Best Stock to Buy Right Now: Target vs. Kohl’s - Which Retail Giant Delivers Maximum Returns?

Retail showdown: Two titans clash as investors hunt for alpha in the consumer space.

Target's Digital Dominance

Bullish analysts point to Target's seamless omnichannel strategy—curbside pickup that actually works, same-day delivery that doesn't bankrupt the company, and a grocery division that keeps customers coming back weekly. Their store-as-hub model continues to outperform pure-play e-commerce rivals.

Kohl's Cash Conundrum

Kohl's leans heavily on promotional strategies and store partnerships, but questions linger about margin compression. Their off-mall locations provide flexibility, yet digital transformation moves at department-store speed—glacial compared to Target's bullet-train pace.

Balance Sheet Battleground

Target's stronger free cash flow generation fuels expansion and dividends simultaneously. Kohl's real estate portfolio offers hidden value, but monetizing assets requires execution—something Wall Street's seen too many retailers promise and fail to deliver.

Consumer spending patterns shift faster than hedge fund allegiances—pick the retailer that adapts, not just survives. Because in retail, today's turnaround story is tomorrow's bankruptcy filing.

Image source: Getty Images.

But there are significant differences, too. Let's see how Kohl's and Target differ, and which WOULD be the better buy in August 2025. Spoiler alert: Target looks like the steadier winner, while Kohl's is the higher-upside turnaround bet if you can stomach the risk.

Comparing Kohl's and Target by the numbers

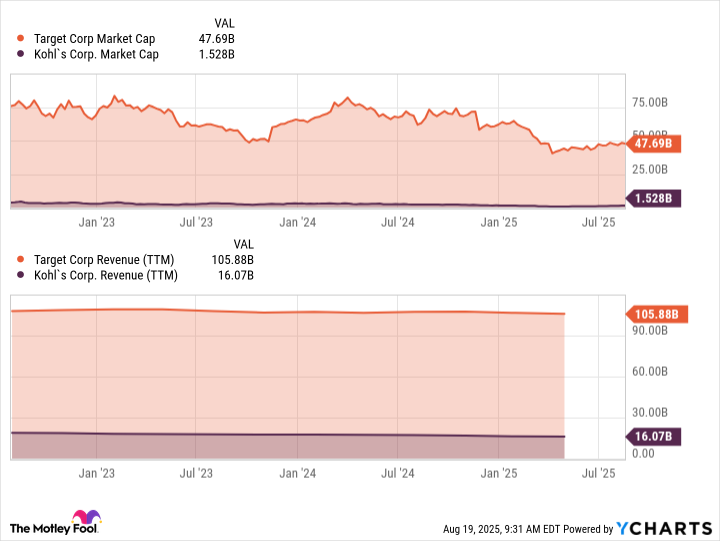

Whether you measure them by revenue or market capitalization, Target has always been bigger than Kohl's. It's not a close race, either:

TGT Market Cap data by YCharts

I could go on with profitability metrics showing the same lopsided balance, but you get the point already: If you want the bigger company, Target is the only choice on the table.

Now, Kohl's doesn't lose every comparison against its larger retail rival. Its gross profit margins are significantly wider. But that advantage doesn't translate into sustained benefits further down Kohl's financial statements. Target takes the lead at the operating margin level, and its bottom-line net profit margin of 4% runs circles around the department store's 0.8% figure.

And Target shows an even stronger advantage in metrics connected to operating efficiency. Target's return on equity is 29.1% versus Kohl's 3.2%, for example.

The two turnaround themes

Kohl's isn't sitting on its cramped hands, of course. The company is running in full turnaround mode under an interim management team. It's reshuffling its private label portfolio, optimizing its overall product lineup, and simplifying the customer experience.

In-house brands are an important part of this effort, including the exclusive Sephora partnership. Kohl's is also remodeling its stores to offer a more intuitive layout. Specifically, the accessories and juniors departments are moving closer to the Sephora shops, as the company has found lots of cross-shopping between these categories.

Target's turnaround plan is built around the company's reputation as a more pleasant place to shop for everyday essentials. Management is leaning into the whimsical "Tar-zhay" branding that suggests some kind of higher-end, slightly European quality. It's a pretty simple strategy, actually.

"We know that when we deliver the Tar-zhay magic, the consumer responds," CEO Brian Cornell said in May's first-quarter 2026 earnings call. "And the common theme is, when we deliver newness at a great value, we see strong performance."

So the company is rolling out thousands of new items across a range of store brands. Target's focus isn't on bargain-bin pricing, but on a healthy balance between low cost and high quality. I would compare Target's strategy with the extremely successful(COST 0.10%) model, where the quality-obsessed Kirkland brand does a lot of heavy financial lifting. If you're ripping pages out of someone else's playbook, you might as well steal them from a world-class competitor.

Target is the easy choice, unless you love risky bets

That brings me back to that all-important question: Should you buy Target or Kohl's stock these days?

As noted, I can imagine different investors making different choices here. Kohl's stock is down by 58% in the last three years, and it trades at just 0.1 times trailing sales. The business is a mess, but there could be a fantastic upside if Kohl's can get back on a more profitable track. It's a high-risk, high-reward option.

But most people should take a second look at Target instead. The "Tar-zhay" tactics are already working, and this is a more robust store chain to begin with. Kohl's turnaround may be a make-or-break affair, but Target is just fine-tuning a business model that already works. That's a safer option, and Target's price-to-sales ratio of 0.5 still leaves plenty of room for robust investment returns.