Where Will Palantir Stock Be in 10 Years?

Data giant Palantir rockets toward AI dominance—but can it sustain the momentum?

Decade-Long Transformation Underway

Palantir's pivot from government contracts to commercial AI platforms fuels explosive growth. Their Foundry software now drives Fortune 500 operations while Gotham secures national security deals. The shift positions them as indispensable infrastructure for data-driven decision making.

Market Forces Reshape Trajectory

Global AI adoption accelerates across sectors—healthcare, finance, defense. Palantir's controversial data-mining expertise becomes suddenly mainstream. Competitors scramble to match their end-to-end solutions, but first-mover advantage sticks. Institutional investors pile in, betting on long-term enterprise lock-in.

Regulatory Headwinds Persist

Privacy concerns and antitrust scrutiny loom—again. Yet Palantir navigates better than peers, leveraging government experience to preempt compliance hurdles. Their lobbying machine outspends tech peers three-to-one, because nothing says 'free market' like buying political influence.

Financial Outlook: Volatility Ahead

Expect wild swings as quarterly earnings toggle between 'AI euphoria' and 'valuation concerns.' Traditional metrics struggle to capture their platform's embedded value. Short sellers get vaporized repeatedly—because apparently, betting against Peter Thiel never gets old.

Bottom line: Palantir either becomes the Oracle of AI or collapses under its own ambition. Ten years is forever in tech—but data tyranny seems increasingly inevitable.

Image source: Getty Images.

Palantir is confident of significantly boosting its revenue

In an interview with CNBC earlier this month, Palantir CEO Alex Karp remarked that the company has a goal of increasing its revenue by 10x while reducing the headcount by 12% simultaneously. While that target seems quite ambitious at first, it doesn't look out of reach.

For some perspective, it's worth looking at Palantir's revenue growth since 2020. The company generated $1.1 billion in annual revenue that year. Cut to the second quarter of 2025, and you can see that Palantir generated just over $1 billion in revenue in a single quarter. The company has guided for just over $4.1 billion in revenue for 2025, which means it is on track to increase revenue by almost 4x in the space of five years.

That would translate into a five-year compound annual growth rate (CAGR) of 30%. A 10x jump from 2025 levels suggests that Palantir is aiming to generate just over $41 billion in revenue in the long run. The good part is that the target seems achievable within the next decade. After all, the company is capitalizing on a lucrative growth opportunity in the FORM of the artificial intelligence (AI) software platforms market, which is expected to generate a whopping $153 billion in revenue by 2028.

IDC points out that the AI software platforms space is growing at almost 41% a year. That's not surprising as an AI software platform gives organizations and governments access to a set of tools to develop and deploy AI applications for their respective use cases. As a result, companies adopting AI software platforms can witness an improvement in productivity and efficiency, and they can also reduce operating costs.

The good part is that Palantir ranks as the No. 1 vendor of AI software platforms, according to various third-party agencies. This explains why customers are turning to the company to integrate AI tools into their business, and this has led to an acceleration in Palantir's growth of late. The company's revenue jumped a solid 48% year over year in the second quarter of 2025.

But what was even more impressive was the $2.27 billion worth of new contracts that Palantir signed during the quarter. That number jumped 140% from the year-ago period and was well ahead of the revenue generated by the company. Palantir, therefore, seems primed for stronger growth in the long run, considering that it is among the top vendors of AI software platforms, a market that's growing at a breathtaking pace right now.

So, the possibility of Palantir increasing its revenue by 10x does seem strong. But how long is that going to take?

Can the company grow its revenue by 10x in the next decade?

If Palantir needs to increase its revenue to $41 billion in 2035 (which would be 10x its projected 2025 revenue), it will have to clock a CAGR of almost 26%, which is lower than the annual growth it has clocked in the past five years. But what's worth noting here is that Palantir's growth has accelerated in the past two years since the launch of its AI solutions for commercial customers.

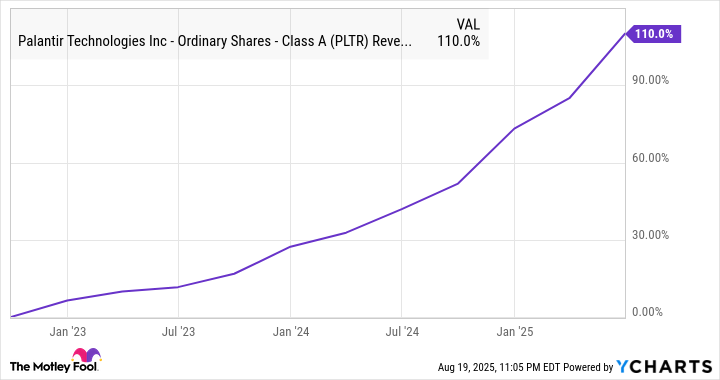

Data by YCharts.

Also, the massive growth in the company's contract value last quarter tells us that it is capable of clocking a CAGR of more than 26% going forward. Another thing worth noting here is that Palantir's bottom line is likely to grow at a faster pace than the increase in its revenue, owing to the company's strong unit economics.

Palantir's operating margin increased by eight percentage points in the first half of 2025. This can be attributed to the rapid increase in the company's customer base, as well as an increase in spending by existing customers. As such, it is easy to see why analysts are expecting a 58% spike in Palantir's earnings in 2025 to $0.65 per share.

In the end, it can be concluded that Palantir is on track to increase its revenue and earnings at a nice clip over the next 10 years. That's why investors who have this AI stock in their portfolios right now should consider holding on to it, as it could make them richer in the long run.