Why Everyone Is Talking About Sirius XM Stock: The Unstoppable Audio Revolution

Sirius XM isn't just surviving—it's dominating the audio landscape while traditional media scrambles to keep up.

The Subscription Juggernaut

While Spotify bleeds cash and broadcast radio fades into static, Sirius XM's subscription model prints money. They've cracked the code on recurring revenue while others chase advertising dollars that never materialize.

Exclusive Content Empire

Howard Stern might have been their initial draw, but today's lineup includes every major sports league, curated music channels without commercials, and news coverage that makes cable networks look amateur. They own content in ways Netflix can only dream about.

The Automotive Moat

Here's where they've outplayed everyone: factory installations. Every new car becomes a potential subscriber—a captive audience before they even hit the dealership parking lot. Genius or predatory? Why not both.

Digital Transformation Play

Their streaming app finally doesn't suck. Better late than never—now they're competing directly with every music service while keeping their satellite advantage. Most companies would kill for one distribution channel; Sirius XM has two.

The numbers don't lie—this isn't some meme stock fantasy. Sirius XM executes while Wall Street analysts still can't decide whether streaming companies should be valued on revenue or user growth. Maybe try valuing them on profits instead? Just a thought.

Shocking the shock jock

For nearly two decades, one of the most coveted assets in Sirius's content library was its exclusive partnership with iconic shock jock Howard Stern. Stern is often credited as the architect of Sirius's early rise, leaving terrestrial radio for a fledging satellite service that, at the time, had little traction or proven product-market fit.

Now, the Stern era at Sirius may be nearing an end. Multiple media outlets have reported that Sirius is weighing whether to MOVE on from Stern's program. While this does not appear to be a full contract cancellation, reports suggest that Sirius no longer sees the same value in Stern's show -- one that historically commanded hundreds of millions of dollars per contract extension.

At first glance, this might seem to signal financial woes for Sirius. But a closer look tells a more nuanced story. Industry chatter indicates that Sirius may be seeking to renew Stern's contract at a vastly reduced rate or even to reallocate those dollars toward new talent -- such as podcast phenomenon Alex Cooper.

Such a shift could prove strategic in the long run. Stern's audience skews older, largely made up of fans who migrated from terrestrial radio in the late 1990s and early 2000s. Today's audio entertainment landscape looks quite different. With remote work and delivery services reducing commute times, the car-centric listening model that once gave Sirius an edge has lost some relevance.

By contrast, signing Cooper to a Stern-like deal could help reposition Sirius for the next generation of listeners, capturing the attention of younger demographics such as millennials and Gen Zers.

Image source: Getty Images.

The Oracle is doing his thing

Few investors on Wall Street command as much attention as Warren Buffett. Colloquially known as the "Oracle of Omaha," Buffett has spent more than six decades buildinginto an investment powerhouse through a series of savvy, often contrarian deals. According to recent filings, Berkshire added 5,030,425 shares of Sirius XM between July 31 and Aug. 4.

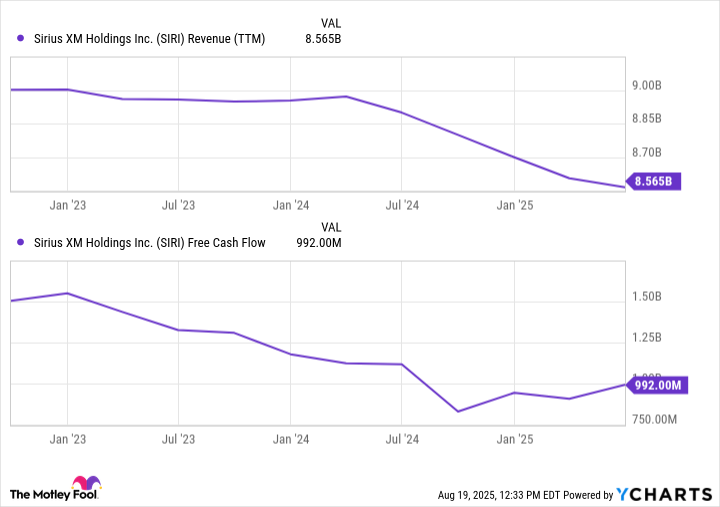

SIRI Revenue (TTM) data by YCharts

This raises an obvious question: Why in the world is Buffett gobbling up shares hand over fist of a declining business? As with the Stern situation, the answer is likely nuanced.

Sirius's revenue decline is primarily attributable to subscriber churn, a challenge that has intensified with the rise of podcasts and alternative streaming platforms. Yet a closer look at the financial profile above sheds light on something most investors are overlooking: The company's free cash FLOW is decelerating more slowly than revenue is falling.

This dynamic matters. Despite some subscriber attrition, nearly three-quarters of Sirius's revenue still comes from subscriptions. This model gives Sirius some durability, allowing the company to command premium pricing power over competing platforms because advertisers want access to a subscription-based audience -- something many of its rivals lack.

Is Sirius XM stock a buy right now?

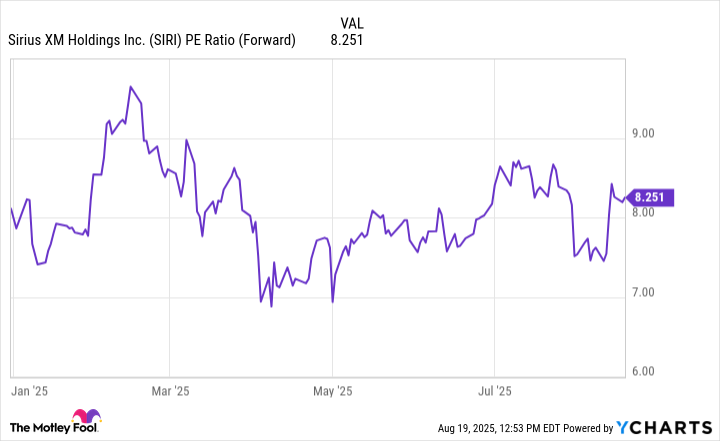

If there is one factor that defines Buffett's investing philosophy, it's that he avoids chasing momentum or paying a premium for businesses trading at frothy valuations. Consider that the average forward price-to-earnings (P/E) multiple across the S&P 500 hovers around 23. By contrast, Sirius XM trades at just 8.2 times forward earnings -- a steep discount to the broader market.

SIRI PE Ratio (Forward) data by YCharts

Buffett likely sees Sirius not as a fading relic but as a legal monopoly with durable profitability -- an asset that still carries enormous value, despite an uneven growth profile. In his eyes, Sirius stock probably sits firmly in DEEP value territory -- making it the type of business he prefers to buy and hold for a long time.

I think much of the headline-driven pessimism is baked into Sirius's share price at this point. While the stock may not carry the same weight as a lucrative high-growth opportunity, now may be a good time to mimic Buffett and scoop up shares of Sirius while it continues to trade at dirt-cheap prices.