Bill Ackman’s Billion-Dollar Bet: The ’Magnificent’ New Addition Rocking Pershing Square’s $13.7B Portfolio

Wall Street's spotlight swings to Pershing Square as Bill Ackman unveils his latest portfolio powerhouse—a move that's sending ripples through the $13.7 billion fund.

THE UNEXPECTED GAMBLE

Ackman isn't playing safe—he's doubling down on disruption. This addition isn't just another blue-chip stock; it's a strategic thrust into uncharted territory that's got analysts scrambling to update their models.

WHY THIS CHANGES THE GAME

Forget traditional asset allocation—this pick defies conventional wisdom. It's not about dividends or P/E ratios; it's about positioning for the next decade's tectonic shifts while everyone else recycles last year's playbook.

THE STREET'S REACTION

Initial skepticism melted faster than a hedge fund's returns during a margin call. Suddenly, every major player is re-evaluating their own strategy—wondering if they missed the signal in the noise.

Because let's be honest—nothing makes finance traditionalists more uncomfortable than someone actually making bold moves instead of just benchmarking against the index. Sometimes the biggest risk isn't being wrong—it's being ordinary while billionaires rewrite the rules.

Image source: Getty Images.

For example, Pershing Square Capital Management's billionaire boss, Bill Ackman, is also closely followed by the investing community. Ackman oversees $13.7 billion in AUM and is best known as an activist investor who aims to extract value from his relatively concentrated investment portfolio.

Although Ackman added to three existing positions during the June-ended quarter, it's the "Magnificent Seven" stock he welcomed into Pershing Square's investment portfolio that deserves all the attention.

Billionaire Bill Ackman loaded up on this dual-industry leader

According to Pershing Square Capital Management's 13F, Ackman oversaw the purchase of 5,823,316 shares of e-commerce colossus(AMZN -1.86%) during the second quarter.

Technically, this isn't a huge surprise, as Ackman spilled the beans in May that his fund had purchased shares of Amazon in the previous month (April). What wasn't known at the time is how big of a position Pershing Square had taken. As of the midpoint of 2025, this stake was worth almost $1.3 billion, which made it Ackman's fourth-largest holding by market value.

April would have been a brilliant time for any investor, not just billionaires, to go shopping. President TRUMP introduced his tariff and trade policy on April 2, which sent equities into a subsequent four-day tailspin. But ever since Trump instituted a 90-day pause on "reciprocal tariff rates" on April 9, it's been all systems go for the Mag-7 stocks and many of Wall Street's leading businesses.

Keeping in mind that we don't know exactly when in April billionaire Bill Ackman invested in Amazon, shares of the company have risen approximately 34% since the closing bell on April 8.

Aside from Amazon stock being attractively priced following the short-lived tariff-induced swoon, the primary catalyst behind this purchase appears to be the belief that Amazon is well-insulated from tariff pressures. Ackman and his top advisors believe Amazon can successfully navigate tariff-related uncertainty. To boot, Amazon CEO Andy Jassy talked up his company's resilience to tariffs and the minimal impact it's had on consumer spending in May.

But there's likely more to this story than just the market's overreaction to tariffs. Ackman's newfound love for Amazon stock is almost certainly based on the company's sustainable moat as a dual-industry leader.

Image source: Amazon.

Amazon's cash flow can more than double in three years

Most people are introduced to Amazon through its world-leading online marketplace. If the president's tariffs continue to modestly lift the prevailing rate of inflation in the U.S., the convenience and cost-savings of online shopping with Amazon can be viewed as beneficial, not detrimental, for the company.

However, the margins associated with online retail sales tend to be relatively low. While selling goods online generates a boatload of revenue for Amazon, the lion's share of its operating cash FLOW originates from its ancillary services.

In addition to being the undisputed largest e-commerce player in retail, Amazon is the clear leader in the cloud infrastructure service space via Amazon Web Services (AWS). AWS accounted for 32% of the estimated $90.9 billion in worldwide cloud infrastructure service spend for the first quarter, based on an analysis from tech firm Canalys.

As of the midpoint of 2025, AWS is pacing more than $123 billion in annual run-rate revenue, and it's maintaining a year-over-year growth rate of 17% to 19%, excluding the impact of foreign currency changes. The incorporation of generative artificial intelligence (AI) solutions and the tools to build and train large language models into AWS is supporting its premium growth rate.

But AWS is just one piece of Amazon's higher-margin puzzle.

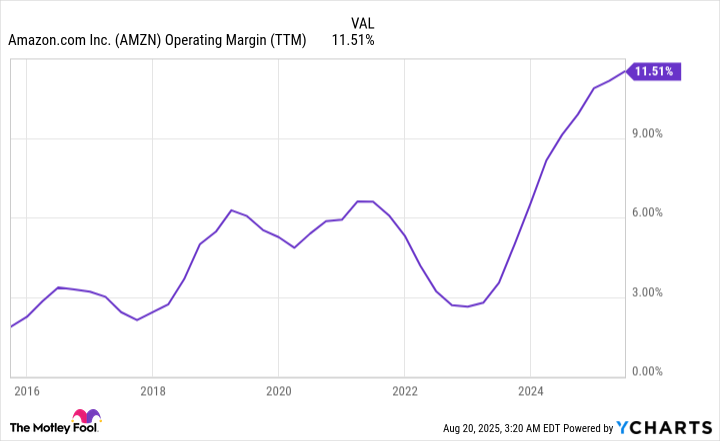

Amazon's operating margin notably increased as its ancillary services have become a larger piece of the pie. AMZN Operating Margin (TTM) data by YCharts. TTM = trailing-12-months.

With billions of monthly visits to its online marketplace and Prime video streaming platform, its advertising allure is growing. Over the previous six quarters, advertising services revenue has jumped between 18% and 24% from the comparable-year period. The company's ad-pricing power should only climb from here.

Additionally, Amazon has maintained low-double-digit sales growth from its subscription services segment. Landing exclusive streaming content deals with the National Football League and National Basketball Association are boosting Prime subscriptions and affording Amazon plenty of pricing power.

Sustained double-digit growth from these ancillary service segments will allow Amazon's operating cash Flow to expand at a considerably faster pace than its total revenue over the coming years. Based on Wall Street's consensus estimate, Amazon's cash flow is on track to more than double from a reported $11.04 per share in 2024 to an estimated $24.32 per share come 2027.

Throughout the 2010s, investors regularly paid 23 to 37 times year-end cash flow to own Amazon stock. Even following its 34% run-up since the closing bell on April 8, Amazon stock is valued at just 9.4 times estimated cash flow in 2027. It WOULD appear that billionaire Bill Ackman has found yet another gem hiding in plain sight.