5 Vanguard ETFs to Buy With $2,000 and Hold Forever

Forget timing the market—these five Vanguard ETFs deliver institutional-grade exposure for just $2,000.

Vanguard's low-fee arsenal cuts through Wall Street's noise

While traditional finance peddles complexity, Vanguard's ETFs bypass the middlemen with razor-thin expense ratios. The $2,000 entry point demolishes old barriers to institutional-style diversification.

Five funds built for the long game

From total market exposure to dividend aristocrats, these ETFs lock in broad-market growth without the active management circus. Their passive strategy quietly compounds while stock pickers chase yesterday's winners.

Hold forever? Maybe—but definitely through multiple cycles

These portfolios weather volatility by design, turning market panic into opportunistic rebalancing. Because nothing terrifies fund managers more than investors who refuse to trade.

Perfect for crypto natives diversifying into real assets

While crypto volatility excites, these ETFs anchor portfolios with steady, predictable growth—the boring foundation that lets you gamble responsibly elsewhere.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

Theis the best-known U.S. stock market index, tracking 500 prominent U.S. companies. You could think of it representing America's economy, which includes the leading technology companies, a group known as the "Magnificent Seven" stocks. But investors who want to get stock performance equal to the S&P 500 have a small issue to contend with. You can't invest in the S&P 500 directly. The workaround is to invest indirectly through the(VOO -0.28%).

Stock prices fluctuate, and the S&P 500 is no different. The index fluctuates from year to year, occasionally experiencing severe downturns. Yet it has always recovered, and it has produced 8% annualized returns on average over nearly a century. No investment is entirely risk-free, but the S&P 500's track record makes it arguably the safest investment fund you'll find for as long as America is a global economic powerhouse.

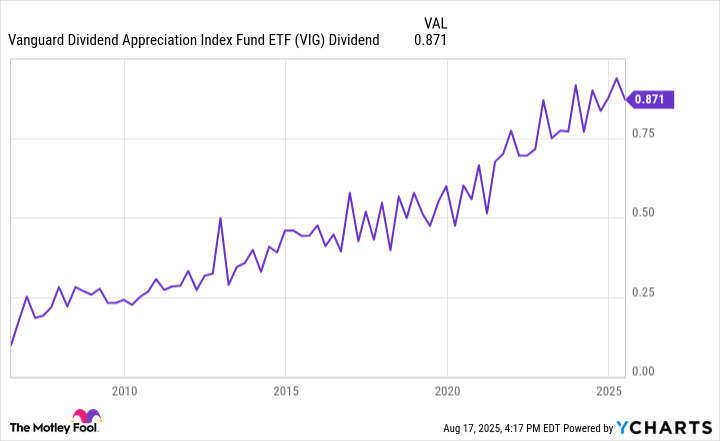

2. Vanguard Dividend Appreciation ETF

Dividends are often an indicator of an excellent business, especially if it can increase that dividend year after year. It's usually a sign of a company that generates more profits than it needs, so it shares them with investors. The(VIG 0.12%) focuses on large U.S. companies that cut you increasing dividend checks over time.

Data by YCharts.

As a result, the ETF's dividend has risen over the years, too. Its dividend yield won't wow you at just over 1.6%, but a growing dividend adds up over the years if you're patient. Investors may also like the ETF's light exposure to the Magnificent Seven:andare the only two Magnificent Seven stocks in the fund, making it a great complement to some of the other ETFs on this list.

3. Vanguard Information Technology ETF

If you want to lean into technology and innovation, the(VGT -0.67%) can help. It's a pure play on the technology sector, spread across all sorts of sub-markets, including various types of software, semiconductors, and infrastructure. While the ETF holds over 317 stocks, its top three holdings,, Microsoft, and Apple, make up over 40% of the ETF, so you'll probably want to feel good about those companies if you're going to invest in this fund.

Fortunately, the ETF is quite diverse after those three. The fourth-highest-weighted stock,, is only 4.69% of the fund, and the weightings drop quickly from there. Investors will like the ETF's low expense ratio of just 0.09%, which is far below that of most technology ETFs. For instance, the popularcharges 0.20%, more than twice as much, despite having underperformed the Vanguard Information Technology ETF over the past decade.

4. Vanguard Real Estate ETF

Diversification is about more than choosing different corporations. Real estate is a classic investment, but few people have the funds, knowledge, or desire to buy properties. The(VNQ 0.29%) is an excellent addition to any long-term portfolio for the real estate flavors it brings to the table. The ETF holds real estate investment trusts (REITs), companies that acquire and lease real estate and distribute their taxable income to shareholders as dividends.

The Vanguard Real Estate ETF holds over 150 REITs across various property types, including residential and commercial buildings, data centers, industrial facilities, and hospitals. Real estate is typically an income investment, and the ETF reflects that. It currently has an adjusted effective yield of 2.8%. Investors can supercharge how their money compounds by reinvesting the dividends.

5. Vanguard Total International Stock ETF

Lastly, it's hard to call a portfolio diverse if almost everything in it is from the United States. Sure, many U.S. companies do business globally, but there are many elite businesses based in other countries. The(VXUS 0.13%) gives investors instant ownership of over 8,600 non-U.S. companies from various developed and emerging countries worldwide.

The ETF's top holdings include well-known foreign giants likeand. It takes all the work out of having to sift through foreign corporate documents, which are often in other languages, making the ETF's teeny-tiny 0.05% expense ratio a bargain. By adding the Vanguard Total International ETF to your portfolio, you are genuinely investing in the global economy.