Prediction: These 2 Trillion-Dollar Artificial Intelligence (AI) Stocks Could Strike a Megadeal That Wall Street Isn’t Ready For

Two AI titans are quietly positioning for a game-changing partnership—and traditional analysts might be caught flat-footed.

The Trillion-Dollar Dance

While Wall Street obsesses over quarterly earnings, these tech behemoths are playing 4D chess. Their combined market cap? A cool $2 trillion—enough to make even the most jaded fund manager spill their triple-shot latte.

AI's Open Secret

Everyone's chasing AI margins, but these two already cracked the code. They're not just building models—they're building ecosystems. And when ecosystems collide? That's when real disruption happens.

Wall Street's Blind Spot

Analysts love spreadsheets but hate surprises. This potential deal doesn't fit neatly into their discounted cash flow models—so they'll likely dismiss it until the press release drops. Typical finance folks—always fighting the last war.

Watch the boardrooms, not the tickers. This isn't about next quarter's guidance—it's about who controls the next decade of computing. And frankly? The suits on the trading floor won't see it coming until their Bloomberg terminals light up like Christmas trees.

Why Apple needs Tesla

Apple's legacy has always been rooted in consumer devices, pioneering category-defining products such as the iPod, iPhone, and iPad. For years, the company was seen as the undisputed master of uncovering latent needs and turning them into must-have innovations.

In recent years, however, Apple's push into advanced hardware has struggled to live up to the company's historic track record.

Last year, the company scrapped its car initiative, Project Titan, after years of research and development. The ambitious project ended without a formal product launch -- leaving Apple with no presence in the automotive market despite years of speculation.

More recently, Apple unveiled its Vision Pro headset, a foray into augmented and VIRTUAL reality. The device has widely been viewed as a disappointment -- a high-end luxury gadget rather than a mass-market breakthrough, limiting its adoption among everyday consumers.

Now, as rumors swirl around a Siri-powered robot in Apple's pipeline, management faces a critical decision: pursue yet another hardware moonshot from scratch and risk billions in capital expenditures (capex), or align with a partner that's already in production.

In my view, Apple doesn't need to reinvent the wheel by sinking more time and money into developing products that may never launch. Instead, Apple could thrive by positioning itself as the software and services LAYER powering intelligent hardware that already exists in the market.

By joining forces with Tesla, Apple could leverage the company's expertise in autonomous driving systems and robotics while integrating its own AI-powered software ecosystem and consumer marketing prowess.

Such a collaboration could allow Apple to leapfrog into both consumer and enterprise adoption of smart devices -- staking a claim in the robotics and autonomous era of AI, without repeating costly mistakes of the past.

Image source: Getty Images.

Why Tesla needs Apple

Tesla's robotaxi and Optimus both carry transformative potential. But bringing these projects to life requires massive investments in compute power and AI infrastructure.

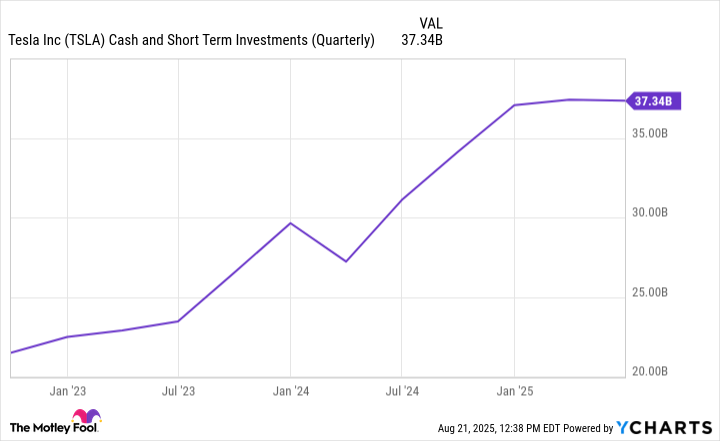

While Tesla's balance sheet boasts a healthy cash cushion, it's worth noting that, like Apple, the company has also made some controversial capital allocation decisions in recent years.

TSLA Cash and Short Term Investments (Quarterly) data by YCharts

Case in point: Tesla recently scaled back its in-house Dojo AI supercomputer project, opting instead to revert to proven infrastructure fromand. Similar to Apple's Project Titan, the recent moves around Dojo underscore how costly and uncertain it can be to build proprietary systems at scale.

This is where a joint venture with Apple could reshape Tesla's financial trajectory. Apple sits on more than $132 billion in cash, equivalents, and marketable securities, and it commands unmatched global distribution channels. By partnering with Apple, Tesla could accelerate the commercialization of Optimus and robotaxi without overplaying its hand financially.

Moreover, Apple's unparalleled brand equity could help transform Tesla's AI-driven machines from prototype concepts into mainstream products -- bridging the gap between Musk's futuristic vision and tangible household and enterprise adoption.

A second chance that no one sees coming

Apple's decision not to acquire Tesla is often portrayed as a missed opportunity. But having spent a decade working in mergers and acquisitions as an investment banking analyst, I can say with confidence that deals rarely unfold as neatly as the financial models suggest. In many cases, strategic partnerships can unlock far greater, more accretive opportunities than an outright acquisition.

As the last of big tech to scale an AI business, both Apple and Tesla now sit at a pivotal crossroad. A collaboration between the two WOULD represent a rare second chance for trillion-dollar innovators to join forces and reshape the future of the technology landscape.

By combining Apple's ecosystem with Tesla's progress in robotics and autonomous systems, the companies could fast-track the commercialization of next-generation AI applications -- moving them from research labs and into the hands of consumers worldwide.