Buffett’s Boldest Bet: 7 Reasons Why Berkshire Hathaway Just Snapped Up This Monster Health Insurance Stock

Berkshire makes massive healthcare move—Warren Buffett's conglomerate just placed a billion-dollar bet on the insurance sector's most dominant player.

Reason 1: Recession-Proof Cash Flow

Health insurance prints money during economic downturns—people get sick regardless of market conditions.

Reason 2: Regulatory Moats

ACA complexities create barriers to entry that protect established players from startup disruption.

Reason 3: Demographic Destiny

Aging populations guarantee rising demand—this isn't speculation, it's arithmetic.

Reason 4: Data Dominance

Decades of claims data creates AI advantages that newcomers can't replicate.

Reason 5: Pricing Power

Annual premium increases stick because—surprise—people prefer living to saving money.

Reason 6: Vertical Integration

Owns everything from providers to pharmacies—capturing value at every healthcare touchpoint.

Reason 7: Political Protection

Both parties protect healthcare profits—because nothing unites politicians like insurance lobby money.

Buffett's playing 4D chess while Wall Street plays checkers—this move secures cash flows that'll outlive us all. Because in a world of meme stocks and crypto hype, sometimes the smartest trade is buying the boring company that literally profits from human suffering.

1. UnitedHealth fits squarely into one of Buffett's favorite industries

One of Buffett's favorite sectors has long been financial services, especially insurance companies. Berkshire's portfolio includes insurance giants like GEICO and, underscoring his conviction in the industry.

Health insurers share many of the underlying business characteristics that make insurance such an attractive industry to Buffett. They provide mission-critical services while also collecting billions in premiums up front, long before claims are paid out. This structure gives insurers a unique combination of financial stability and durability, qualities that Buffett prizes.

Image source: Getty Images.

2. Buffett loves moats

Some of Berkshire's largest holdings include,,,, and. While these companies span different industries, they share a common thread: massive brand equity that makes them difficult to dislodge.

Buffett has always favored businesses with durable economic moats. In the health insurance space, the idea of a moat is reinforced by and industry dominated by just a few major players -- with UnitedHealth being the largest among them.

Right now, however, UnitedHealth's brand moat shows some small cracks in the armor, creating what Buffett likely views as a rare opportunity to invest in an industry leader while sentiment remains sour.

3. Recurring insurance fees + brand equity = heaps of cash flow

Recurring insurance premiums paired with strong brand equity translates into powerful unit economics -- notably in the form of consistent free cash FLOW generation.

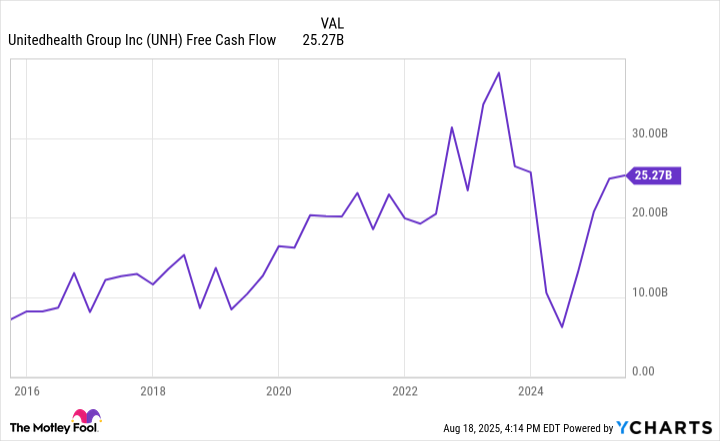

UNH Free Cash Flow data by YCharts

For UnitedHealth, its vertically integrated model -- spanning insurance, healthcare services, and data analytics -- enables the company to produce tens of billions in annual cash flow.

This fits neatly into Buffett's preference of favoring businesses with steady, predictable cash flow. Despite some recent hiccups, management has signaled confidence that growth will resume by next year -- suggesting even stronger cash flow and profitability metrics could arrive sooner than many anticipate.

4. UnitedHealth Group literally pays you to own the stock

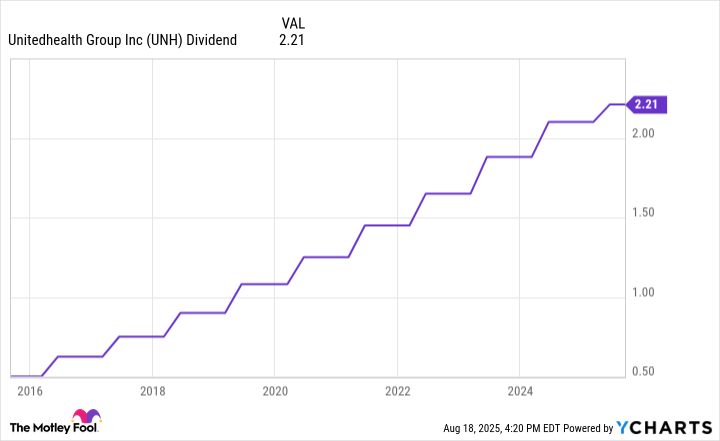

One way UnitedHealth puts its excess cash to work is by paying -- and steadily growing -- its dividend payment. This is a feature that Buffett undoubtedly appreciates. Known for his unwavering patience, Buffett often holds on to Core positions for years, if not decades.

UNH Dividend data by YCharts

Over time, that discipline has transformed some of Berkshire's greatest growth bets into reliable income streams -- with dividends serving as a reward for simply staying the course, even during periods of pronounced volatility.

5. The company is buying back shares, and...

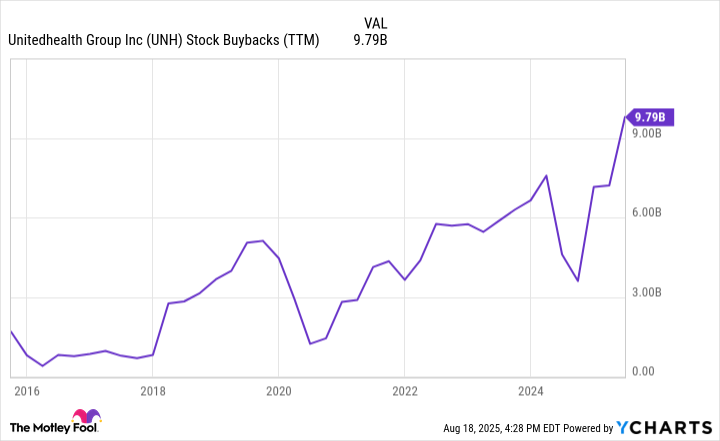

Another way UnitedHealth is delivering value to shareholders is through consistent stock buybacks. Companies often buy back their own stock as a signal that management thinks shares are undervalued.

UNH Stock Buybacks (TTM) data by YCharts

To put this into perspective, it's worth examining what UnitedHealth insiders have doing with their own shares -- a telling indicator of how those closest to the business view its long-term potential.

6. ... so are insiders; what could this suggest?

According to SEC filings, several insiders at UnitedHealth -- including CEO Stephen Hemsley -- have collectively purchased roughly $30 million of stock in recent months, right in the middle of the sell-off.

When combined with the company's aggressive share buybacks, this insider activity sends a clear message: Management is confident in UnitedHealth's ability to engineer a turnaround and views the stock as a bargain right now.

7. UnitedHealth Group stock is dirt cheap

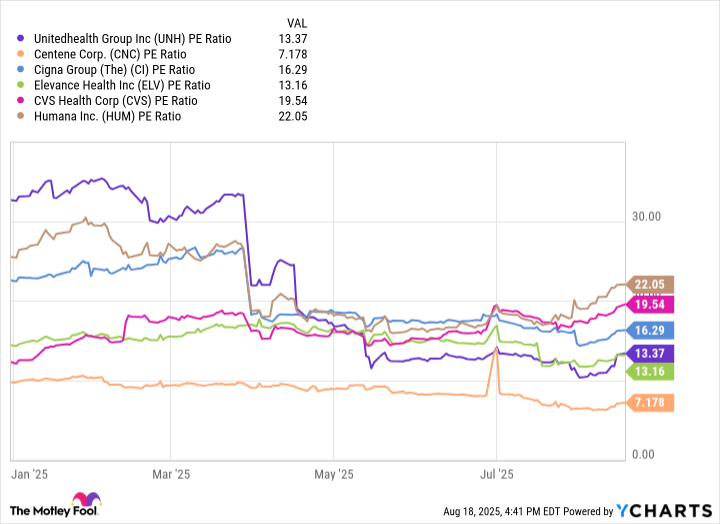

The chart benchmarks UnitedHealth Group against a set of managed care and insurance peers based on the price-to-earnings (P/E) multiple.

UNH PE Ratio data by YCharts

At just 13x earnings, UnitedHealth sits squarely in the middle of this cohort. On its own, that doesn't reveal much. But zooming out, the picture becomes more clear: After months of valuation compression, UnitedHealth stock is now trading NEAR five-year lows.

This suggests that investors are pricing UnitedHealth as a low-growth (or even no-growth), high-risk opportunity rather than the industry leader it truly is -- one that WOULD typically command a premium.

Against this backdrop, Buffett's move makes perfect sense. He likely sees glaring misalignment between perceived risk and actual risk -- most of which is already reflected in the price.

UnitedHealth remains a fundamentally strong business that has undergone a historic valuation derate. In Buffett's eyes, that looks less like trouble and more like an opportunity. Put simply, buying UnitedHealth stock at this moment is classic Buffett value investing.

For these reasons, I think now is a lucrative opportunity to follow the Oracle's lead and scoop up shares of UnitedHealth stock for a bargain, too.