty Income is one of the biggest REITs in the world, with more than 15,600 global properties.

It makes more money by purchasing more properties, often through acquiring smaller REITs, and creating long-term lease contracts. The model requires a long funding pipeline to buy properties and new properties to buy, and as you might imagine, it's more challenging to do that profitably and successfully when interest rates are high. That's led to market pessimism, and Realty Income stock is about 25% off of its all-time highs.

However, as interest rates have started to decline and the economy demonstrates resilience, the market is climbing, and investors are feeling more favorably disposed toward some of the best real estate stocks. Realty Income has been performing well despite the pressure, with adjusted funds from operations (AFFO) of $1.05 in the 2025 second quarter, a penny less than last year, but an increase in AFFO-per-share guidance for the full year.

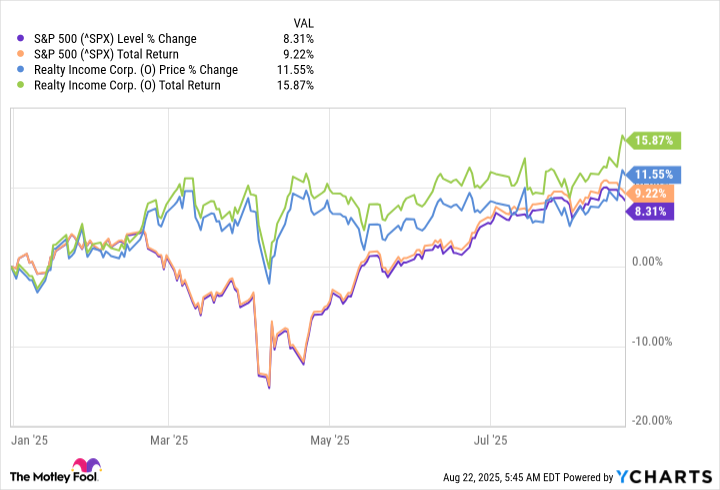

Realty Income has been looking more like a bargain, and smart investors have been scooping up shares. Realty Income stock is now outpacing the market, with and without dividends included.

^SPX data by YCharts

A business model that works

Realty Income is a retail REIT, and it leases its properties to 1,600 different tenants in 91 different industries. It works primarily with well-known and established retail chains that are large and reliable, and it signs long-term leases that create a recurring revenue stream.

Although the focus on solid retailers that sell essentials is touted as an advantage, it has recently branched out to other industries, which offers its own advantages in diversification. It's also becoming more diversified by region. Its top three tenants are 7-Eleven,and, and grocery and convenience stores account for about 20% of paid leases. But other top-10 tenants includeand, and U.K. supermarket chain Sainsbury's is No. 11.

There's plenty of opportunity to keep growing. Management has identified an $8.5 trillion market in leasable properties in its current markets and $14 trillion in an addressable market as it expands into new verticals like data centers.

You can't beat this dividend

Realty Income has been paying a dividend for more than 55 years, and it pays the dividend monthly. It raises it quarterly, and it's raised it for the past 111 quarters. That puts it in a league of its own, and it's on track to keep it up.

Often, dividend stocks that are that reliable don't have a high yield; the benefit is in the dependability and the track record. Realty Income's dividend yields 5.4% at today's price, an excellent yield that's more than 3 times higher than theaverage.

If interest rates come down and the real estate market improves, Realty Income will be in an even better position to deliver value for shareholders. There are bound to be ups and downs over many years, but long-term investors seeking an excellent dividend stock will find it with Realty Income.