The Ultimate Growth Cryptos to Buy With $1,000 Right Now

Forget waiting for the next bull run—these digital assets are primed for explosive growth with just a grand.

BNB: The Exchange Powerhouse

Binance's native token continues defying expectations, sitting comfortably above its previous ATH while traditional finance scrambles to catch up. The ecosystem's relentless expansion makes this more than just an exchange token—it's the backbone of decentralized finance.

Ethereum Killers Gaining Ground

Alternative layer-1 protocols are eating Ethereum's lunch on transaction speed and cost efficiency. Their developer adoption rates tell the real story—builders vote with their code, and they're choosing networks that don't charge mortgage payments for gas fees.

DeFi Blue Chips Printing Real Yield

While traditional wealth managers push 2% bond yields, decentralized protocols deliver double-digit APY without asking for your KYC documents. The smart money knows real yield doesn't come from a prospectus—it comes from code that actually works.

NFT Infrastructure Plays

The next wave of digital ownership isn't about monkey pictures—it's about the infrastructure enabling trillion-dollar asset tokenization. These protocols turn everything from real estate to intellectual property into tradable digital assets.

Remember: past performance doesn't guarantee future results, but betting against technological innovation has historically been a terrible financial decision. The train's leaving the station—your $1,000 can either buy a ticket or watch from the platform.

1. Lululemon

(LULU 0.32%) has spent two decades building one of the strongest brands in athletic wear. Because of its prestige, customers are still willing to pay triple-digit prices for leggings, as well as line up for limited product drops. Direct-to-consumer sales, which make up about half its revenue mix, continue to carry rich margins and keep brand control in-house.

But it's not all smooth sailing for the athleisure icon. Indeed, one might even say easy growth is behind it. Management expects net revenue to be in the range of $11.1 billion to $11.3 billion for 2025, representing 5% to 7% growth. That's a far cry from the pandemic days when double-digit growth seemed to be the norm. Its North America segment is stagnant, and same-store sales aren't delivering fireworks like they used to. International is growing fast, especially in China, but it's not big enough to MOVE the whole needle.

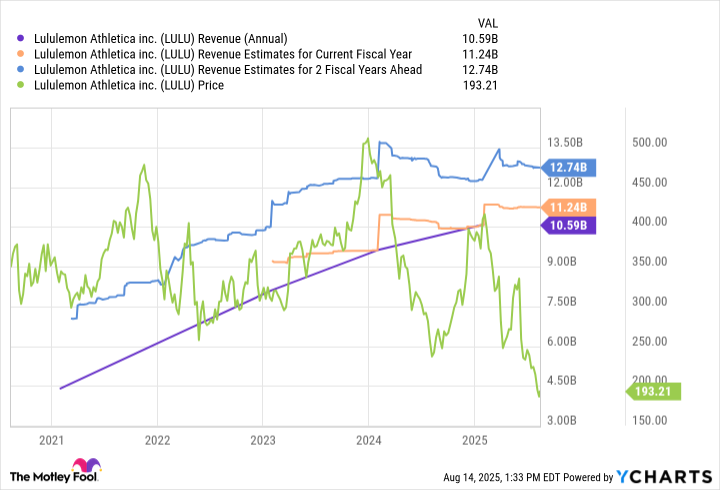

LULU Revenue (Annual) data by YCharts

This slowdown in revenue growth has done more than just take a little air out of Lululemon's stock. It's let out over half the balloon. Shares are down to about $205 (at time of writing) from $390 to $410 earlier this year, even though annual revenue is still inching higher. Analysts expect annual revenue to reach $12.74 billion two years from now, a respectable gain, even if that's not the hypergrowth that Lululemon investors were used to in the past.

Image source: Getty Images.

Still, even as revenue growth slows, there's a bull case to be made for sticking with Lululemon for the long term. The stock's forward price-to-earnings ratio, currently around 13.4, is a major discount to its historical average. That gap alone suggests that the market has priced in slowing growth, which leaves room for expansion if margins hold steady and earnings keep climbing.

A loyal customer base gives Lululemon pricing power that few apparel brands can match, and underpenetrated markets (like menswear and overseas) remain long-term levers the company can pull. It might take some time, but growth in those lanes could push earnings higher and sentiment back toward a premium valuation if management can execute well.

2. MercadoLibre

(MELI -0.29%) is what you'd get ifandmerged, then set up shop in Latin America. Indeed, it's the dominant marketplace in a region where e-commerce and digital banking still have years -- maybe even decades -- of growth ahead.

The bull argument for MercadoLibre goes something like this. E-commerce penetration across the company's key markets -- such as Brazil and Mexico -- still trails developed economies, to say nothing of its expected expansion into smaller, still-unpenetrated Latin American countries (like Ecuador and Peru). Meanwhile, millions in Latin America lack bank accounts or credit access, and cash remains common. As more households shift from cash to digital money, its financial arm -- Mercado Pago -- could easily become an "on-ramp," turning first-time users into repeat payers, and repeat payers into credit customers.

Currently, MercadoLibre dominates the Latin American market. According to data collected by eMarketer, it moves more merchandise than its next 15 competitors put together. And yet -- and this is a big one -- over two-thirds of online spending in Latin America is still up for grabs. That's a big opportunity for MercadoLibre, which will have the infrastructure and brand power to capture a huge chunk of it.

Of course, we can't overlook potential headwinds. Currency and policy changes can make individual quarters lumpy, while tariffs and civil unrest in key markets could also cause hiccups and down periods. What matters for the long haul, however, is whether active buyers, total payment volume, and ad revenue can keep outgrowing costs, while take rates (the percentage or revenue that MercadoLibre keeps from each transaction) and margins hold steady.

If those dots connect -- and by the looks of it, they should -- MercadoLibre could be positioned to join Amazon in the trillion-dollar club in the next 15 years.