This Artificial Intelligence (AI) Stock Has Massive Potential and a Shockingly Low Price

AI Stock Breaks All Expectations With Jaw-Dropping Valuation

The Hidden Gem Wall Street Overlooked

While traditional finance types were busy arguing about interest rates, this AI play quietly built revolutionary technology at a fraction of expected cost. The algorithms don't just analyze data—they predict market movements before humans even spot the patterns.

Undervalued? That's an understatement. The current price reflects pre-2020 thinking in a post-AGI world. Institutional investors keep chasing crypto pumps while missing the actual technological disruption happening right under their noses.

This isn't just another tech stock—it's the engine behind the next generation of automated trading systems, predictive analytics, and decentralized intelligence networks. The price might look like a typo today, but tomorrow's investors will wonder how they ever missed it.

Image source: Getty Images.

An attractive price for a world-class company

A stock's price itself doesn't tell you if it's "cheap" or "expensive;" a $500 stock could be cheap, and a $5 stock could be expensive when you consider the valuation.

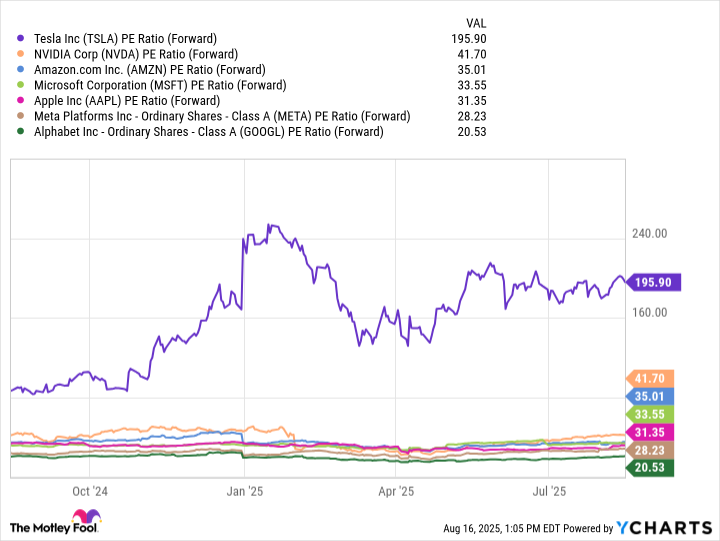

That said, with a company like Alphabet, I think it's fair to compare its valuation to companies within the "Magnificent Seven" -- a name given to seven of the tech world's most valuable and influential companies. Alphabet is currently trading at around 20.5 times its projected earnings for the next 12 months. That's by far the cheapest of any Magnificent Seven stock, with the second-cheapest being, trading at 28.2.

TSLA PE Ratio (Forward) data by YCharts.

Alphabet's current price-to-earnings (P/E) ratio, which tells you how much you're paying per $1 of a company's profits, is 21.7, well below thetech sector's average of 38.

This alone doesn't make Alphabet's stock cheap, but when you consider the company's earnings growth potential, the upside is hard to ignore.

AI has aided, not negatively impacted Google Search so far

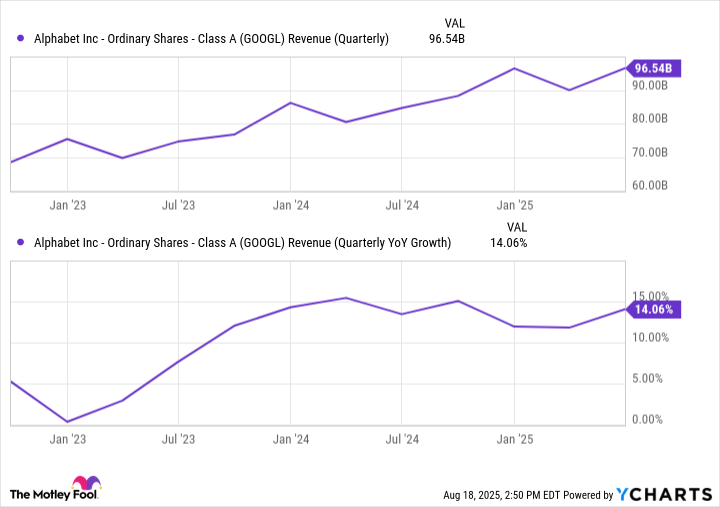

In the second quarter, Alphabet's revenue and operating income both increased 14% year over year to $96.4 billion and $31.3 billion, respectively. Alphabet's main business, Google Search, revenue grew 12% to $54.2 billion.

GOOGL Revenue (Quarterly) data by YCharts.

Google Search's revenue growth is particularly important because there were some concerns that AI developments could negatively affect it, but that hasn't seemingly been the case thus far. The thought was that people using generative AI tools (ChatGPT, Grok, etc.) for searching instead of Google could cut into volume and how much it makes from click-throughs.

However, this past quarter showed that AI developments have actually been a plus for Google. AI Overviews -- a summarize box that appears when you make certain searches -- has over 2 billion monthly users across 200 countries, and Alphabet said it has the fastest AI responses in the industry.

Alphabet also introduced AI Max last quarter, which is a suite of AI-powered tools and features that aid advertisers in Search campaigns. The company noted that advertisers who activate AI Max see 14% more conversions on their campaigns. From Alphabet's standpoint, the more conversions for advertisers, the better it is for its own business because advertisers will be more willing to keep spending to achieve good returns on their investments.

Alphabet has a full-stack AI operation

You can break down the AI ecosystem into three broad segments: research, training, and end applications. Some companies focus on a particular part of the ecosystem, but Alphabet has the benefit of operating in all three areas.

Alphabet has DeepMind, an AI research company that is responsible for pioneering breakthroughs that have made AI as we know it today possible; it has Google Cloud that gives it the proper infrastructure for training its own AI models; and it has end applications like Google Gemini, which it can integrate directly into its products and services.

Having the full in-house stack gives Alphabet a unique advantage because it reduces dependence and allows the company to develop, test, and deploy AI fairly quickly. This is much different from companies likeor, which rely heavily on OpenAI's technology for model development and integration.

AI aside, Alphabet is well positioned to be a market-beating stock for quite some time. At its current prices, it seems like one of the better big tech bargains on the market.